Defence Finance Monitor Digest #74

Defence Finance Monitor is a specialised source of analysis for professionals who seek to anticipate how strategic priorities shape investment patterns in the defence sector. In a landscape shaped by high-stakes political choices and rapid technological shifts, understanding the link between military doctrine, operational requirements, and industrial policy is not a competitive edge—it is a prerequisite.

We analyse how strategic imperatives set by NATO, the European Union, allied Indo-Pacific democracies, and national Ministries of Defence translate into procurement programmes, innovation roadmaps, and long-term industrial priorities. Rather than listing individual companies, we track how clearly defined strategic challenges—such as deterrence gaps, technological dependencies, or capability shortfalls—are converted into funding schemes and institutional demand. Only companies that respond to these challenges become relevant to institutional buyers and, by extension, to investors. This framework has already enabled a growing community of analysts and financial professionals to make more consistent, risk-aware decisions and to avoid costly misalignments.

Building on this methodology, we are developing a structured database of companies analysed and classified according to the strategic-technological criteria set out in our framework. Subscribing to Defence Finance Monitor therefore provides not only access to in-depth reports, but also to a continuously expanding database of European and allied defence firms assessed against clear benchmarks. Each company is positioned according to its alignment with EU and NATO priority capability areas, its contribution to European strategic autonomy, its level of interoperability and deterrence value, and its role in reducing dependencies on non-allied suppliers. Classification also covers technology readiness levels, participation in EU and NATO programmes, intellectual property assets, and dual-use applications. This allows subscribers to compare, benchmark, and identify the most strategically relevant actors within a coherent, transparent, and decision-oriented taxonomy.

Subscribing to Defence Finance Monitor means gaining access to a strategic intelligence service that connects financial decisions with defence priorities. At the core of our work is a structured database of European and allied defence companies, classified according to strategic-technological criteria such as autonomy, interoperability, deterrence, and supply chain resilience. In today’s environment, profitable investment requires more than market data: it requires understanding how limited public resources are channelled toward specific capability gaps, sovereign technologies, and the reduction of non-allied dependencies. By combining in-depth reports with a continuously expanding company database, Defence Finance Monitor enables investors to anticipate demand, benchmark firms against institutional priorities, and avoid costly misalignments.

European Drone Defence Initiative (EDDI): Building Europe’s Counter-UAS Architecture

The European Drone Defence Initiative (EDDI) emerges from the institutional and strategic architecture of the Defence Readiness Roadmap 2030, which operationalises the vision set out in the White Paper for European Defence – Readiness 2030. Conceived at the intersection of technological sovereignty and deterrence credibility, EDDI is the European Union’s first collective response to the rapid proliferation of unmanned aerial systems as instruments of warfare, surveillance, and coercion. The White Paper defines the transformation of airspace into a contested operational environment, highlighting how Russia’s full-scale invasion of Ukraine and its extensive reliance on drones for reconnaissance and precision strikes exposed Europe’s systemic vulnerability to low-cost, high-impact technologies. This awareness prompted the European Council in June 2025 to request a defence roadmap centred on readiness, industrial resilience, and shared capability development. Within that framework, the Commission and the High Representative identified four European Flagships — the Drone Defence Initiative, the Eastern Flank Watch, the European Air Shield, and the European Space Shield — as operational anchors of a continental deterrence posture. EDDI represents the most immediate and technologically dynamic of these programmes, linking the lessons learned in Ukraine with the EU’s ambition to ensure interoperability with NATO while asserting industrial independence in critical defence technologies. It symbolises Europe’s strategic shift from fragmented procurement to coordinated readiness, transforming the defence of airspace into a cross-domain policy integrating innovation, production, and alliance coherence.

LPP Holding: Strategic-Technological Assessment for European Defense Autonomy and NATO Interoperability

LPP Holding is a Czech technology company that has swiftly become a standout innovator in Europe’s defence sector. From its base in Prague, it develops autonomous unmanned systems that have already proven their value on the battlefield. The company’s lightweight drones and robotic vehicles, equipped with artificial intelligence navigation, operate without GPS or constant remote control – a capability that has been stress-tested in the electronic warfare conditions of Ukraine[1][2]. In just a few years, LPP has evolved from an ambitious startup into a holding group uniting more than ten specialized tech firms, each contributing to a vertically integrated model of innovation[3]. Its portfolio spans autonomous ground vehicles, AI-guided aerial drones, advanced sensors, and even avionics for jet trainers, all developed in-house. Led by former senior Czech military and engineering experts, LPP bridges cutting-edge R&D with real-world defence needs. As Europe strives for greater strategic autonomy in the face of global tensions, LPP Holding’s rise offers a compelling example of home-grown European tech stepping up to enhance collective security.

