Defence Finance Monitor Digest #80

Defence Finance Monitor is a specialised source of analysis for professionals who seek to anticipate how strategic priorities shape investment patterns in the defence sector. In a landscape shaped by high-stakes political choices and rapid technological shifts, understanding the link between military doctrine, operational requirements, and industrial policy is not a competitive edge—it is a prerequisite.

We analyse how strategic imperatives set by NATO, the European Union, allied Indo-Pacific democracies, and national Ministries of Defence translate into procurement programmes, innovation roadmaps, and long-term industrial priorities. Rather than listing individual companies, we track how clearly defined strategic challenges—such as deterrence gaps, technological dependencies, or capability shortfalls—are converted into funding schemes and institutional demand. Only companies that respond to these challenges become relevant to institutional buyers and, by extension, to investors. This framework has already enabled a growing community of analysts and financial professionals to make more consistent, risk-aware decisions and to avoid costly misalignments.

Building on this methodology, we are developing a structured database of companies analysed and classified according to the strategic-technological criteria set out in our framework. Subscribing to Defence Finance Monitor therefore provides not only access to in-depth reports, but also to a continuously expanding database of European and allied defence firms assessed against clear benchmarks. Each company is positioned according to its alignment with EU and NATO priority capability areas, its contribution to European strategic autonomy, its level of interoperability and deterrence value, and its role in reducing dependencies on non-allied suppliers. Classification also covers technology readiness levels, participation in EU and NATO programmes, intellectual property assets, and dual-use applications. This allows subscribers to compare, benchmark, and identify the most strategically relevant actors within a coherent, transparent, and decision-oriented taxonomy.

Subscribing to Defence Finance Monitor means gaining access to a strategic intelligence service that connects financial decisions with defence priorities. At the core of our work is a structured database of European and allied defence companies, classified according to strategic-technological criteria such as autonomy, interoperability, deterrence, and supply chain resilience. In today’s environment, profitable investment requires more than market data: it requires understanding how limited public resources are channelled toward specific capability gaps, sovereign technologies, and the reduction of non-allied dependencies. By combining in-depth reports with a continuously expanding company database, Defence Finance Monitor enables investors to anticipate demand, benchmark firms against institutional priorities, and avoid costly misalignments.

India Approves $9 Billion in New Arms Acquisitions to Accelerate Defence Modernisation and Industrial Self-Reliance

India’s Defence Acquisition Council (DAC), chaired by Defence Minister Rajnath Singh, has approved a fresh round of capital procurement proposals worth 79,000 crore rupees (approximately $9 billion), one of the country’s largest defence authorisations in recent years. The decision, covering projects across the Army, Navy, and Air Force, underscores New Delhi’s determination to modernise its armed forces while anchoring military expansion within the Make in India and Atmanirbhar Bharat (Self-Reliant India) frameworks. It signals a dual ambition: to strengthen operational readiness against evolving regional threats and to consolidate an indigenous defence-industrial base capable of sustaining long-term technological independence.

Leonardo and Rheinmetall Secure First Contract for Italy’s New Armoured Combat Fleet, Marking a Milestone in European Defence Integration

Italy has taken a decisive step in renewing its ground combat capabilities with the award of a landmark contract to the joint venture Leonardo Rheinmetall Military Vehicles (LRMV) for the delivery of the first 21 A2CS Combat Vehicles to the Italian Army. The contract, valued at approximately €950 million, represents the operational debut of the Leonardo–Rheinmetall partnership and a concrete move toward the creation of a European industrial champion in armoured systems. The first vehicles are expected to be delivered by the end of 2025, initiating a new phase in the modernisation of Italy’s heavy forces.

JISR Institute – Strategic-Technological Analysis

In an era when Europe seeks technological self-reliance in defense, one Czech startup is quietly enabling that ambition. JISR Institute, a.s., based in the Czech Republic, develops and delivers advanced multi-domain C4ISR (Command, Control, Communications, Computers, Intelligence, Surveillance, and Reconnaissance) and electronic warfare solutions. Its systems have already been proven in NATO exercises and real military operations, reflecting a level of credibility unusual for a young company. JISR Institute’s engineers – many drawn from the Czech Armed Forces and defense research community – bring deep expertise in signals intelligence and battlefield communications. The company has, in less than a decade, become a go-to partner for integrating complex sensors and command software within European militaries. By focusing on NATO-interoperable standards and leveraging entirely European technology, JISR Institute exemplifies how home-grown innovation can reduce dependence on foreign (especially non-allied) suppliers. The following analysis explores how this small, high-tech defense firm contributes to European strategic autonomy and enhanced collective deterrence through its unique capabilities and collaborations.

