Defence Finance Monitor Digest #70

Defence Finance Monitor is a specialised source of analysis for professionals who seek to anticipate how strategic priorities shape investment patterns in the defence sector. In a landscape shaped by high-stakes political choices and rapid technological shifts, understanding the link between military doctrine, operational requirements, and industrial policy is not a competitive edge—it is a prerequisite.

We analyse how strategic imperatives set by NATO, the European Union, allied Indo-Pacific democracies, and national Ministries of Defence translate into procurement programmes, innovation roadmaps, and long-term industrial priorities. Rather than listing individual companies, we track how clearly defined strategic challenges—such as deterrence gaps, technological dependencies, or capability shortfalls—are converted into funding schemes and institutional demand. Only companies that respond to these challenges become relevant to institutional buyers and, by extension, to investors. This framework has already enabled a growing community of analysts and financial professionals to make more consistent, risk-aware decisions and to avoid costly misalignments.

Building on this methodology, we are developing a structured database of companies analysed and classified according to the strategic-technological criteria set out in our framework. Subscribing to Defence Finance Monitor therefore provides not only access to in-depth reports, but also to a continuously expanding database of European and allied defence firms assessed against clear benchmarks. Each company is positioned according to its alignment with EU and NATO priority capability areas, its contribution to European strategic autonomy, its level of interoperability and deterrence value, and its role in reducing dependencies on non-allied suppliers. Classification also covers technology readiness levels, participation in EU and NATO programmes, intellectual property assets, and dual-use applications. This allows subscribers to compare, benchmark, and identify the most strategically relevant actors within a coherent, transparent, and decision-oriented taxonomy.

Subscribing to Defence Finance Monitor means gaining access to a strategic intelligence service that connects financial decisions with defence priorities. At the core of our work is a structured database of European and allied defence companies, classified according to strategic-technological criteria such as autonomy, interoperability, deterrence, and supply chain resilience. In today’s environment, profitable investment requires more than market data: it requires understanding how limited public resources are channelled toward specific capability gaps, sovereign technologies, and the reduction of non-allied dependencies. By combining in-depth reports with a continuously expanding company database, Defence Finance Monitor enables investors to anticipate demand, benchmark firms against institutional priorities, and avoid costly misalignments.

Company Profiles & Industrial Intelligence

Alpine Space Ventures – Germany: Strategic-Technological Analysis

A new venture firm in Munich is quietly reshaping Europe’s high-tech defense landscape. Alpine Space Ventures, led by veterans of SpaceX, has positioned itself at the intersection of Europe’s space ambitions and strategic security needs. Born in 2020 amid a rising wave of “NewSpace” entrepreneurship, this insider-led fund is channeling capital and expertise into the critical building blocks of Europe’s space economy. Its portfolio of startups – from satellite manufacturers to propulsion specialists – reflects a deliberate mission: to bolster Europe’s autonomous access to space and reduce reliance on non-allied suppliers. Backed by major institutions like the European Investment Fund and the NATO Innovation Fund, Alpine Space Ventures operates with one foot in Europe and the other across the Atlantic, ensuring European innovators can benefit from transatlantic partnerships without compromising sovereignty. The result is a unique investment approach that prioritizes tangible technologies over hype, aiming to strengthen Europe’s deterrence and resilience in an era when control of space is integral to security and economic power.

Willog (South Korea) – Strategic-Technological Analysis

Willog is a young South Korean technology company that has rapidly emerged at the intersection of advanced logistics and defense innovation. Founded in 2021 in Seoul, the company began by tackling challenges in cold-chain transportation, ensuring that sensitive products like vaccines and pharmaceuticals remain within safe conditions during transit. Willog’s founders leveraged their experience in the food industry to develop a solution where others saw a blind spot: real-time monitoring and management of goods in motion. The result is a proprietary combination of Internet of Things (IoT) sensors and artificial intelligence (AI) analytics that bring unprecedented visibility to supply chains. After proving its worth in commercial sectors – from pharma to precision manufacturing – Willog recently entered the defense arena by partnering with the Republic of Korea Army to modernize military logistics. This move positions Willog at the forefront of a global trend: militaries adopting Industry 4.0 technologies to transform support operations. For European defense observers, the company offers a case study in how a nimble, venture-backed firm from an allied nation can contribute to strategic objectives like supply chain resilience and operational readiness without fanfare or geopolitical baggage. Willog’s journey from a startup addressing refrigerated trucks to a partner in military digital transformation raises compelling questions about its potential role in enhancing European strategic autonomy and NATO interoperability.

