Defence Finance Monitor Digest #77

Defence Finance Monitor is a specialised source of analysis for professionals who seek to anticipate how strategic priorities shape investment patterns in the defence sector. In a landscape shaped by high-stakes political choices and rapid technological shifts, understanding the link between military doctrine, operational requirements, and industrial policy is not a competitive edge—it is a prerequisite.

We analyse how strategic imperatives set by NATO, the European Union, allied Indo-Pacific democracies, and national Ministries of Defence translate into procurement programmes, innovation roadmaps, and long-term industrial priorities. Rather than listing individual companies, we track how clearly defined strategic challenges—such as deterrence gaps, technological dependencies, or capability shortfalls—are converted into funding schemes and institutional demand. Only companies that respond to these challenges become relevant to institutional buyers and, by extension, to investors. This framework has already enabled a growing community of analysts and financial professionals to make more consistent, risk-aware decisions and to avoid costly misalignments.

Building on this methodology, we are developing a structured database of companies analysed and classified according to the strategic-technological criteria set out in our framework. Subscribing to Defence Finance Monitor therefore provides not only access to in-depth reports, but also to a continuously expanding database of European and allied defence firms assessed against clear benchmarks. Each company is positioned according to its alignment with EU and NATO priority capability areas, its contribution to European strategic autonomy, its level of interoperability and deterrence value, and its role in reducing dependencies on non-allied suppliers. Classification also covers technology readiness levels, participation in EU and NATO programmes, intellectual property assets, and dual-use applications. This allows subscribers to compare, benchmark, and identify the most strategically relevant actors within a coherent, transparent, and decision-oriented taxonomy.

Subscribing to Defence Finance Monitor means gaining access to a strategic intelligence service that connects financial decisions with defence priorities. At the core of our work is a structured database of European and allied defence companies, classified according to strategic-technological criteria such as autonomy, interoperability, deterrence, and supply chain resilience. In today’s environment, profitable investment requires more than market data: it requires understanding how limited public resources are channelled toward specific capability gaps, sovereign technologies, and the reduction of non-allied dependencies. By combining in-depth reports with a continuously expanding company database, Defence Finance Monitor enables investors to anticipate demand, benchmark firms against institutional priorities, and avoid costly misalignments.

U.S. Troop Reduction in Romania: Strategic and Industrial Implications for European Defense

The decision by the United States to end the rotation of the 2nd Infantry Brigade Combat Team of the 101st Airborne Division marks a deliberate recalibration of the American military footprint on NATO’s Eastern Flank. The brigade, deployed to Romania after Russia’s full-scale invasion of Ukraine in 2022, is returning to Fort Campbell, Kentucky, without replacement. Washington has framed the move as part of a broader “force posture realignment,” intended to balance global priorities rather than signaling a retreat from Europe. The Romanian Ministry of Defense confirmed that around one thousand U.S. troops will remain stationed in the country, maintaining operations at the Mihail Kogălniceanu Air Base, Deveselu, and Câmpia Turzii. Nevertheless, the redeployment has revived debate over the balance of responsibility between the United States and Europe in sustaining deterrence on the continent’s most exposed frontier, and over the capacity of European allies to fill any resulting operational gaps with their own resources.

The “Solidarity Pool” and Europe’s Military Mobility Revolution

Europe’s emerging “solidarity pool” marks a decisive step in the continent’s transition from dependence to strategic autonomy. The initiative, launched by the European Commission in close coordination with NATO, aims to build an integrated logistical network capable of moving heavy equipment and troops across the continent within hours. For decades, Europe’s fragmented infrastructure — bridges too weak for modern tanks, tunnels too narrow, rail gauges mismatched — has been a structural obstacle to credible deterrence. The Russian invasion of Ukraine exposed this vulnerability: Europe may have the forces and equipment, but not the means to move them fast enough. The €17 billion mobility program seeks to turn Europe’s geography from a liability into an asset, linking western and eastern regions through reinforced land, rail, and maritime corridors. Beyond its engineering scope, this initiative represents a strategic pivot: the physical manifestation of Europe’s awakening to a defense era defined by self-reliance, logistical speed, and credible response without guaranteed American reinforcement.

