Defence Finance Monitor Digest #67

Defence Finance Monitor is a specialised source of analysis for professionals who seek to anticipate how strategic priorities shape investment patterns in the defence sector. In a landscape shaped by high-stakes political choices and rapid technological shifts, understanding the link between military doctrine, operational requirements, and industrial policy is not a competitive edge—it is a prerequisite.

We analyse how strategic imperatives set by NATO, the European Union, allied Indo-Pacific democracies, and national Ministries of Defence translate into procurement programmes, innovation roadmaps, and long-term industrial priorities. Rather than listing individual companies, we track how clearly defined strategic challenges—such as deterrence gaps, technological dependencies, or capability shortfalls—are converted into funding schemes and institutional demand. Only companies that respond to these challenges become relevant to institutional buyers and, by extension, to investors. This framework has already enabled a growing community of analysts and financial professionals to make more consistent, risk-aware decisions and to avoid costly misalignments.

Building on this methodology, we are developing a structured database of companies analysed and classified according to the strategic-technological criteria set out in our framework. Subscribing to Defence Finance Monitor therefore provides not only access to in-depth reports, but also to a continuously expanding database of European and allied defence firms assessed against clear benchmarks. Each company is positioned according to its alignment with EU and NATO priority capability areas, its contribution to European strategic autonomy, its level of interoperability and deterrence value, and its role in reducing dependencies on non-allied suppliers. Classification also covers technology readiness levels, participation in EU and NATO programmes, intellectual property assets, and dual-use applications. This allows subscribers to compare, benchmark, and identify the most strategically relevant actors within a coherent, transparent, and decision-oriented taxonomy.

Subscribing to Defence Finance Monitor means gaining access to a strategic intelligence service that connects financial decisions with defence priorities. At the core of our work is a structured database of European and allied defence companies, classified according to strategic-technological criteria such as autonomy, interoperability, deterrence, and supply chain resilience. In today’s environment, profitable investment requires more than market data: it requires understanding how limited public resources are channelled toward specific capability gaps, sovereign technologies, and the reduction of non-allied dependencies. By combining in-depth reports with a continuously expanding company database, Defence Finance Monitor enables investors to anticipate demand, benchmark firms against institutional priorities, and avoid costly misalignments.

The Return of Mass: Intelligent Quantity and the Industrial Logic of Modern Warfare

The war in Ukraine has reintroduced the idea of mass as a decisive factor in warfare, yet in a radically different form from the industrial age. The mass of the twenty-first century is not measured in divisions, tanks, or artillery pieces, but in swarms of autonomous systems, distributed sensors, and algorithmic networks capable of producing continuous operational pressure. The premise of this transformation is that superiority no longer derives from possessing the most advanced platform, but from being able to generate, replenish, and adapt forces faster than an adversary. The traditional equation between technological sophistication and battlefield dominance has been broken. Drones, loitering munitions, and software-defined systems have demonstrated that volume, resilience, and connectivity can outweigh the advantage of a small number of highly complex assets. This is the essence of the new concept of “intelligent mass”: a balance between quantity and cognition that transforms scale from a matter of production into a matter of adaptability. Warfare is returning to the logic of saturation, but in a digital form, where networks, data, and learning algorithms replace manpower as the drivers of mass.

Iridium Communications Inc.

Iridium Communications Inc. stands out with a constellation of 66 low-Earth-orbit satellites delivering true global coverage[1][2]. This unique architecture – where each satellite links to its neighbors – ensures resilient worldwide connectivity even in the most remote or contested environments[2]. Iridium’s network has become mission-critical for sectors needing beyond-line-of-sight communication, from military push-to-talk systems to maritime safety services. As Europe pursues its own secure satellite connectivity (e.g. the IRIS² program), Iridium represents both a model and a strategic partner to watch: its L-band network can provide an alternative to non-European providers, yet its U.S. ownership also highlights the very dependency challenges that EU strategic autonomy seeks to overcome[3][4]. The reader will find below a deep dive into Iridium’s corporate structure, technology offerings, and role in the European defense-technology landscape – assessing how this U.S. satellite operator aligns with Europe’s goals for interoperability, deterrence, and supply-chain resilience.