Cogniware: Strategic-Technological Profile for European Defense and Security Autonomy

Cogniware, s.r.o. is a European deep-tech company at the forefront of advanced data analytics and artificial intelligence for security applications[1]. Headquartered in Prague, this small but globally active firm has quietly built a reputation for turning complex, unstructured datasets into actionable intelligence. Its flagship platform, Cogniware Argos, helps law enforcement and intelligence agencies connect the dots across disparate data sources – from digital evidence to social media – to uncover hidden patterns and threats[1][2]. Over the past decade, Cogniware has supported government clients worldwide in tackling organized crime, fraud, and security risks by providing user-friendly tools that harness AI to reveal critical insights[3]. In an era when Europe seeks technological autonomy and stronger defenses, Cogniware stands out as a niche player offering a home-grown solution to data-driven security challenges. Its story – from integrating big-tech software to developing proprietary analytics – offers insight into how European innovators contribute to strategic autonomy. The following analysis explores Cogniware’s corporate identity, technology portfolio, and strategic fit within EU and NATO objectives, highlighting the company’s role in reducing reliance on non-European suppliers while enhancing Europe’s collective security capabilities.

Dronetag (Czech Republic) – Enabling Secure & Autonomous Drone Airspace

In Europe’s increasingly crowded skies, the ability to identify and manage drones in real time has moved from a regulatory formality to a strategic imperative. Small unmanned aircraft are now ubiquitous across civilian and security domains, raising both opportunities and concerns for European authorities. Dronetag, a Prague-based deep-tech startup, has positioned itself at the forefront of this challenge. Founded by a young engineer while still at university, the company develops IoT-based “digital license plates” for drones – tiny transmitters and receivers that make drones visible to air traffic managers, law enforcement, and defense systems. This unassuming technology addresses a critical gap: ensuring that all drones, whether delivering packages or conducting surveillance, can be identified and tracked under European rules. As EU institutions push for greater strategic autonomy in emerging technologies, Dronetag’s innovation offers a home-grown solution to reduce reliance on foreign drone tech. The following analysis explores how this startup’s remote identification devices and software contribute to a safer European airspace, bolster NATO’s situational awareness, and lay groundwork for more resilient defense capabilities. It uncovers Dronetag’s corporate DNA, its integration into EU and NATO innovation frameworks, and its potential role in diminishing Europe’s dependence on untrusted drone suppliers. The aim is to assess objectively – without hype or rhetoric – whether Dronetag’s technology can become a strategic asset for Europe’s autonomy and security, or remains a niche capability with promise yet to be realized.

Groundcom: Strategic-Technological Assessment for European Defense and Space Autonomy

Groundcom is an emerging European space technology company leveraging ground stations to transform how satellites communicate with Earth. Founded in 2020 and headquartered in Brno, Czech Republic, Groundcom builds and operates a global network of satellite ground stations to provide affordable, real-time links for low Earth orbit (LEO) constellations[1]. In an era when secure and constant connectivity with orbiting assets is paramount for both commercial and defense missions, this deep-tech startup addresses a critical segment of the space value chain often overlooked by the public. Groundcom’s mission – offering “Ground Station-as-a-Service” to satellite operators – aligns with Europe’s drive for greater strategic autonomy in space infrastructure. By developing its own hardware and software, the company enables clients to control their satellites without investing in proprietary antennas, using Groundcom’s automated network instead[2][3]. Such capabilities are increasingly significant as Europe seeks to reduce reliance on non-European suppliers and ensure that vital space-based services remain under allied control. Groundcom’s story illustrates the intersection of entrepreneurial innovation with continental strategic priorities: a small startup aiming to fill big gaps in Europe’s defense and space ecosystem. The following analysis delves into how this company’s technology and business model contribute to European strategic autonomy, NATO interoperability, and the reduction of critical dependencies in the space communications domain.

