Defence Finance Monitor Digest #78

Defence Finance Monitor is a specialised source of analysis for professionals who seek to anticipate how strategic priorities shape investment patterns in the defence sector. In a landscape shaped by high-stakes political choices and rapid technological shifts, understanding the link between military doctrine, operational requirements, and industrial policy is not a competitive edge—it is a prerequisite.

We analyse how strategic imperatives set by NATO, the European Union, allied Indo-Pacific democracies, and national Ministries of Defence translate into procurement programmes, innovation roadmaps, and long-term industrial priorities. Rather than listing individual companies, we track how clearly defined strategic challenges—such as deterrence gaps, technological dependencies, or capability shortfalls—are converted into funding schemes and institutional demand. Only companies that respond to these challenges become relevant to institutional buyers and, by extension, to investors. This framework has already enabled a growing community of analysts and financial professionals to make more consistent, risk-aware decisions and to avoid costly misalignments.

Building on this methodology, we are developing a structured database of companies analysed and classified according to the strategic-technological criteria set out in our framework. Subscribing to Defence Finance Monitor therefore provides not only access to in-depth reports, but also to a continuously expanding database of European and allied defence firms assessed against clear benchmarks. Each company is positioned according to its alignment with EU and NATO priority capability areas, its contribution to European strategic autonomy, its level of interoperability and deterrence value, and its role in reducing dependencies on non-allied suppliers. Classification also covers technology readiness levels, participation in EU and NATO programmes, intellectual property assets, and dual-use applications. This allows subscribers to compare, benchmark, and identify the most strategically relevant actors within a coherent, transparent, and decision-oriented taxonomy.

Subscribing to Defence Finance Monitor means gaining access to a strategic intelligence service that connects financial decisions with defence priorities. At the core of our work is a structured database of European and allied defence companies, classified according to strategic-technological criteria such as autonomy, interoperability, deterrence, and supply chain resilience. In today’s environment, profitable investment requires more than market data: it requires understanding how limited public resources are channelled toward specific capability gaps, sovereign technologies, and the reduction of non-allied dependencies. By combining in-depth reports with a continuously expanding company database, Defence Finance Monitor enables investors to anticipate demand, benchmark firms against institutional priorities, and avoid costly misalignments.

Europe’s Race to Rearm: Industrial Transformation, Strategic Dependence, and the Next Phase of Defence Integration

Europe’s accelerated rearmament effort is reshaping the continent’s defence economy and the global balance of industrial power. After three decades of underinvestment following the end of the Cold War, the war in Ukraine has triggered an unprecedented expansion in defence spending across the European Union and NATO member states. What began as an emergency response to replenish depleted stocks has evolved into a structural realignment: Europe is rediscovering its role as a security producer rather than merely a beneficiary of American protection. Yet the speed and intensity of this rearmament have also exposed contradictions within Europe’s defence-industrial system — its fragmentation, dependency on U.S. suppliers, and the volatility of its newly resurgent equity markets.

Korea’s Defence Industry Sustains Global Export Momentum amid Rising European and Indo-Pacific Demand

South Korea’s defence industry has entered a phase of structural expansion, positioning itself as a global supplier in a security environment increasingly defined by long-term rearmament and regional deterrence. Between 2020 and 2024, the country rose to tenth place among global arms exporters, according to SIPRI data, and the trend shows no sign of slowing through 2025. The continued war in Ukraine, intensifying maritime competition in the Indo-Pacific, and the widening scope of NATO’s procurement programs have generated sustained demand for modern weapons systems. Korean producers, combining technological reliability with price competitiveness, have become preferred partners for nations seeking immediate delivery and interoperability without the political restrictions that constrain other suppliers. Hanwha Aerospace, LIG Nex1, Korea Aerospace Industries (KAI), Hanwha Systems and Hyundai Rotem now form an integrated export complex at the centre of this transformation.