LPP Holding: Strategic-Technological Assessment for European Defense Autonomy and NATO Interoperability

LPP Holding is a Czech technology company that has swiftly become a standout innovator in Europe’s defence sector. From its base in Prague, it develops autonomous unmanned systems that have already proven their value on the battlefield. The company’s lightweight drones and robotic vehicles, equipped with artificial intelligence navigation, operate without GPS or constant remote control – a capability that has been stress-tested in the electronic warfare conditions of Ukraine[1][2]. In just a few years, LPP has evolved from an ambitious startup into a holding group uniting more than ten specialized tech firms, each contributing to a vertically integrated model of innovation[3]. Its portfolio spans autonomous ground vehicles, AI-guided aerial drones, advanced sensors, and even avionics for jet trainers, all developed in-house. Led by former senior Czech military and engineering experts, LPP bridges cutting-edge R&D with real-world defence needs. As Europe strives for greater strategic autonomy in the face of global tensions, LPP Holding’s rise offers a compelling example of home-grown European tech stepping up to enhance collective security.

Cogniware: Strategic-Technological Profile for European Defense and Security Autonomy

Cogniware, s.r.o. is a European deep-tech company at the forefront of advanced data analytics and artificial intelligence for security applications[1]. Headquartered in Prague, this small but globally active firm has quietly built a reputation for turning complex, unstructured datasets into actionable intelligence. Its flagship platform, Cogniware Argos, helps law enforcement and intelligence agencies connect the dots across disparate data sources – from digital evidence to social media – to uncover hidden patterns and threats[1][2]. Over the past decade, Cogniware has supported government clients worldwide in tackling organized crime, fraud, and security risks by providing user-friendly tools that harness AI to reveal critical insights[3]. In an era when Europe seeks technological autonomy and stronger defenses, Cogniware stands out as a niche player offering a home-grown solution to data-driven security challenges. Its story – from integrating big-tech software to developing proprietary analytics – offers insight into how European innovators contribute to strategic autonomy. The following analysis explores Cogniware’s corporate identity, technology portfolio, and strategic fit within EU and NATO objectives, highlighting the company’s role in reducing reliance on non-European suppliers while enhancing Europe’s collective security capabilities.

