Defence Finance Monitor Digest #79

Defence Finance Monitor is a specialised source of analysis for professionals who seek to anticipate how strategic priorities shape investment patterns in the defence sector. In a landscape shaped by high-stakes political choices and rapid technological shifts, understanding the link between military doctrine, operational requirements, and industrial policy is not a competitive edge—it is a prerequisite.

We analyse how strategic imperatives set by NATO, the European Union, allied Indo-Pacific democracies, and national Ministries of Defence translate into procurement programmes, innovation roadmaps, and long-term industrial priorities. Rather than listing individual companies, we track how clearly defined strategic challenges—such as deterrence gaps, technological dependencies, or capability shortfalls—are converted into funding schemes and institutional demand. Only companies that respond to these challenges become relevant to institutional buyers and, by extension, to investors. This framework has already enabled a growing community of analysts and financial professionals to make more consistent, risk-aware decisions and to avoid costly misalignments.

Building on this methodology, we are developing a structured database of companies analysed and classified according to the strategic-technological criteria set out in our framework. Subscribing to Defence Finance Monitor therefore provides not only access to in-depth reports, but also to a continuously expanding database of European and allied defence firms assessed against clear benchmarks. Each company is positioned according to its alignment with EU and NATO priority capability areas, its contribution to European strategic autonomy, its level of interoperability and deterrence value, and its role in reducing dependencies on non-allied suppliers. Classification also covers technology readiness levels, participation in EU and NATO programmes, intellectual property assets, and dual-use applications. This allows subscribers to compare, benchmark, and identify the most strategically relevant actors within a coherent, transparent, and decision-oriented taxonomy.

Subscribing to Defence Finance Monitor means gaining access to a strategic intelligence service that connects financial decisions with defence priorities. At the core of our work is a structured database of European and allied defence companies, classified according to strategic-technological criteria such as autonomy, interoperability, deterrence, and supply chain resilience. In today’s environment, profitable investment requires more than market data: it requires understanding how limited public resources are channelled toward specific capability gaps, sovereign technologies, and the reduction of non-allied dependencies. By combining in-depth reports with a continuously expanding company database, Defence Finance Monitor enables investors to anticipate demand, benchmark firms against institutional priorities, and avoid costly misalignments.

Cognitive Warfare and the AI-Driven Defense Ecosystem in Great Power Competition

Cognitive warfare has rapidly emerged as a new arena of great power competition, characterized by battles for influence over perception and decision-making rather than dominance of physical territory. It denotes warfare waged in the mind—both human minds and increasingly the algorithms that inform them—where adversaries seek to shape how targets think and decide[1]. This concept goes beyond propaganda or cyberattacks; it is about gaining strategic advantage by controlling the “cognitive domain” of conflict. Major powers are recognizing this domain as critical. NATO studies describe cognitive warfare as targeting “the brain to gain cognitive advantage,” exploiting psychological and informational vulnerabilities to weaken an adversary’s resolve and system resilience[2][3]. In practice, cognitive operations aim to influence public opinion, strategic calculations, and even automated decision-support systems in order to achieve objectives with minimal conventional force. With the rise of advanced artificial intelligence (AI) and big-data analytics, this battleground has expanded: whoever masters AI-enabled perception-shaping tools may steer events before the first shot is fired. As this analysis will show, cognitive warfare is distinct from traditional information warfare, yet deeply intertwined with it, and its rise is catalyzing new doctrines and a new ecosystem of AI-driven defense companies that blur the lines between military power and information power in the 21st century.