Company Profiles & Industrial Intelligence

iCOMAT (UK) – Strategic Technological Analysis

In the race to master next-generation defense materials, UK-based startup iCOMAT has emerged as a trailblazer. This University of Bristol spin-out is redefining what composite materials can do for aerospace and defense. iCOMAT’s claim to fame is a patented manufacturing process that can “steer” carbon fibers into curved paths without creating flaws – a breakthrough unlocking ultra-light, resilient structures once thought impossible. By enabling defect-free curved composites, iCOMAT tackles a critical challenge for hypersonic missiles and advanced aircraft: how to build airframes and components that can withstand extreme speeds and temperatures (>2,000 °C) while remaining exceptionally lightweight. The company’s innovations have already drawn investment from NATO’s new €1 billion innovation fund and partnerships with major industry players, signaling its strategic importance. For Europe, iCOMAT represents more than just a deep-tech startup – it embodies a homegrown solution to bolster strategic autonomy in advanced materials, promising to reduce reliance on foreign suppliers and give European defense systems a decisive edge.

Less Common Metals (UK) – Strategic Technological Analysis

In a world where advanced weapons, electric vehicles, and renewable energy systems all hinge on powerful rare-earth magnets, Europe’s supply chain vulnerabilities have come into sharp focus. Less Common Metals (LCM) Ltd is a British company at the crux of this challenge and opportunity. Founded in 1992 and based in northern England, LCM has become one of the very few non-Chinese producers of rare-earth metals and alloys. The company operates in a highly strategic niche: it refines critical raw materials like neodymium, praseodymium, dysprosium, and terbium into magnet-ready alloys, providing an alternative source for essential components used in fighter jets, guided missiles, satellite systems, and electric drivetrains. As Europe strives for greater strategic autonomy and resilience, LCM’s role has evolved from a specialty metals maker into a key enabler of Western supply-chain security. This introduction sets the stage for an in-depth analysis of how LCM’s technological capabilities and strategic initiatives align with Europe’s defense needs and the broader push to reduce dependence on non-allied suppliers.

Elistair (France) – Strategic-Technological Analysis

From its base in France’s Auvergne-Rhône-Alpes region, Elistair is redefining persistent aerial surveillance with tethered drones that can hover for hours or even days. Founded in 2014 by two engineers from École Centrale Lyon, the company has grown from a startup into a trusted provider of “eye in the sky” solutions for defense and security forces across Europe and beyond. Elistair’s patented tethered unmanned aerial systems (UAS) address a critical challenge in drone operations – limited battery life – by using a Kevlar-reinforced micro-tether to deliver continuous power and secure data downlink from a ground station. This innovation allows its drones to maintain persistent surveillance over strategic sites for up to 24–50+ hours, far outlasting free-flying battery-powered UAVs. European militaries and security agencies have deployed Elistair’s tethered drones to guard NATO bases, monitor EU borders, and protect critical events, gaining real-time situational awareness without relying on non-European suppliers. In an era of rising concern over foreign-made drones, Elistair offers a sovereign European alternative that is interoperable with NATO networks and compliant with stringent cybersecurity standards. Its story – from early support by the French Defence Agency to contracts with allied forces – exemplifies how Europe’s homegrown tech innovators can strengthen strategic autonomy while bolstering transatlantic security ties.

IT’S BRAIN (France) – AI-Supported Cognitive Testing for Neuropsychiatric Diagnosis

Nestled within Europe’s leading neuroscience hub at Paris-Saclay, the start-up IT’S BRAIN is quietly redefining cognitive assessment with its digital test platform. Born from a decade of academic research, this spin-off of Université Paris-Saclay has transformed laboratory insights into a practical tool that clinicians can use to measure how our brains handle speed, precision, and decision-making. The company’s flagship product, MindPulse, condenses what used to require hours of paper exams into a fifteen-minute computerized test, delivering a rich cognitive report in minutes. It’s an innovation that has already attracted attention beyond the clinic: from helping European astronauts monitor mental sharpness under zero gravity to hinting at future applications in soldier performance and crisis response. IT’S BRAIN embodies a new breed of dual-use technology ventures – those blending healthcare and high-tech – emerging in Europe’s quest for greater strategic autonomy. By keeping its technology home-grown and data securely hosted in France, the company aligns with broader European aims to reduce reliance on foreign suppliers and protect sensitive health information. The story of IT’S BRAIN is a case study in turning academic science into a strategic asset, one that piques the interest of both medical professionals and defense planners looking to fortify Europe’s cognitive edge.

