Defence Finance Monitor Digest #63

Defence Finance Monitor is a specialised source of analysis for professionals who seek to anticipate how strategic priorities shape investment patterns in the defence sector. In a landscape shaped by high-stakes political choices and rapid technological shifts, understanding the link between military doctrine, operational requirements, and industrial policy is not a competitive edge—it is a prerequisite.

We analyse how strategic imperatives set by NATO, the European Union, allied Indo-Pacific democracies, and national Ministries of Defence translate into procurement programmes, innovation roadmaps, and long-term industrial priorities. Rather than listing individual companies, we track how clearly defined strategic challenges—such as deterrence gaps, technological dependencies, or capability shortfalls—are converted into funding schemes and institutional demand. Only companies that respond to these challenges become relevant to institutional buyers and, by extension, to investors. This framework has already enabled a growing community of analysts and financial professionals to make more consistent, risk-aware decisions and to avoid costly misalignments.

Building on this methodology, we are developing a structured database of companies analysed and classified according to the strategic-technological criteria set out in our framework. Subscribing to Defence Finance Monitor therefore provides not only access to in-depth reports, but also to a continuously expanding database of European and allied defence firms assessed against clear benchmarks. Each company is positioned according to its alignment with EU and NATO priority capability areas, its contribution to European strategic autonomy, its level of interoperability and deterrence value, and its role in reducing dependencies on non-allied suppliers. Classification also covers technology readiness levels, participation in EU and NATO programmes, intellectual property assets, and dual-use applications. This allows subscribers to compare, benchmark, and identify the most strategically relevant actors within a coherent, transparent, and decision-oriented taxonomy.

Subscribing to Defence Finance Monitor means gaining access to a strategic intelligence service that connects financial decisions with defence priorities. At the core of our work is a structured database of European and allied defence companies, classified according to strategic-technological criteria such as autonomy, interoperability, deterrence, and supply chain resilience. In today’s environment, profitable investment requires more than market data: it requires understanding how limited public resources are channelled toward specific capability gaps, sovereign technologies, and the reduction of non-allied dependencies. By combining in-depth reports with a continuously expanding company database, Defence Finance Monitor enables investors to anticipate demand, benchmark firms against institutional priorities, and avoid costly misalignments.

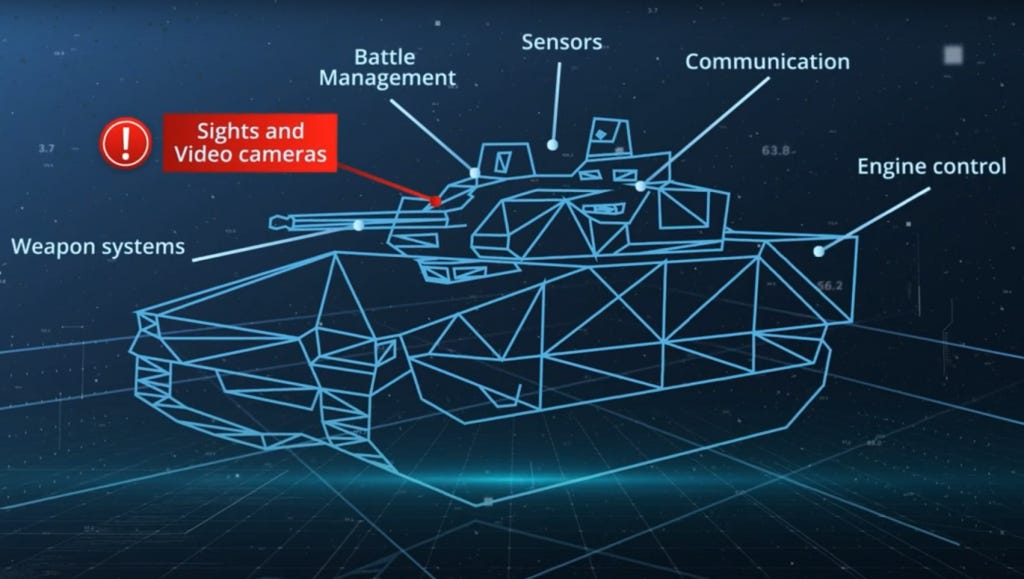

Clavister: European Cybersecurity Provider for Defence and Strategic Autonomy

Clavister is not a household name, but in European cybersecurity circles it stands as a quietly pivotal player. Born and bred in Sweden, this company has spent over two decades carving out a niche as a provider of high-performance network security solutions – including next-generation firewalls and secure network gateways – explicitly developed in Europe. In an era when digital sovereignty and supply chain trustworthiness are at a premium, Clavister offers something rare: defense-grade cybersecurity technology that European governments and militaries can call their own. The firm’s products, branded under evocative names like “Cyber Armour,” are already protecting armored vehicles, military networks and critical infrastructure on the continent. Clavister’s story is about European innovation meeting strategic necessity – a local alternative to big American firewall vendors and an answer to rising concerns about hidden backdoors in foreign-made equipment. As Europe pursues strategic autonomy in tech, Clavister has positioned itself as a homegrown solution to keep Europe’s networks secure and its defense systems resilient. It’s a story of Swedish technical ingenuity aligning with continental strategic ambitions, and one that might just entice defense planners and policy enthusiasts to read on.