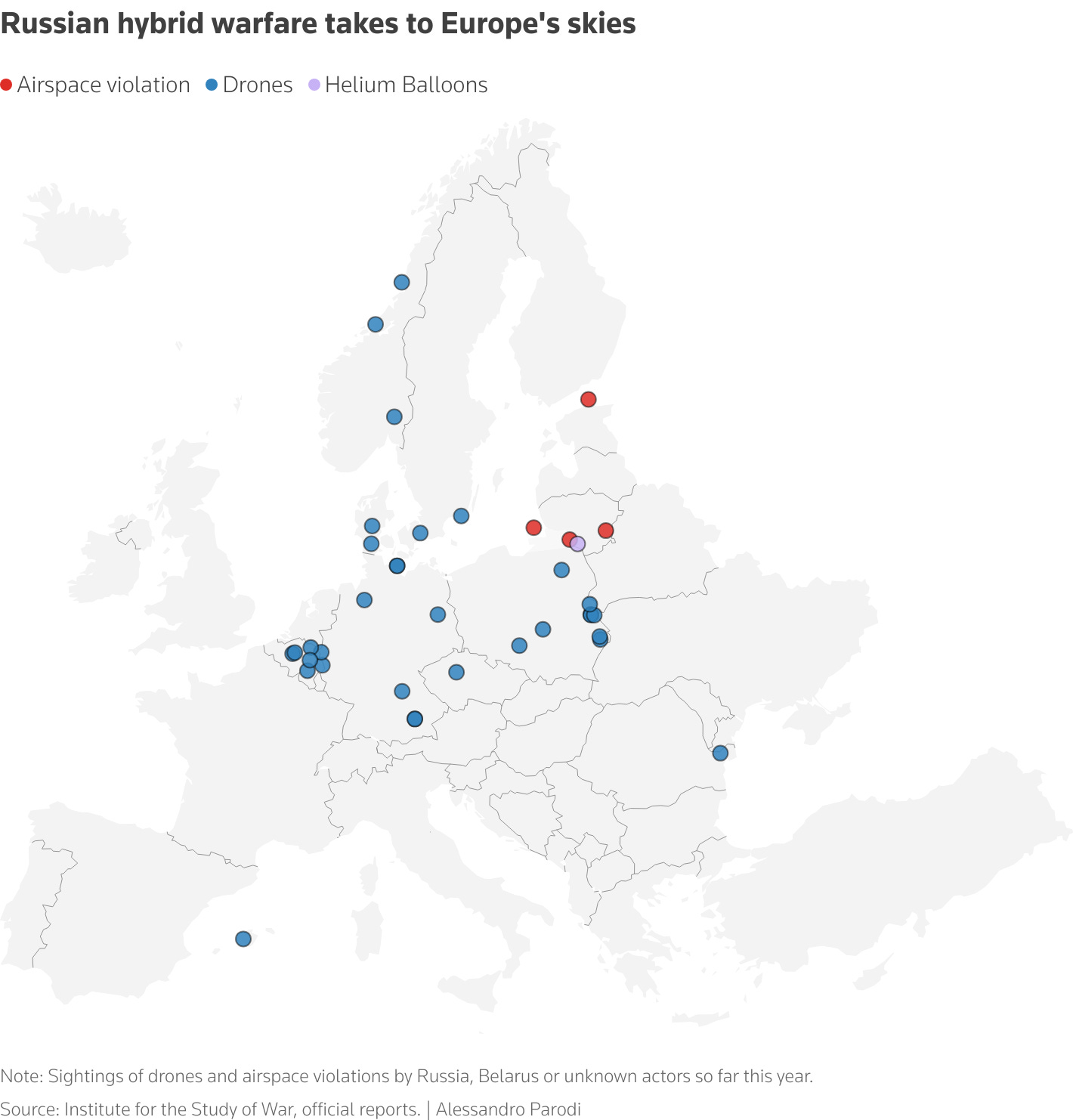

Europe Faces Expanding Hybrid Threats as Drone Incursions Test NATO’s Air Defence Resilience

A series of drone incursions and airspace violations across Europe since early autumn has raised new concerns over the continent’s air defence readiness and its exposure to hybrid warfare tactics. The incidents — ranging from airspace breaches by Russian military jets to unidentified drone sightings over airports and military bases — have disrupted civilian operations and triggered coordinated responses from NATO air commands. European Commission President Ursula von der Leyen described the pattern as a form of “hybrid warfare” aimed at “sowing division and insecurity” among European allies, noting that while not all incidents could be conclusively attributed to Moscow, their cumulative effect undermines public confidence and operational stability.

Japan’s “Domestic Content Ratio”: The Key Metric for Assessing Real Defence-Industrial Strength

Japan’s defence expansion cannot be assessed merely by the size of its procurement budget. The real measure of progress lies in the Domestic Content Ratio (DCR) — the share of a programme’s total value that is generated within Japan through domestic design, production, subcontracting, and maintenance. This metric reveals whether rising budgets are translating into actual industrial capacity, skilled employment, technological autonomy, and export potential. A growing DCR indicates that spending is strengthening national production bases, reducing schedule and supply risks, and stimulating innovation. A stagnant ratio, by contrast, signals structural dependence on imports and U.S. Foreign Military Sales (FMS), with minimal returns for Japan’s manufacturing ecosystem.

