Defence Finance Monitor Digest #75

Defence Finance Monitor is a specialised source of analysis for professionals who seek to anticipate how strategic priorities shape investment patterns in the defence sector. In a landscape shaped by high-stakes political choices and rapid technological shifts, understanding the link between military doctrine, operational requirements, and industrial policy is not a competitive edge—it is a prerequisite.

We analyse how strategic imperatives set by NATO, the European Union, allied Indo-Pacific democracies, and national Ministries of Defence translate into procurement programmes, innovation roadmaps, and long-term industrial priorities. Rather than listing individual companies, we track how clearly defined strategic challenges—such as deterrence gaps, technological dependencies, or capability shortfalls—are converted into funding schemes and institutional demand. Only companies that respond to these challenges become relevant to institutional buyers and, by extension, to investors. This framework has already enabled a growing community of analysts and financial professionals to make more consistent, risk-aware decisions and to avoid costly misalignments.

Building on this methodology, we are developing a structured database of companies analysed and classified according to the strategic-technological criteria set out in our framework. Subscribing to Defence Finance Monitor therefore provides not only access to in-depth reports, but also to a continuously expanding database of European and allied defence firms assessed against clear benchmarks. Each company is positioned according to its alignment with EU and NATO priority capability areas, its contribution to European strategic autonomy, its level of interoperability and deterrence value, and its role in reducing dependencies on non-allied suppliers. Classification also covers technology readiness levels, participation in EU and NATO programmes, intellectual property assets, and dual-use applications. This allows subscribers to compare, benchmark, and identify the most strategically relevant actors within a coherent, transparent, and decision-oriented taxonomy.

Subscribing to Defence Finance Monitor means gaining access to a strategic intelligence service that connects financial decisions with defence priorities. At the core of our work is a structured database of European and allied defence companies, classified according to strategic-technological criteria such as autonomy, interoperability, deterrence, and supply chain resilience. In today’s environment, profitable investment requires more than market data: it requires understanding how limited public resources are channelled toward specific capability gaps, sovereign technologies, and the reduction of non-allied dependencies. By combining in-depth reports with a continuously expanding company database, Defence Finance Monitor enables investors to anticipate demand, benchmark firms against institutional priorities, and avoid costly misalignments.

Proteus: How France Is Reinventing Anti-Drone Defence Inspired by Ukraine

The French Army has begun testing a new counter-drone defence system called Proteus, developed in record time and now in training with the 35th Parachute Artillery Regiment. The exercises are taking place at the vast Canjuers military range in southern France and mark an important step in the country’s modernisation of its short-range air-defence forces. The system was born from a simple yet innovative idea: to reuse and upgrade old 20-millimetre anti-aircraft cannons by mounting them on mobile trucks and equipping them with modern optics, sensors, and fire-control software to fight drones. The goal is to build an agile, fast, and low-cost defence capability against threats that are increasingly widespread and difficult to intercept.

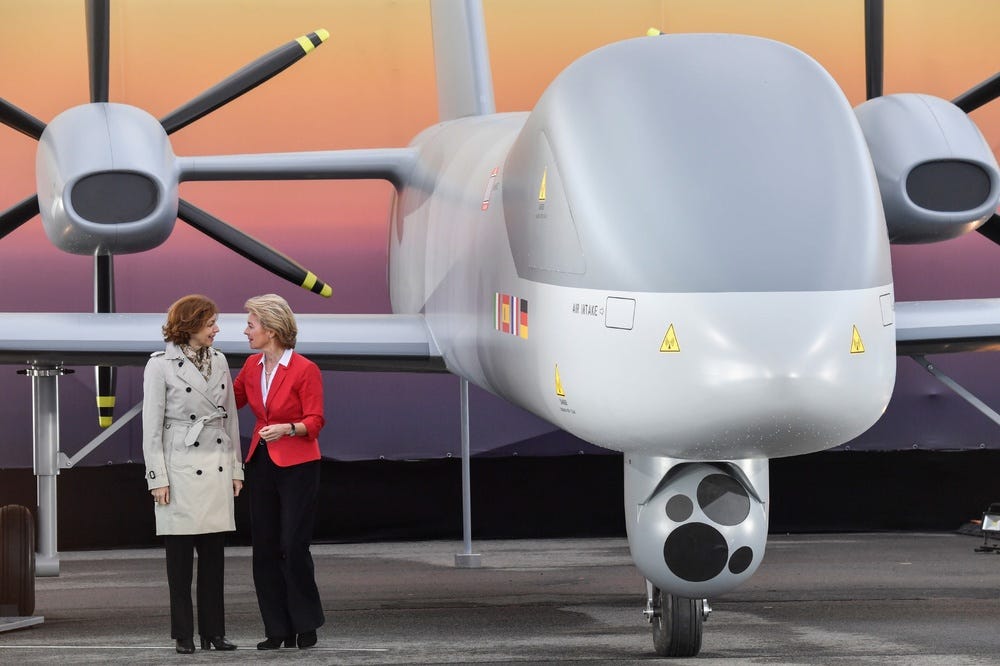

The Invisible Network of Europe: How EDDI Is Redesigning the Continent’s Aerial Defence

The European Drone Defence Initiative (EDDI) is the programme through which the European Union is building a new infrastructure for the continent’s air defence. Framed within the Defence Readiness Roadmap 2030, EDDI is one of the four flagship projects forming the backbone of the EU’s new collective security strategy, together with the Eastern Flank Watch, the European Air Shield, and the European Space Shield. Its purpose is twofold: to develop an integrated system for the detection and neutralisation of drones, and to establish a shared technological and industrial architecture that enables Europe to act as a single defence space. The initiative aims for initial operational capability by the end of 2026 and full functionality by 2027, based on shared standards for sensors, radars, command-and-control software, and engagement procedures. The European Commission and Member States seek to align the entire network with NATO command structures, ensuring both technical compatibility and strategic coherence. The goal is to overcome national fragmentation and create a continental defence grid capable of providing continuous surveillance and real-time response against threats that know no borders.

