Europe, Proportionality, and the Forgotten Language of Deterrence

In Europe’s strategic discourse, proportionality has become the default reference point whenever the issue of responses to threats and aggressions is raised. Whether the subject is terrorism, cyberattacks, or hostile actions by rival powers, the formula is almost ritual: a proportionate response, calibrated, commensurate to the damage suffered. This approach, seemingly balanced and consistent with international law, hides a structural weakness: Europe has lost the ability to speak the true language of deterrence. Deterrence is not, and has never been, a mechanism of symmetry. It is built on disproportion, on a psychological construct in the adversary’s mind that works only if he is convinced that any aggression will provoke a devastating, immediate, and unavoidable reaction.

Company Profiles & Industrial Intelligence

Enevate B.V. (Kitepower) – Strategic-Technological Analysis

Enevate B.V., known commercially as Kitepower, is a Dutch deep-tech startup drawing on 15+ years of university research[1]. Its flagship product is an airborne wind energy system (AWES) – a tethered kite (drone) that generates electricity by flying in high-altitude winds and reeling out power lines to a ground generator[2][3]. Originating as a spin-off from TU Delft’s Wubbo Ockels wind-energy group[1][3], Kitepower has steadily advanced its technology from laboratory prototypes to field demonstrations. In 2021 its 100 kW Falcon system was deployed in a Dutch military exercise in Aruba[3], marking Europe’s first off-continent test of this novel renewable generator. More recently, Kitepower was selected for NATO’s DIANA energy-resilience accelerator[2], underlining alliance interest. For European defense planners, Kitepower’s appeal lies in its promise of portable, low-footprint power generation – a potentially game-changing way to supply electricity to remote bases without long fuel supply lines or large turbines. This report will examine Kitepower’s organizational profile, technology portfolio, program engagements, and dual-use market strategy to assess its strategic value for EU autonomy, NATO operations, deterrence posture, and supply-chain resilience.

Strategic-Technological Analysis of GaltTec OÜ

In the evolving landscape of European defense and energy security, GaltTec OÜ has quickly drawn attention as an Estonian deep-tech startup innovating in micro-generation technology. Founded in 2022 by entrepreneurial scientists from the University of Tartu[1], GaltTec specializes in micro-tubular solid oxide fuel cells (mSOFCs) for drones, IoT, and space applications. By integrating breakthroughs in materials science and microfabrication, the company addresses critical needs for lightweight, long-endurance power in both commercial and military contexts[2]. Its journey – from university spin-off to participant in NATO’s DIANA accelerator[3][4] – highlights its alignment with Europe’s strategic autonomy goals. This analysis examines GaltTec’s corporate identity, technology portfolio, program participation, and strategic impact within EU and NATO frameworks, evaluating how its innovations can enhance deterrence, interoperability, and supply-chain resilience. The findings show that GaltTec offers a promising dual-use capability by diversifying Europe’s energy sources and reinforcing the defense industry’s technological base.

IceWind – Strategic-Technological Analysis (Icelandic Micro-Wind Turbines)

Introduction: IceWind is an Icelandic deep-tech startup specializing in rugged, vertical-axis micro-wind turbines designed for extreme environments. Its novel six-bladed design is intended to provide reliable off-grid power – for example, replacing diesel generators at remote telecom towers and research outposts[1][2]. By enabling local renewable energy in harsh climates, IceWind’s technology intersects with European defense and security priorities (arctic sovereignty, energy resilience) and NATO’s focus on expeditionary power. Iceland’s government has highlighted the company’s potential in allied innovation programs – notably its selection for NATO’s DIANA energy resilience challenge[3]. This analysis examines IceWind’s corporate identity, strategic mission, technology portfolio and readiness, European and NATO program ties, research origins, dual-use applications, industrial partnerships, market domains, IP assets, and leadership. We then assess how IceWind contributes to European strategic autonomy (substituting non-allied energy sources), NATO interoperability, deterrence (through resilient power supply), transatlantic cooperation, and supply-chain resilience.

