Emerging European Defense and Dual-Use Technology Startups

Europe’s defense landscape has shifted sharply since 2022 toward heavy investment in cutting-edge military capabilities and dual-use technologies. Governments and allied institutions have launched new funding programs and accelerated procurement to enhance strategic autonomy and rearmament. For example, the European Defence Fund’s 2025 work programme allocates over €1.06 billion to R&D in priority areas (ground, air, space, energy resilience and AI, among others) with special schemes to support SMEs and mid-caps. The 2024 Strategic Technologies for Europe Platform (STEP) under EDF also targets digital and deep-tech innovation for defense, and the EU’s new “Re-Arm Europe” plan and 2030 Readiness White Paper explicitly aim to boost pan-European defense production and technological sovereignty. Reflecting this ambition, NATO’s DIANA accelerator now recruits scores of startups developing dual-use solutions – in 2025, DIANA selected over 70 companies from 20 countries in areas such as energy, sensing, secure communications and human performance. Likewise, national governments (e.g. the UK’s multi-billion-pound aerospace R&D initiatives) have signaled that dual-use aerospace and AI capabilities are strategic priorities. In sum, Europe’s defense innovation ecosystem is growing rapidly, with startups addressing frontier domains from drones and AI to quantum and renewable power, backed by unprecedented levels of venture and public funding.