OTB Strategic-Technological Profile

OTB Ventures is quietly shaping Europe’s high-tech future from behind the scenes. Headquartered in the Netherlands, this venture capital firm doesn’t manufacture satellites or cybersecurity systems itself – instead, it finances the deep-tech startups that do. In an era when the EU is striving for strategic autonomy in defense and emerging technologies, OTB has become an unexpected linchpin. Its investment portfolio reads like a catalogue of Europe’s most crucial capabilities: AI platforms that hunt financial criminals, microsatellites peering through clouds, autonomous drone interceptors, and even novel chips that could break reliance on foreign semiconductors. Backed by both European Union institutions and NATO’s own innovation fund, OTB operates at the intersection of government security strategy and entrepreneurial innovation. The firm’s influence extends from Warsaw to Silicon Valley boardrooms, quietly ensuring that Europe’s next generation of defense and dual-use technologies can be built at home – and on Europe’s terms.

Portal Biotech – Strategic-Technological Analysis

Portal Biotech is a pioneering life sciences company at the intersection of biotechnology and defense. Founded in 2021, this British startup has quickly drawn the attention of NATO and allied investors for its groundbreaking approach to detecting biological threats and enhancing medical capabilities. Portal’s core innovation – often described as the “holy grail” of proteomics – is the world’s first platform for full-length, single-molecule protein sequencing[1]. In practical terms, this means a lab-on-a-chip device capable of identifying pathogens or biomarkers in real time, without the need for bulky equipment or lengthy lab analyses. Such technology carries obvious appeal for military planners: a tool that can spot an engineered bioweapon or emerging disease in the field within hours rather than days[2] fundamentally strengthens biodefense and pandemic response. Portal Biotech’s dual-use innovations straddle healthcare and security, exemplifying the new breed of deep-tech startups contributing to European strategic autonomy. Backed by the NATO Innovation Fund and leading venture firms, Portal is emerging as a critical asset in Europe’s quest to reduce dependence on foreign suppliers in critical biotech sectors. The company’s story – from academic labs to defense applications – offers a fascinating glimpse into how cutting-edge cell engineering and AI-driven analytics are being harnessed to bolster Europe’s security and resilience.