Company Profiles & Industrial Intelligence

Anduril’s Jet-Powered Loyal Wingman Makes First Flight, Signalling a Shift in Air Combat Architecture

Anduril Industries reported the successful maiden flight of its jet-powered unmanned aircraft, a milestone that advances the U.S. Air Force’s effort to field collaborative combat aircraft capable of operating alongside crewed fighters. The prototype, flown at a California test facility, demonstrated semi-autonomous flight control and recovery capabilities, confirming the platform’s basic handling and systems integration. The achievement marks a tangible step in the Pentagon’s broader initiative to distribute sensing, strike and electronic-warfare functions across mixed manned-unmanned formations.

SpaceKnow: European Strategic-Technological Analysis

SpaceKnow is a Prague-based provider of cutting-edge satellite intelligence, turning imagery from space into actionable analysis for defense, government, and commercial markets. Born from a bold vision in 2013, this deep-tech startup has pioneered the use of artificial intelligence to extract insights from vast quantities of Earth observation data. Its journey from a two-person venture into a transatlantic geospatial analytics firm embodies the spirit of European innovation and strategic autonomy. Today, SpaceKnow’s platform harnesses multi-source satellite feeds – from optical to radar – and applies proprietary algorithms to monitor global activities in near-real-time. The company’s solutions have been quietly at work in scenarios ranging from tracking industrial output in China’s factory belts to identifying “dark ships” in European waters linked to covert operations[1]. As Europe seeks to strengthen its technological sovereignty and reduce dependence on non-allied sources, SpaceKnow offers a compelling story of a home-grown capability that is enhancing situational awareness for both economic and security needs. The following analysis delves into SpaceKnow’s strategic-technological profile, examining how its AI-powered intelligence supports Europe’s defense objectives, NATO interoperability, and the broader goal of reducing critical dependencies on foreign providers.

Eyedea Recognition: Strategic-Technological Profile Supporting European Security and Defense Autonomy

In a quiet corner of Prague, a university spin-off has been redefining how Europe harnesses artificial intelligence for security. Eyedea Recognition emerged from academic labs with a singular vision: to give European authorities their own cutting-edge tools for visual intelligence. This Czech startup specializes in advanced facial and object recognition software – the kind of technology typically dominated by big foreign players – but developed and kept entirely in Europe[1]. Its algorithms can sift through crowded images and videos to identify faces, vehicles, and critical details with remarkable accuracy. Law enforcement agencies have taken notice. Europol and national police forces have adopted Eyedea’s solutions to track terrorists and criminals across borders[2][3]. In an era when Europe is striving for strategic tech autonomy, Eyedea’s rise offers a compelling example of home-grown innovation reducing reliance on imports. The company stands at the crossroads of European strategic interests: empowering security forces with AI, enhancing interoperability within NATO allies, and ensuring Europe isn’t beholden to outside suppliers for vital security capabilities. This report delves into Eyedea Recognition’s strategic-technological profile – a story of academic excellence turned into a sovereign capability quietly strengthening Europe’s hand in security and defense.