GreenWaves Technologies – Strategic-Technological Analysis (European Context)

A small French startup is quietly helping Europe regain control over critical microchip technologies. GreenWaves Technologies, based in Grenoble, develops fingernail-sized processors that deliver artificial intelligence capabilities on minimal power—an essential feature for smart sensors and Internet of Things (IoT) devices. Founded in 2014, the company pioneered one of the first ultra-low-power RISC-V microcontrollers for AI at the network edge. Its chips, no larger than a coin, can analyze images, sound or vibrations on the device itself instead of relying on cloud computing. This innovation has big implications for European strategic autonomy. By designing open-architecture semiconductors in Europe, GreenWaves reduces reliance on foreign (especially Chinese or U.S.) suppliers in a sector often seen as Europe’s “Achilles’ heel.” Defense and security planners have noticed: GreenWaves’ technology is now viewed as a building block for Europe’s next-generation intelligent sensors and devices, potentially powering everything from soldier wearables to autonomous nano-drones. In an era when secure supply chains and technological sovereignty are top priorities, GreenWaves exemplifies how European deep-tech startups can punch above their weight.

Strategic-Technological Analysis of Siren (Ireland)

In an era when digital intelligence and data analytics have become linchpins of security, one European company is quietly redefining how law enforcement and security agencies connect the dots. From its base in Ireland, Siren has emerged as a cutting-edge provider of investigative intelligence software – the kind of technology that can sift vast databases, open-source intelligence (OSINT), and big data to illuminate hidden networks of crime or terror. Far from a household name, Siren operates behind the scenes, powering complex investigations for police forces, cybersecurity teams, and financial crime units. Its all-in-one platform promises to replace time-consuming manual data sleuthing with AI-driven link analysis and intuitive search across disparate sources. Crucially, Siren represents something larger for Europe: a home-grown alternative in a field often dominated by non-European solutions. In a time of renewed emphasis on European strategic autonomy and reduced reliance on foreign providers, Siren’s rise offers a compelling glimpse into Europe’s technological self-reliance – and a potent tool in the global fight against evolving threats.

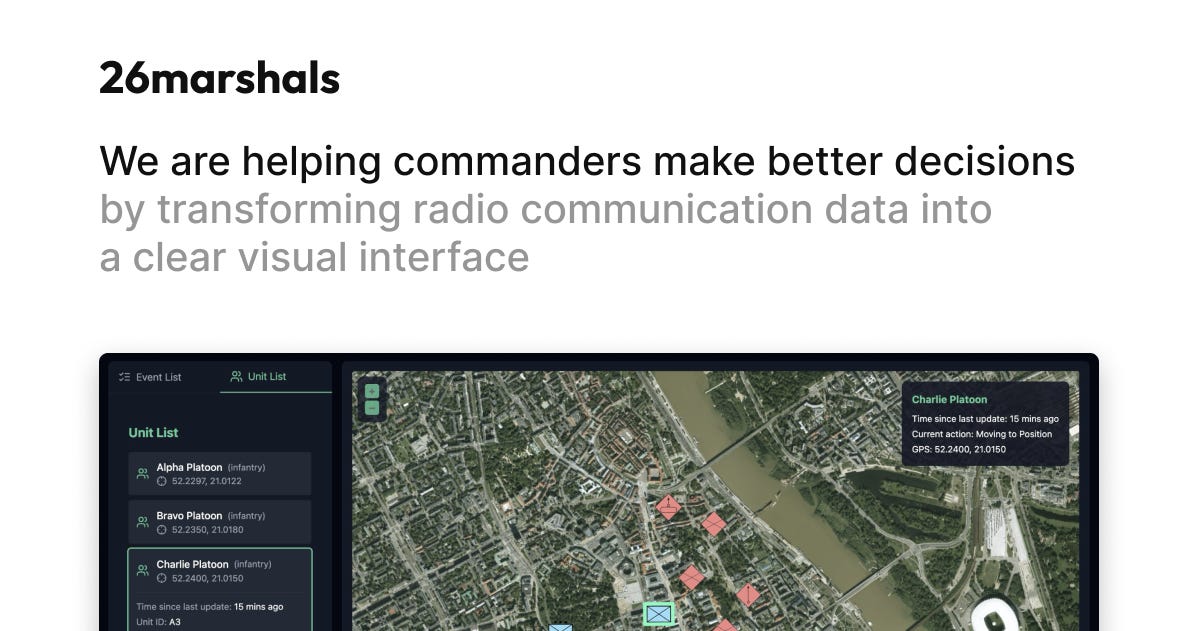

26Marshals: Transforming Tactical Radio Chatter into Real-Time Battlefield Intelligence

In the chaos of modern combat, critical information often travels as urgent bursts of radio chatter crackling over tactical networks. Frontline commanders must interpret these fragmented voice communications on the fly – a daunting task amid the fog of war. 26Marshals, a London-based defense tech startup, is tackling this challenge by harnessing artificial intelligence to convert raw radio conversations into actionable battlefield insights. Born from Europe’s emerging defense innovation ecosystem, the company has developed an AI-driven solution (aptly named “Ear of Napoleon”) that listens to tactical radio nets and instantly displays key information to officers in the field. This technology arrives at a pivotal moment: European militaries are racing to digitize command-and-control processes, NATO allies emphasize faster decision cycles, and recent conflicts have underscored the cost of missed or misunderstood communications. 26Marshals’ ambitious approach – providing real-time intelligence from legacy radio systems without overhauling existing infrastructure – hints at a new era of smarter tactical command. The following analysis explores how this young company’s unique capability aligns with Europe’s strategic autonomy goals and could strengthen allied deterrence in an increasingly contested world.