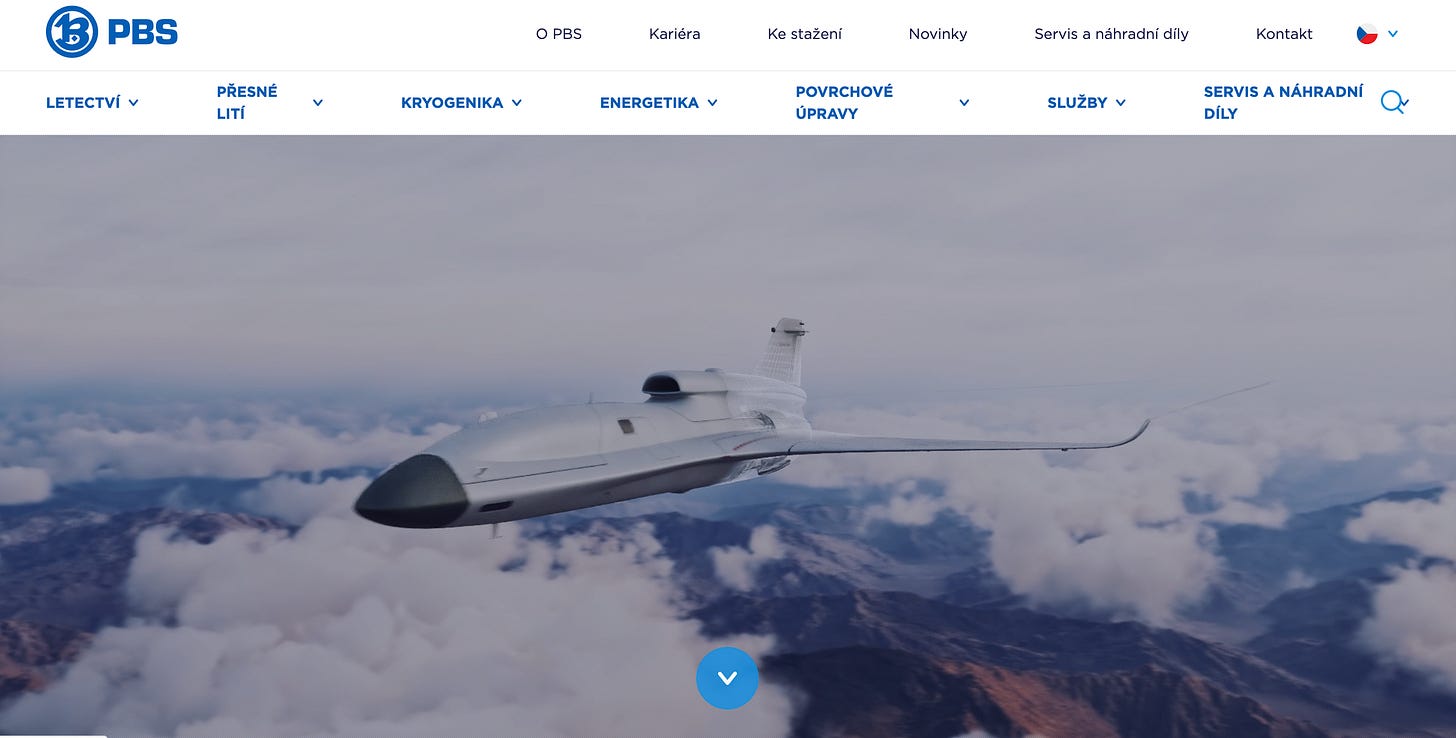

PBS Velká Bíteš: Strategic-Technological Role in European Defense Autonomy and UAV Propulsion

Nestled in the Czech industrial heartland, PBS Velká Bíteš has quietly become a linchpin of Europe’s high-tech aerospace sector. Known formally as První brněnská strojírna Velká Bíteš (PBS VB), this 75-year-old engineering firm develops the compact jet engines and power units propelling Europe’s latest drones and missiles[1][2]. Its unassuming origins belie a cutting-edge portfolio that spans turbine propulsion, precision casting, and cryogenic systems. Today, PBS’s turbojet engines empower unmanned aircraft and long-range strike systems for NATO allies, exemplifying European ingenuity in defense. The company’s collaborations—from partnering with MBDA on a next-generation cruise missile to co-developing advanced jet auxiliaries with a U.S. aerospace giant—underline its strategic value. As Europe pursues greater strategic autonomy and technological sovereignty, PBS Velká Bíteš stands out as a mid-cap innovator at the crossroads of transatlantic cooperation and European self-reliance, making it a compelling subject for strategic-technological analysis.