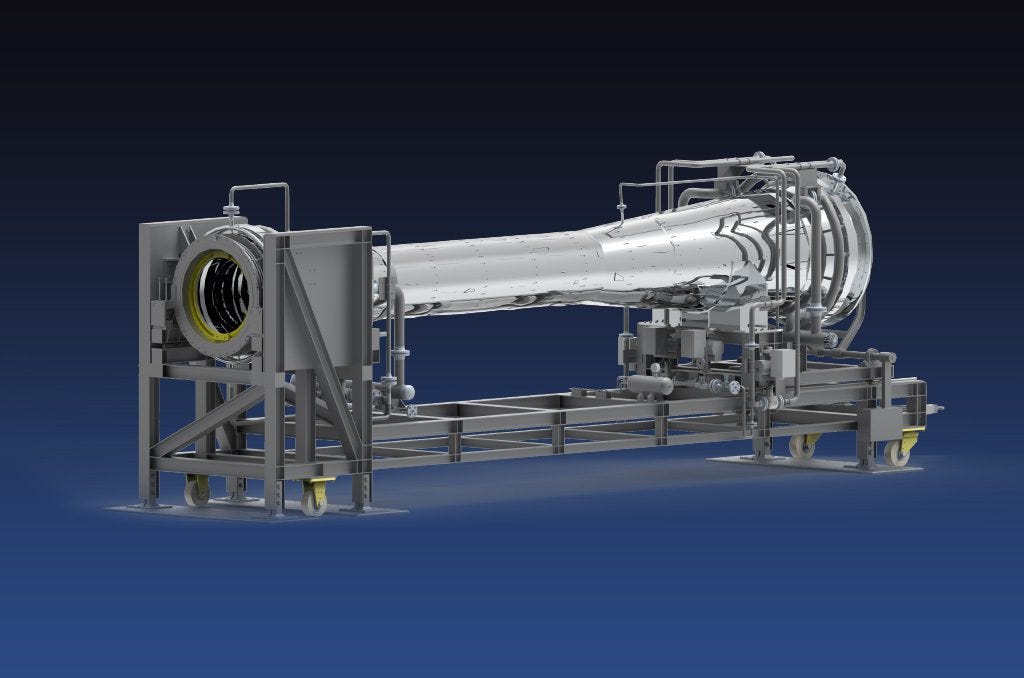

Novaeka S.r.l.: Strategic-Technological Analysis

Novaeka S.r.l. is an Italian aerospace engineering company based in Padua, Italy, specializing in the design and manufacture of cryogenic rocket engine test benches and fluidic ground support systems. Its modular test facilities support liquid-propellant engines up to 10 tonnes of thrust[1], and it also develops advanced digital twins and numerical simulation tools for propulsion system validation. In the context of European space and defense goals, Novaeka’s capabilities contribute directly to the continent’s ability to independently develop and certify new launch and missile engines. Its in-house facility for bench assembly[2] and multidisciplinary team (aerospace, mechanical, chemical engineering and software expertise[3]) position it as a key supplier of propulsion test infrastructure. By enabling indigenous development of cryogenic engine technologies, Novaeka helps reduce reliance on external providers, strengthening European space autonomy[4]. Europe’s new space security strategy explicitly calls for autonomous access to space and reduced strategic dependencies[4], making Novaeka’s work on homegrown test systems directly relevant. Overall, Novaeka represents an emerging SME deep-tech player in Europe’s dual-use space-propulsion segment[5][6].