Company Profiles & Industrial Intelligence

Eutelsat (France) — Strategic-Technological Analysis

Eutelsat Communications S.A. is Europe’s premier satellite communications operator, combining over 40 years of space expertise with a unique multi-orbit network of geostationary (GEO) and low-earth-orbit (LEO) satellites[1]. In the wake of intensifying geopolitical tensions – notably the war in Ukraine and concerns over over-reliance on U.S. and Chinese space assets – EU and NATO leaders have turned a spotlight on Eutelsat as a potential cornerstone of European connectivity sovereignty[2][3]. Eutelsat’s recent merger with OneWeb and the ensuing build-out of a LEO constellation mark a strategic pivot from traditional TV broadcasting toward secure broadband and defence communications. European governments are now injecting hundreds of millions of euros into Eutelsat to ensure it can compete with Starlink and meet military needs[4][5]. This report delves deeply into Eutelsat’s corporate identity, technology portfolio, program participation, and strategic gaps – examining how the company aligns with EU/NATO priorities on strategic autonomy, multi-domain deterrence, and resilient communications infrastructure. By analyzing Eutelsat’s current capabilities, dependencies, and partnerships, we assess its role in strengthening Europe’s defense-industrial base and reducing reliance on non-allied suppliers.

Zero Point Motion: Photonic Inertial Sensors for Europe’s Navigation Sovereignty

Zero Point Motion Ltd is a Bristol-based deep-tech startup pioneering ultra-sensitive inertial sensors by fusing silicon photonics with MEMS technology[1][2]. Founded in 2020 by physicist Dr. Ying Lia Li (Imperial College and UCL alumnus), the company emerged from university research on optomechanical sensors[3][4]. In early 2025 it closed a £4M pre-Series A funding round to commercialize its next-generation accelerometers and gyroscopes[5][2]. Its novel approach – leveraging optical resonators for readout – yields inertial devices up to 100× more sensitive than legacy MEMS units[1][6]. Zero Point Motion’s technology is explicitly aimed at “transforming defence, space exploration, and autonomous systems” by enabling precise navigation even when GPS is unavailable[7][2]. In this report we analyze ZPM through the lens of European strategic autonomy and NATO interoperability. We evaluate how its photonic-based inertial sensors could strengthen allied position/navigation/time (PNT) capabilities and reduce dependence on non-allied suppliers (particularly Chinese or U.S. navigation components). We also examine its R&D origins, partnerships, and program involvement in European and transatlantic innovation frameworks. The goal is to assess ZPM’s potential contribution to a resilient European defense industrial base and NATO multi-domain operations, identifying both its existing strengths and the gaps that must be addressed for full strategic impact.

Qnami – Strategic-Technological Company Analysis

Qnami AG is a Swiss deep-tech company at the forefront of quantum sensing. It develops nano-scale magnetic microscopes and diamond sensor chips that measure magnetic and electric fields with unprecedented precision[1][2]. Founded in 2017 as a spin-off from the University of Basel[1], Qnami’s goal is to translate quantum physics breakthroughs into practical sensing instruments. Its flagship product, the ProteusQ™, is the first commercial scanning NV (nitrogen-vacancy) magnetometer, which uses single-atom defects in diamond to image magnetic fields at the nanoscale[1][2]. Qnami positions itself not as a traditional defense contractor but as a technology enabler: by selling cutting-edge scientific equipment to research institutions and high-tech industries, it seeks to seed advanced capabilities in Europe. Its technologies intersect with key European Emerging and Disruptive Technology (EDT) priorities such as quantum technologies and advanced materials, and they hold potential dual-use applications in security and deterrence[2][3]. This analysis examines Qnami’s profile in terms of European strategic autonomy and defense objectives. It considers the company’s legal and organizational structure, business focus, technology portfolio, program involvement, partnerships, and strategic gaps. The goal is to assess how Qnami’s quantum sensing innovations contribute to Europe’s goal of technological sovereignty, enhanced deterrence, and multi-domain interoperability.