Company Profiles & Industrial Intelligence

Partory: Europe’s On‑Demand Digital Factory for Defense Supply Resilience

In an era of strained global supply chains and evolving security challenges, a Czech startup is quietly transforming how Europe sources critical mechanical components. Partory is turning idle machine shops across the continent into a digital factory on demand – a network of over 8,000 CNC machines, lasers, and welding rigs ready to produce parts at a moment’s notice[1][2]. Founded in 2018 by two brothers in Hradec Králové, this industrial B2B platform leverages AI to match engineering part requests with surplus capacity among 1,500+ audited European manufacturers[3]. The implications extend far beyond cost savings and procurement efficiency. By insisting on “Made in Europe” and refusing to outsource production outside the EU[4], Partory has positioned itself as more than a marketplace – it is emerging as a strategic asset for European defense autonomy. From supplying spare parts for heavy machinery to envisioning rapid response manufacturing for military needs, Partory tantalizes with the promise of a resilient, sovereign supply chain. Its story – blending advanced software with Europe’s rich manufacturing base – is a compelling glimpse into how dual-use innovation can strengthen NATO readiness and European strategic autonomy alike. In the following report, we delve into Partory’s model, technology, and strategic relevance for Europe’s defense ecosystem.

Colt CZ Group: Strategic-Technological Assessment for European Defense Autonomy

Colt CZ Group SE is a historic European arms manufacturer that has rapidly transformed into a transatlantic defense player. Headquartered in Prague, this Czech-rooted company is renowned for its small arms – from service pistols to assault rifles – now sold under legendary brands including Česká Zbrojovka (CZ) and Colt[1][2]. The Group’s recent expansion into ammunition production and advanced weapons systems reflects a strategic vision beyond traditional firearms. In an era when Europe is striving for greater defense autonomy, Colt CZ Group stands out as a mid-cap manufacturer aligning its industrial growth with Europe’s security priorities. Its acquisitions of iconic Western brands and partnerships across NATO countries signal an ambition to ensure that European armed forces and allies have reliable, non-dependent sources for critical gear[3]. This introduction explores how a venerable Czech armory has reinvented itself as a modern defense group contributing to Europe’s strategic autonomy and collective deterrence capabilities.

Excalibur Army – Strategic-Technological Analysis

Excalibur Army has emerged as a pivotal European defense company transforming Cold War-era military assets into modern combat capabilities. Founded in the Czech Republic in the 1990s as a trader in surplus tanks and armored vehicles, it has since grown into a leading manufacturer and integrator of land systems for European armed forces. Today the company produces state-of-the-art howitzers, rocket launchers, combat vehicles, and engineering equipment – all tailored to NATO standards and European requirements. Its journey from refurbishing aging Soviet platforms to fielding advanced 155 mm artillery showcases the broader evolution of Europe’s defense industry in pursuit of strategic autonomy. In an era when Europe seeks to strengthen its deterrence and reduce reliance on non-allied suppliers, Excalibur Army stands as a case study in homegrown capability. Balancing legacy expertise with new technology development, the company plays a quietly critical role in bolstering Europe’s defense posture and supply chain resilience. This introduction offers a glimpse of Excalibur Army’s profile and strategic significance, setting the stage for a deeper analysis of how this Czech mid-cap firm contributes to Europe’s security and technological sovereignty.

Tatra Trucks: Strategic-Technological Assessment for European Defense Autonomy and NATO Mobility

Tatra Trucks is an iconic Czech vehicle manufacturer with a heritage dating back to the mid-19th century. Over more than 170 years, it has built a reputation for engineering rugged all-terrain trucks and special chassis that perform in the harshest conditions[1][2]. From arctic winters to desert heat, Tatra’s heavy-duty platforms have proven their reliability and off-road prowess under military and civilian demands. This storied company, based in Kopřivnice in the Czech Republic, has transitioned from its early beginnings in automobile production to become a cornerstone of the European defense industrial base. Today, Tatra’s name is synonymous with the distinctive backbone-chassis trucks that carry critical equipment – from artillery and radar systems to armored troop carriers – for armed forces in Europe and around the world[3][4]. Now under Czech ownership and part of the Czechoslovak Group’s defense portfolio, Tatra Trucks is leveraging its engineering legacy to drive innovation in areas like autonomous driving and hydrogen propulsion. The company’s evolution reflects Europe’s broader push for strategic autonomy: by supplying NATO-standard, home-grown tactical vehicles, Tatra is helping reduce reliance on non-allied suppliers while reinforcing Europe’s military mobility and logistics capabilities. This analysis will explore how Tatra Trucks aligns with Europe’s strategic goals – from advanced technology development to strengthening collective defense – and assess its role in enhancing European deterrence and industrial sovereignty.