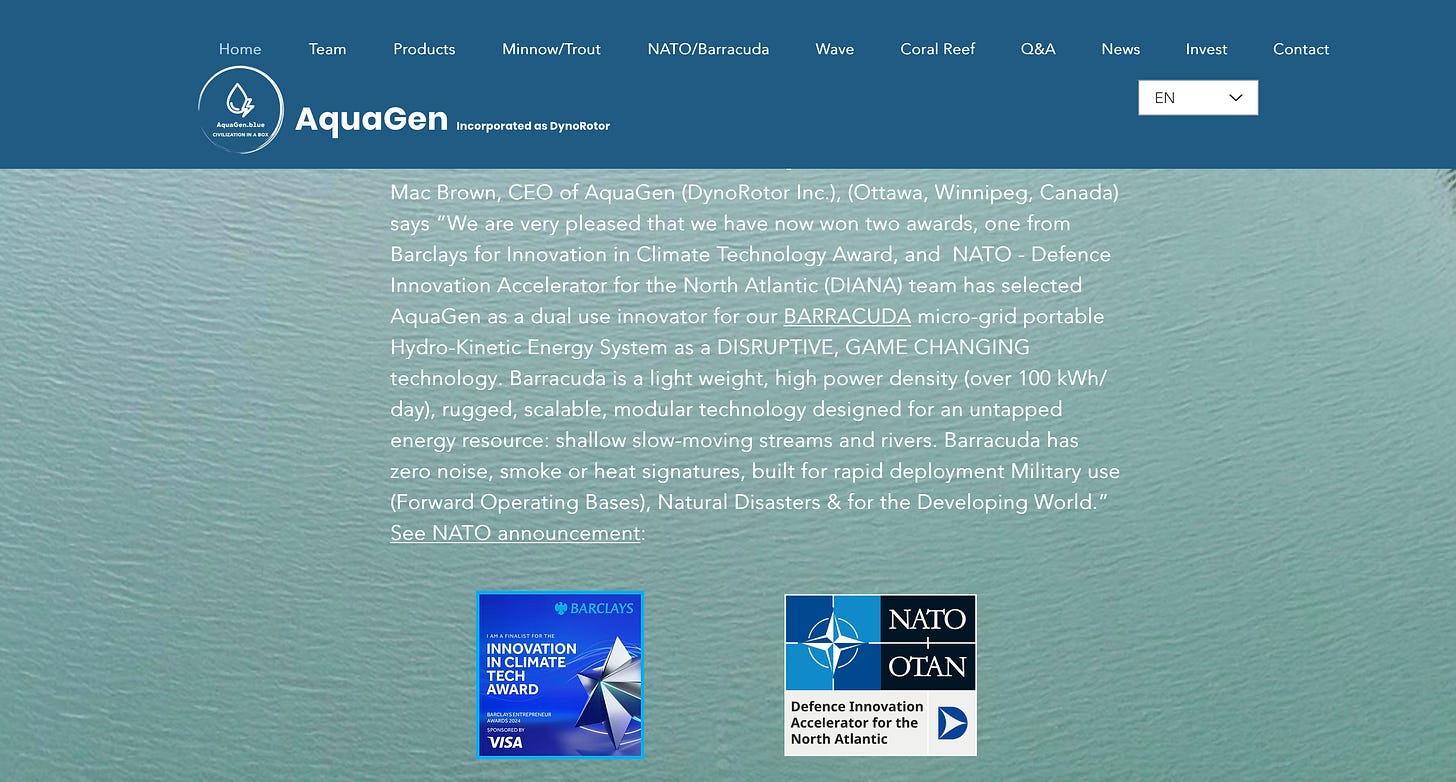

DynoRotor Inc. (AquaGen.Blue) – Strategic-Technological Analysis

DynoRotor Inc. (trading as AquaGen Blue) is an innovative hydrokinetic turbine developer whose compact river-and-stream generators have attracted interest beyond civilian markets. The company’s portable Barracuda micro-turbine has won awards and a NATO DIANA selection for dual-use energy resilience[1][2]. While DynoRotor’s focus is renewable power, its capabilities intersect with defense needs: rapid-deployment off-grid energy for forward bases and remote sensors. As Europe seeks strategic autonomy and resilient power supplies, DynoRotor’s technology raises questions about supply-chain independence, alliance interoperability, and deterrence support. This report examines the company’s legal identity, technology portfolio, and strategic fit within EU/NATO defense objectives, highlighting both its promise in multi-domain energy support and the gaps it leaves in Europe’s broader defense industrial requirements.