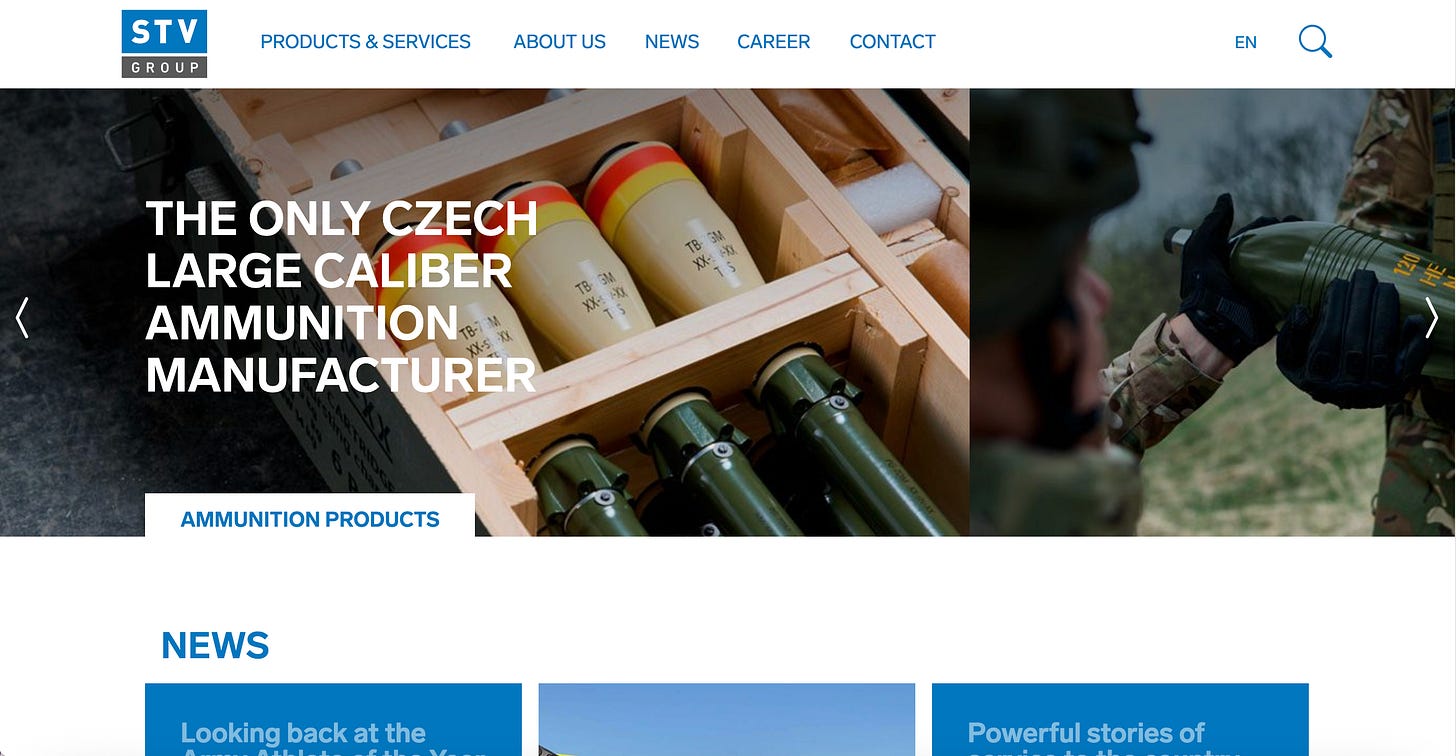

STV Group: Strategic-Technological Profile for European Defense Autonomy

STV Group a.s. is a Czech defense company that has quietly become a pivotal player in Europe’s quest for technological sovereignty. Headquartered in Prague, STV Group carries forward a century-old tradition of ammunition manufacturing, yet its modern profile is anything but old-fashioned. The company has emerged as the Czech Republic’s only producer of large-caliber ammunition, serving as a lifeline for European armies seeking reliable shells and explosives[1]. Beyond artillery rounds, STV Group has expanded its reach into smart armaments and defense services, from advanced anti-tank mine systems to first-person-view (FPV) drones unveiled at international expos. This unassuming mid-sized firm thus finds itself at the forefront of European defense innovation. Its story is one of transformation: leveraging deep industrial know-how to address Europe’s pressing defense gaps, and doing so with a focus on European collaboration and autonomy. The allure of STV Group lies in how it links Czech craftsmanship with cutting-edge defense needs – a combination that promises to bolster Europe’s strategic independence in an era of global uncertainty.

Tatra Trucks: Strategic-Technological Assessment for European Defense Autonomy and NATO Mobility

Tatra Trucks is an iconic Czech vehicle manufacturer with a heritage dating back to the mid-19th century. Over more than 170 years, it has built a reputation for engineering rugged all-terrain trucks and special chassis that perform in the harshest conditions[1][2]. From arctic winters to desert heat, Tatra’s heavy-duty platforms have proven their reliability and off-road prowess under military and civilian demands. This storied company, based in Kopřivnice in the Czech Republic, has transitioned from its early beginnings in automobile production to become a cornerstone of the European defense industrial base. Today, Tatra’s name is synonymous with the distinctive backbone-chassis trucks that carry critical equipment – from artillery and radar systems to armored troop carriers – for armed forces in Europe and around the world[3][4]. Now under Czech ownership and part of the Czechoslovak Group’s defense portfolio, Tatra Trucks is leveraging its engineering legacy to drive innovation in areas like autonomous driving and hydrogen propulsion. The company’s evolution reflects Europe’s broader push for strategic autonomy: by supplying NATO-standard, home-grown tactical vehicles, Tatra is helping reduce reliance on non-allied suppliers while reinforcing Europe’s military mobility and logistics capabilities. This analysis will explore how Tatra Trucks aligns with Europe’s strategic goals – from advanced technology development to strengthening collective defense – and assess its role in enhancing European deterrence and industrial sovereignty.