Private Equity Eyes Defence: A New Investment Frontier

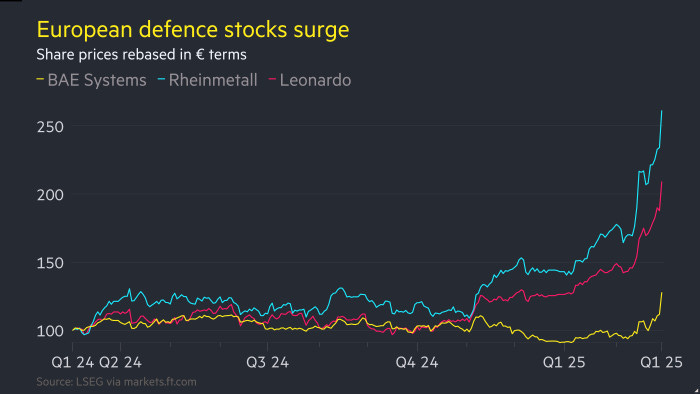

After decades on the sidelines, private equity firms are aggressively moving into the defence sector, seeing it as a new frontier for investment amid rising global tensions. The once–shunned arms industry – long avoided by PE over ethical concerns and slow growth – is now viewed as ripe with opportunity as governments ramp up military spending. “As Europe rearms, private equity firms are scouring for investment opportunities in the once-shunned defence sector,” Bloomberg reported, noting that defence assets “once seen as toxic” are now in high demand. The war in Ukraine and mounting geopolitical risks have fundamentally changed investor attitudes. In 2025, private investors poured roughly $790 million into defence deals by spring – approaching the annual total of any year in the past two decades. This surge signals that big private capital sees defence as a growth market, not a pariah.