Mercer: Strategic-Technological Relevance for European Defense and Dual-Use Autonomy

Mercer is a perhaps unexpected yet increasingly influential player at the nexus of defense and technology. A U.S.-headquartered consultancy known traditionally for expertise in human capital and risk management, Mercer has quietly expanded its role into areas that underpin modern defense capabilities. In an era when European security depends not only on jets or tanks but on data-driven decision support, resilient supply chains, and skilled workforces, Mercer’s blend of analytics and advisory services has found new relevance. The company brings cutting-edge solutions – from artificial intelligence tools to cybersecurity culture assessments – to government and industry clients, positioning itself as a partner in strategic transformation. Mercer’s work with organizations like the U.S. Department of Defense (DoD) has demonstrated its ability to improve readiness and efficiency in critical missions. Now, as Europe pursues greater strategic autonomy and technological sovereignty, Mercer’s global experience and innovative approaches to problem-solving are raising interest. How does a firm rooted in pensions and HR consulting become a catalyst for European defense resilience? The answer lies in Mercer’s strategic pivot toward the emerging needs of allies and its capacity to substitute or support traditional defense suppliers in certain niche but vital domains.

FEAC Engineering – Strategic-Technological Analysis

In the port city of Patras, Greece, a small engineering firm is quietly reshaping how Europe builds and protects its critical assets. FEAC Engineering P.C., founded in 2014, has emerged as a specialist in simulation-driven engineering and digital twin technology. With a team of PhD-level engineers and physicists, this Greek company has leveraged advanced computer modeling and artificial intelligence to tackle complex challenges from naval ship design to offshore infrastructure protection. Its proprietary software platform, known as PITHIA, can create live “digital twins” of structures like warships, ports, and subsea cables – providing real-time insights into their condition and vulnerabilities. Over the past decade, FEAC’s expertise has been sought in European defense research projects and by leading industry partners.

Neuraspace – Strategic-Technological Analysis for European Defense and Space Autonomy

Neuraspace, a young Portuguese deep-tech company, has swiftly positioned itself at the forefront of Europe’s efforts to safeguard critical space infrastructure. Founded just a few years ago, this Coimbra-based venture addresses one of today’s most pressing strategic challenges: the congestion and security of Earth’s orbital environment. Every week brings headlines of new satellites launched, close calls with space debris, or geopolitical tensions extending into orbit – and Neuraspace has emerged with a solution that speaks directly to these concerns. The company leverages artificial intelligence and advanced sensors to monitor objects in space and predict potential collisions or threats, offering a level of automated vigilance previously unseen in the European space sector. In doing so, Neuraspace is not only filling a technological gap but also advancing Europe’s strategic autonomy in space. Its work promises to reduce dependence on outside powers for satellite safety data and to enhance the resilience of European and allied satellites against both accidental conjunctions and intentional interference. As competition in space intensifies, Neuraspace stands out as a timely example of innovation aligning with Europe’s broader defense and industrial goals – a story that invites a deeper look into how this startup is helping the continent secure its final frontier.

Siltronic AG: Strategic-Technological Assessment for European Defense and Dual-Use Autonomy

Siltronic AG may not be a household name, but this German company stands at the heart of Europe’s high-tech ambitions. As a leading producer of ultra-pure silicon wafers – the base material on which virtually all microchips are built – Siltronic underpins the digital technologies that power modern economies and defense systems. From smartphones and solar panels to fighter jet avionics, the silicon substrates supplied by Siltronic form the foundation of countless electronic innovations. In an era when Europe is striving for “strategic autonomy” in critical technologies, Siltronic occupies a pivotal position. The company’s trajectory reflects the continent’s broader challenges and triumphs in the semiconductor arena: it has weathered global supply disruptions, fended off a high-profile foreign takeover attempt, and forged partnerships in cutting-edge European projects. This introduction sets the stage for a deep dive into how Siltronic’s capabilities contribute to Europe’s technological sovereignty and security – and why its success is closely intertwined with the EU’s strategic future.

JISR Institute – Strategic-Technological Analysis

In an era when Europe seeks technological self-reliance in defense, one Czech startup is quietly enabling that ambition. JISR Institute, a.s., based in the Czech Republic, develops and delivers advanced multi-domain C4ISR (Command, Control, Communications, Computers, Intelligence, Surveillance, and Reconnaissance) and electronic warfare solutions. Its systems have already been proven in NATO exercises and real military operations, reflecting a level of credibility unusual for a young company. JISR Institute’s engineers – many drawn from the Czech Armed Forces and defense research community – bring deep expertise in signals intelligence and battlefield communications. The company has, in less than a decade, become a go-to partner for integrating complex sensors and command software within European militaries. By focusing on NATO-interoperable standards and leveraging entirely European technology, JISR Institute exemplifies how home-grown innovation can reduce dependence on foreign (especially non-allied) suppliers. The following analysis explores how this small, high-tech defense firm contributes to European strategic autonomy and enhanced collective deterrence through its unique capabilities and collaborations.