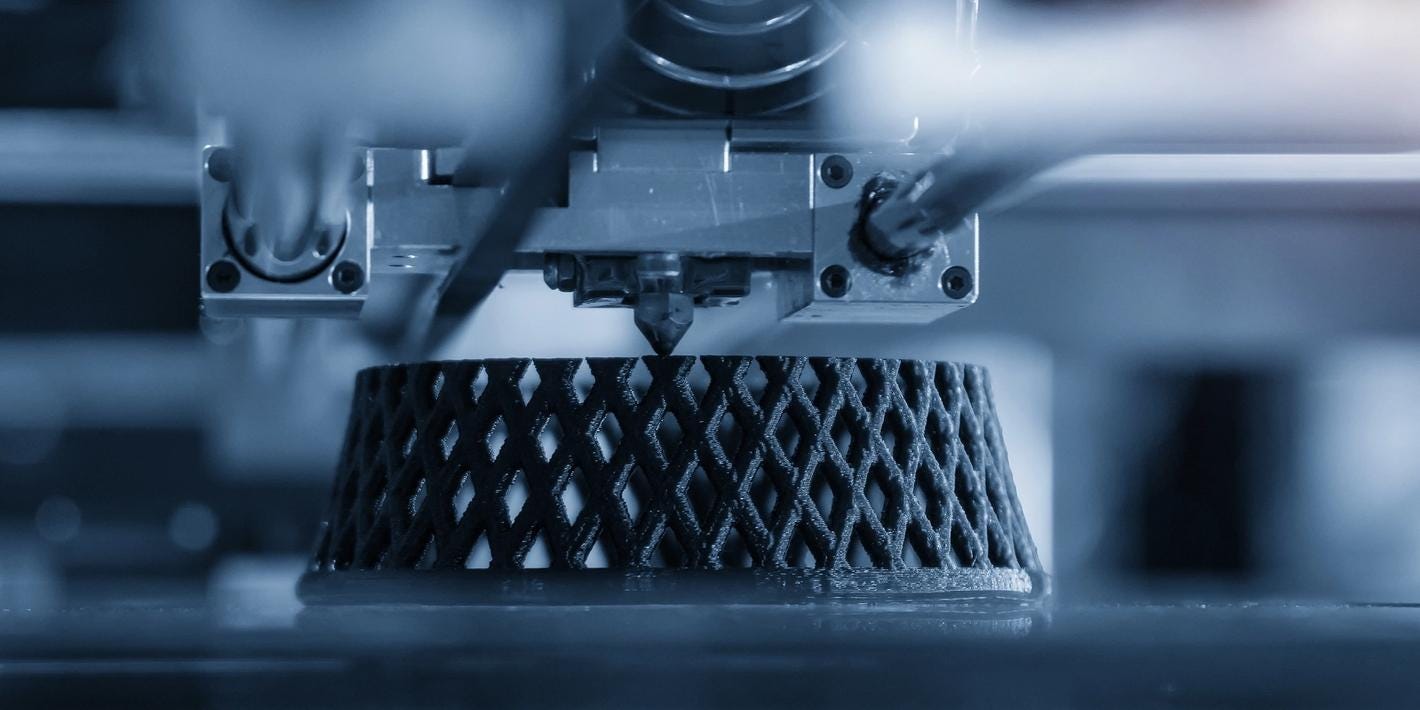

Additive Manufacturing in Defense

Additive manufacturing (AM), or 3D printing, builds parts layer-by-layer from digital designs and is being embraced by militaries as a transformative tool. It is “no longer science fiction” – as the European Defence Agency notes, AM is already reshaping the defence sector by enabling on-site spare production and new designs. U.S. leaders report that the “soft hum of 3D printers” is replacing antiquated machinery in unit depots and organic industrial bases. The Pentagon explicitly sees AM as a way to maintain technological overmatch: new DoD policy directs services to use AM to transform maintenance and supply chains and boost logistics resiliency. In short, by 2025–2035 additive manufacturing has moved from R&D into fielded capability, promising to dramatically shorten repair times and empower forces with on-demand parts and bespoke solutions.

Next Generation Dismounted Soldier System (NGDSS) – A PESCO Collaborative Project

The Next Generation Dismounted Soldier System (NGDSS) is a multinational European defence project launched under the EU’s Permanent Structured Cooperation (PESCO) framework in its sixth wave of initiatives (2025). PESCO aims to deepen defence cooperation among participating EU member states by jointly developing strategic military capabilities. In line with these goals, NGDSS focuses on equipping the European soldier of the future with advanced integrated systems to enhance combat effectiveness, resilience, and interoperability. The project’s approval in May 2025 brought the total number of PESCO projects to 75, underscoring the EU’s collective commitment to strengthening defence readiness. NGDSS is coordinated by Italy with Latvia as the other founding participant. Although a relatively small consortium of two countries, the project holds broader significance for EU land forces and the European defence industry. Both Italy and Latvia seek to leverage NGDSS to modernise their infantry units for high-intensity warfare, while ensuring that the new soldier systems will be interoperable across Europe and within NATO standards. All development is embedded in the EU’s drive for strategic autonomy and a stronger European Defence Technological and Industrial Base (EDTIB), even as it remains complementary to NATO efforts on soldier modernisation.

Hensoldt AG: European Defence Sensor Champion

Hensoldt AG has emerged as a linchpin of Europe’s defence technological base. Specializing in sensor, radar, and optronics systems, the Germany-headquartered firm has seen rapid growth from 2022 to 2025 amid a historic upswing in European defence spending. In the wake of Russia’s invasion of Ukraine, EU and NATO nations have boosted defence budgets by over 30% in real terms from 2021 to 2024. Germany alone allocated a €100 billion Sondervermögen (special fund) for defence and approved new exemptions to debt limits to enable even further spending. This environment has fueled record order intake and revenue for Hensoldt, which is now firmly established as a leading European defence electronics house with roughly 9,000 employees and a global footprint. Backed by strategic shareholders – the German government (25.1% stake) and Italy’s Leonardo S.p.A. (~22.8%) – and a public float on the Frankfurt exchange, Hensoldt is uniquely positioned at the nexus of Europe’s industrial policy and defence market demands. The following report assesses Hensoldt’s industrial profile, core technologies, financial performance and prospects, participation in key programs, and its contribution to European strategic autonomy through 2025 and beyond.

Mapping the Capital Gaps in the EU Defence Build-Up

Russia’s invasion of Ukraine in 2022 triggered a historic surge in EU defence spending. EU member states collectively spent a record €279 billion on defence in 2023, a 10% increase from 2022. Moreover, 2024 spending is forecast to reach €326 billion, reflecting a ninth consecutive year of growth. This “Zeitenwende” (turning point) in European defence has seen 22 out of 27 EU countries boost budgets in 2023, with 11 nations increasing outlays by over 10%. The return of high-intensity war to Europe forced capitals to strengthen military capabilities; in 2023 a record €72 billion (26% of total defence expenditure) went into new equipment procurement and related investments. For the first time, EU collaborative funding mechanisms like the European Defence Fund (EDF) also made a noticeable impact (over €100 million in 2023) on joint R&T projects. Despite this progress, European leaders recognize that simply spending more is not enough – spending better and together is now a core objective. The following sections map the major defence investment plans of 2022–2025, delineate public vs. private capital flows, identify structural financing gaps, and contrast the EU’s approach with U.S. defence-finance pipelines.