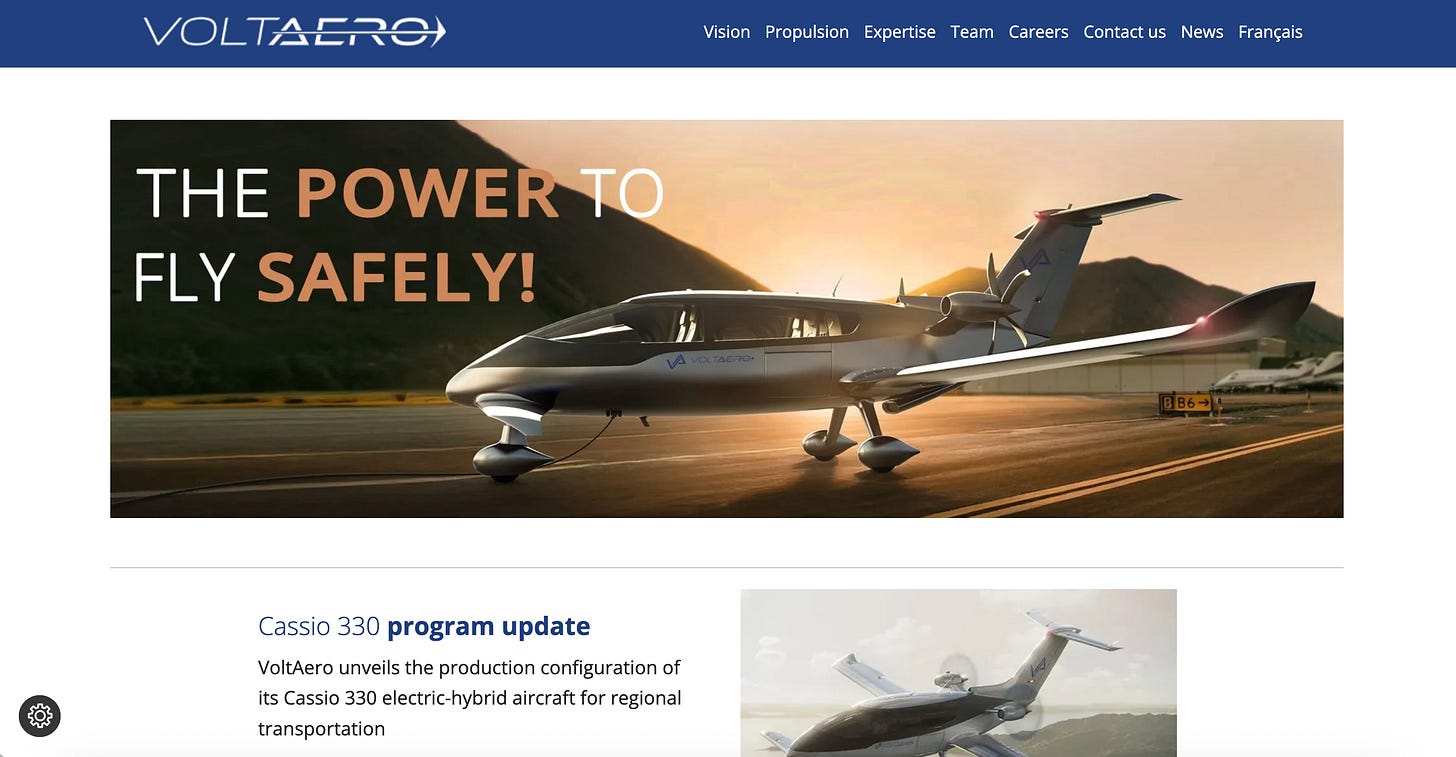

VoltAero (France) – Strategic-Technological Analysis

VoltAero is a French electric–hybrid aviation company emerging as a pioneer in clean regional flight. Based in Nouvelle-Aquitaine (southwest France), it develops the Cassio family of hybrid-electric airplanes designed for quiet, efficient point-to-point travel[1][2]. Founded by former Airbus and automotive executives, VoltAero has attracted significant funding (e.g. a €2.1 M European Innovation Council grant in 2020[3] and a €5.6 M French government “France 2030” grant in 2023[4]) to mature its technology. Its leadership includes CEO/CTO Jean Botti (ex-Airbus CTO) and Marina Evans (ex-Safran/Snecma executive)[5]. In 2024 the company opened a 2,400 m² final assembly plant at Rochefort Airport (Saint-Agnant, France) to begin industrial production[6][7]. VoltAero’s core innovation is its series-hybrid propulsion – combining Safran electric motors (for takeoff and cruise) with a Kawasaki combustion engine as an in-flight range extender[8][9]. The Cassio 330 (four-to-five seats) has completed thousands of kilometers of test flights[2][10] and is entering EASA certification, with larger variants (six- and ten-seat) planned next[11].

GMV Innovating Solutions S.L.: A Spanish Defense and Dual-Use Technology Group

GMV Innovating Solutions S.L. is a Spanish high-tech engineering group founded in 1984 and headquartered in Tres Cantos (Madrid), Spain[1][2]. The privately owned company is led by President Mónica Martínez Walter and CEO Jesús Serrano (an aeronautical engineer by training)[3][4]. GMV operates across multiple domains – notably space, defense and security, navigation, and cyber – with an international presence (offices in 12 countries and clients in nearly 80)[5][1]. A core part of the European defense industrial base, GMV combines proprietary R&D with participation in multilateral consortia and government programs. Its management team includes Spanish-educated specialists in engineering and international defense, and the firm has the requisite security accreditations for classified programs (GMV personnel have spoken on EU security clearance issues[6]). The company is not publicly listed; it remains a private mid-cap group with a broad portfolio of defense and dual-use capabilities.