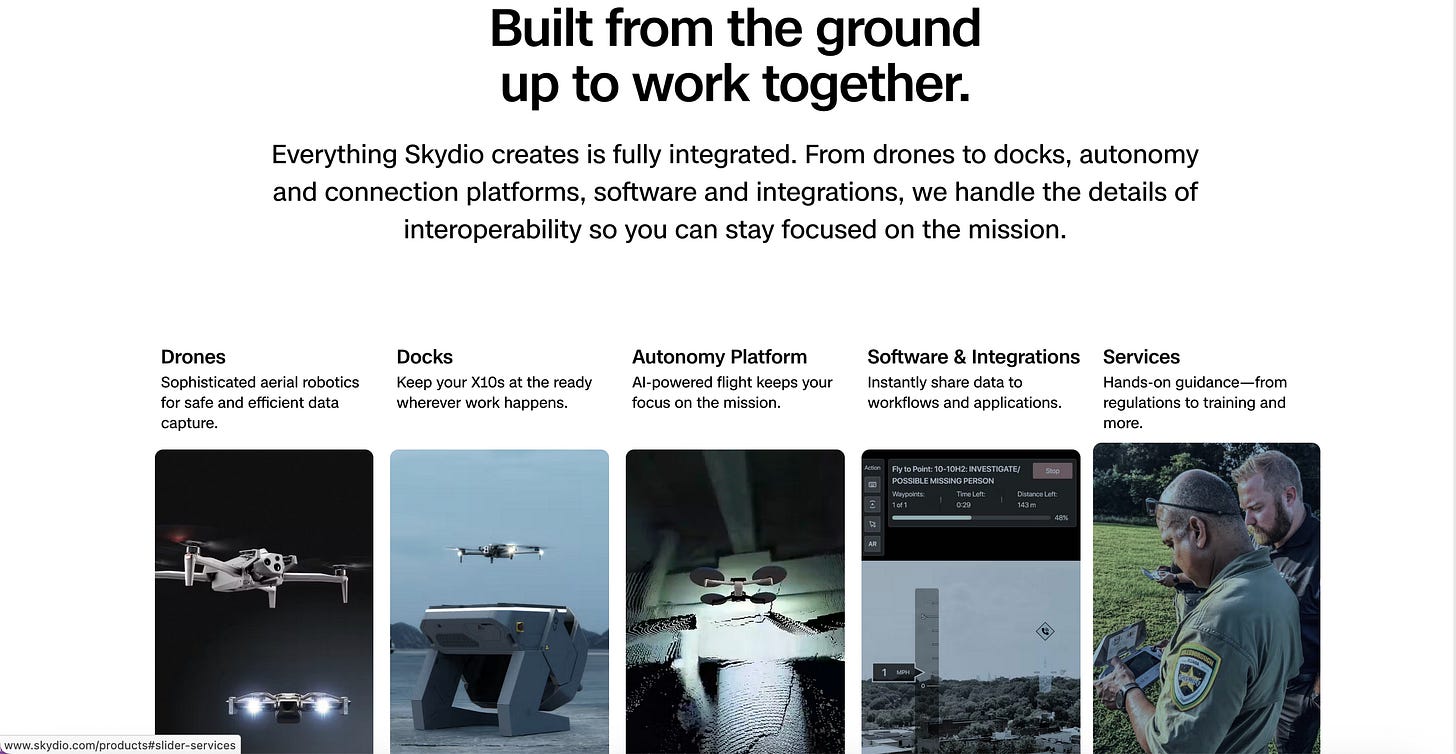

Skydio: Implications for European Security

In an era when drones dominate battlefields and security operations, Skydio has emerged as a Silicon Valley pioneer whose technology is quietly redefining autonomous flight. Founded in 2014 by MIT alumni in California, this U.S. drone maker initially made headlines with self-flying “selfie drones” for consumers[1]. Today, Skydio’s AI-powered unmanned aircraft have evolved into sought-after tools for militaries and governments worldwide. European defense planners, grappling with a heavy reliance on foreign drones and concerns over Chinese tech dominance[2][3], have begun to take notice of Skydio. The company’s advanced small drones promise high-performance intelligence and reconnaissance capabilities—offering a Western-made alternative to Chinese systems. As NATO allies push for more secure, interoperable, and resilient tech supply chains, Skydio finds itself at the nexus of transatlantic innovation and European strategic needs. This analysis explores how Skydio’s autonomous drone technology could enhance Europe’s defense autonomy and capabilities, examining its fit within EU priorities, NATO frameworks, and the broader goal of reducing dependencies on non-allied suppliers. The following report uncovers Skydio’s corporate profile, technology portfolio, European engagements, and potential role in strengthening Europe’s security and industrial sovereignty.