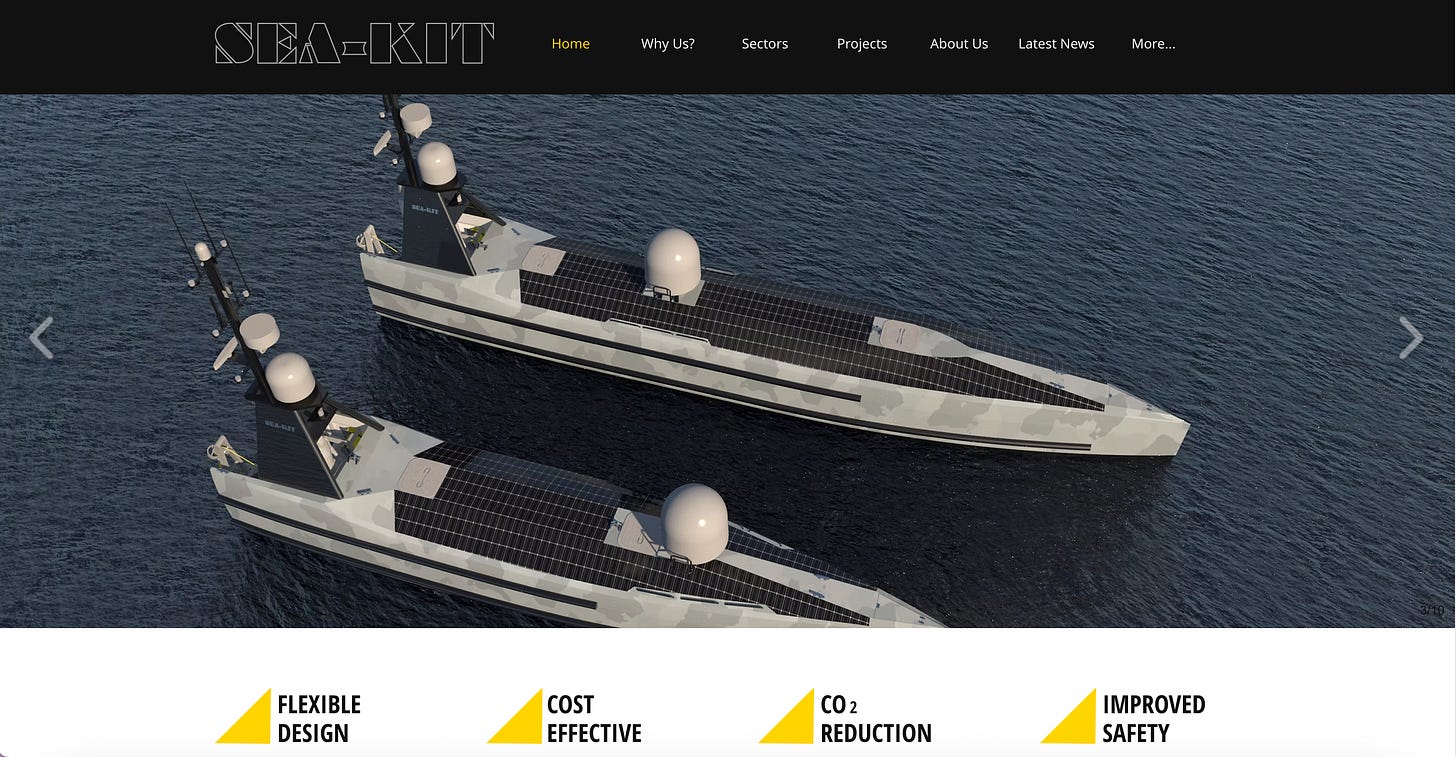

Sea-Kit International – Strategic-Technological Analysis

Sea-Kit International Ltd is a UK-based developer of unmanned maritime vessels. Founded in 2017 (registered in Essex, UK[1]), it designs and builds uncrewed surface vessels (USVs) for offshore survey and security tasks. Sea-Kit’s 12m “X-class” USVs and larger “XL” models serve as mother-ships for deploying autonomous subsurface drones and sensors. In 2023 Sea-Kit was acquired by Fugro NV (a Dutch publicly-listed geo-data firm), becoming a Fugro subsidiary[2]. Its operations remain centered in Tollesbury, Essex (headquarters at Blackwater House)[3][1] with global outreach via Fugro’s network. Sea-Kit holds Lloyd’s Register Unmanned Marine Systems (UMS) certification (Category 0) for safety and design[4], reflecting rigorous engineering standards. The company is capable of servicing both civil and defense programs under UK/NATO security regimes, though no public classified contracts are listed. Its leadership and R&D team, drawn mainly from UK/EU maritime engineering, ensure European technical control over its products.