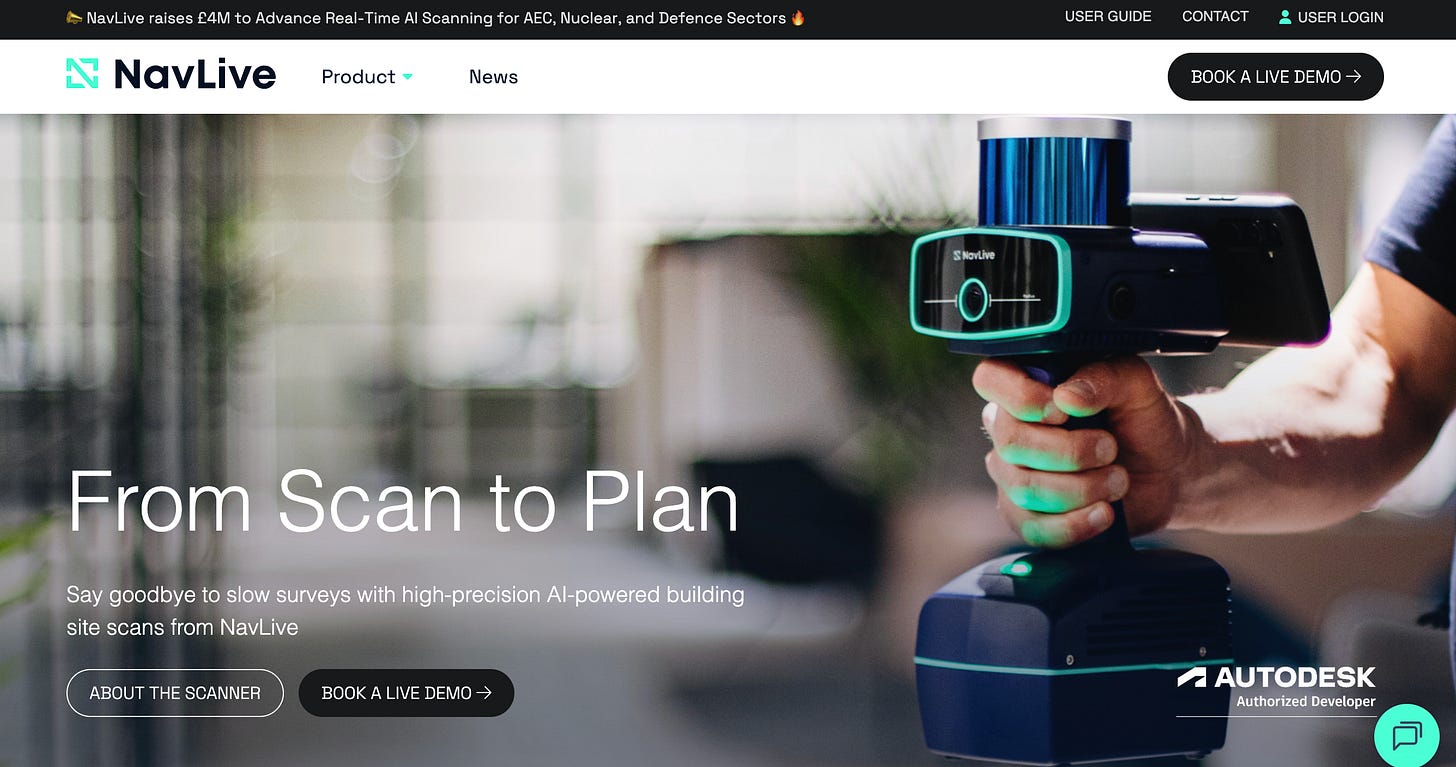

Strategic-Technological Analysis: NavLive

NavLive Ltd (Oxford, United Kingdom) is an academic spin-out from the University of Oxford Robotics Institute, founded in 2022[1]. It markets a handheld 3D mapping scanner. This scanner fuses multi-camera vision with LiDAR and inertial sensors. The device uses AI-based SLAM algorithms to generate high-accuracy floor plans and point clouds in real time[2][3]. This technology was developed as an Oxford Robotics research prototype. It has been piloted at construction and nuclear facilities, including projects with the UK Atomic Energy Authority and major engineering firms (Jacobs, Mace, Atkins)[4][5]. Its key innovation is rapid on-the-move scanning of complex structures. This approach dramatically reduces survey times (minutes instead of days) while identifying deviations from design[6][7]. Within the European defence context, NavLive’s real-time mapping suggests new autonomy in infrastructure intelligence. It offers an alternative to foreign-made survey systems[8][9]. This raises questions about data sovereignty and NATO interoperability. For example, can a UK-origin device be integrated into EU/NATO architectures to enhance deterrence? This overview highlights the core technology and its relevance to European strategic autonomy. The full strategic analysis and detailed scoring are contained in the subscriber-only report.

Strategic-Technological Analysis of SenseFly (EPFL Spin-off, Switzerland)

SenseFly is a Swiss drone manufacturer that emerged from the Ecole Polytechnique Fédérale de Lausanne (EPFL) over a decade ago. This Lausanne-based spin-off, originally founded in 2009 by researchers including Professor Dario Floreano and his students, pioneered lightweight autonomous fixed-wing unmanned aerial vehicles (UAVs) for high-resolution mapping and data collection[1][2]. Over time the company’s eBee series became a world-leading commercial mapping drone, logging over one million flights and collecting imagery for agencies ranging from surveying firms to border security services[1]. In 2021 senseFly was acquired by U.S. firm AgEagle Aerial Systems, integrating its Swiss R&D into a transatlantic enterprise. Today senseFly’s technology underpins advanced autonomous drones (including ISR versions) now deployed by European and NATO forces[3][4]. This report investigates senseFly’s strategic role in European defence, focusing on its technological portfolio, autonomy impact, and alignment with EU/NATO strategic objectives.