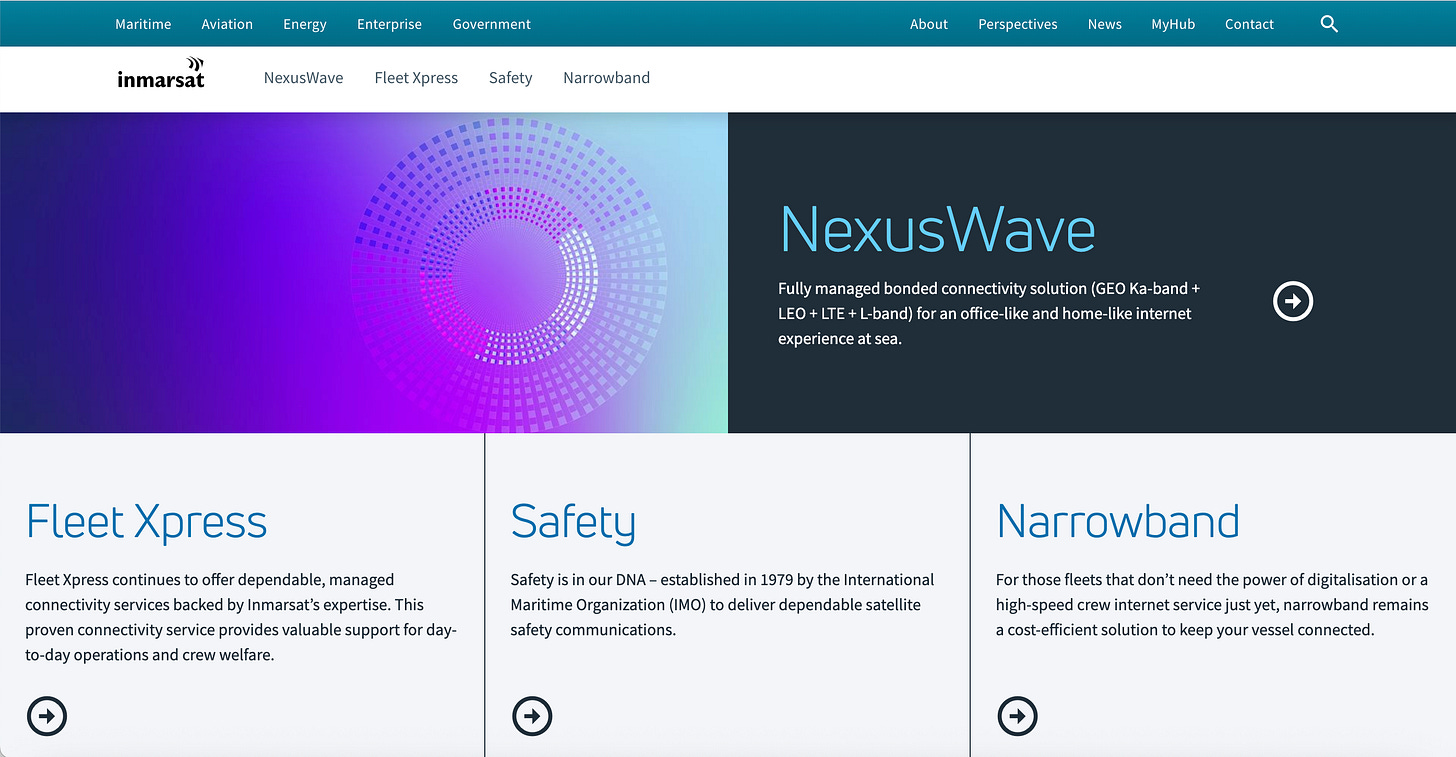

Inmarsat (UK) – Strategic-Technological Analysis

Inmarsat is a pioneer of satellite communications whose origins trace back to a United Nations mandate for maritime safety in 1979. Over four decades, this London-headquartered company has evolved from a niche provider of emergency ship-to-shore links into a linchpin of global connectivity for ships, aircraft, governments and militaries. Today, Inmarsat’s satellites form an essential web of communications that European armed forces and industries quietly rely on when terrestrial networks fail or hostile jamming looms. The company’s journey – from intergovernmental roots to a privatized, high-tech enterprise now under US ownership – offers a unique lens on Europe’s quest for strategic autonomy in space and cyberspace. How does Inmarsat bolster European defense capabilities and multi-domain operations, and where might dependencies remain? This analysis will delve into Inmarsat’s technology portfolio, alliances and role in initiatives aimed at strengthening Europe’s deterrence and reducing reliance on non-allied suppliers, providing a nuanced perspective on its strategic value.