Defence Finance Monitor Digest #62

Defence Finance Monitor is a specialised source of analysis for professionals who seek to anticipate how strategic priorities shape investment patterns in the defence sector. In a landscape shaped by high-stakes political choices and rapid technological shifts, understanding the link between military doctrine, operational requirements, and industrial policy is not a competitive edge—it is a prerequisite.

We analyse how strategic imperatives set by NATO, the European Union, allied Indo-Pacific democracies, and national Ministries of Defence translate into procurement programmes, innovation roadmaps, and long-term industrial priorities. Rather than listing individual companies, we track how clearly defined strategic challenges—such as deterrence gaps, technological dependencies, or capability shortfalls—are converted into funding schemes and institutional demand. Only companies that respond to these challenges become relevant to institutional buyers and, by extension, to investors. This framework has already enabled a growing community of analysts and financial professionals to make more consistent, risk-aware decisions and to avoid costly misalignments.

Building on this methodology, we are developing a structured database of companies analysed and classified according to the strategic-technological criteria set out in our framework. Subscribing to Defence Finance Monitor therefore provides not only access to in-depth reports, but also to a continuously expanding database of European and allied defence firms assessed against clear benchmarks. Each company is positioned according to its alignment with EU and NATO priority capability areas, its contribution to European strategic autonomy, its level of interoperability and deterrence value, and its role in reducing dependencies on non-allied suppliers. Classification also covers technology readiness levels, participation in EU and NATO programmes, intellectual property assets, and dual-use applications. This allows subscribers to compare, benchmark, and identify the most strategically relevant actors within a coherent, transparent, and decision-oriented taxonomy.

Subscribing to Defence Finance Monitor means gaining access to a strategic intelligence service that connects financial decisions with defence priorities. At the core of our work is a structured database of European and allied defence companies, classified according to strategic-technological criteria such as autonomy, interoperability, deterrence, and supply chain resilience. In today’s environment, profitable investment requires more than market data: it requires understanding how limited public resources are channelled toward specific capability gaps, sovereign technologies, and the reduction of non-allied dependencies. By combining in-depth reports with a continuously expanding company database, Defence Finance Monitor enables investors to anticipate demand, benchmark firms against institutional priorities, and avoid costly misalignments.

Shark Robotics: A Pillar of European Defense Robotics Autonomy

Shark Robotics is a French robotics innovator drawing increasing attention for its rugged unmanned ground vehicles (UGVs) that operate where humans cannot. From blazing cathedral infernos to warzones riddled with explosives, Shark’s machines have repeatedly proven their mettle, preserving life and infrastructure under extreme conditions. Founded in 2016 in the historic port city of La Rochelle, the company has rapidly evolved from a scrappy startup into a key player in Europe’s defense and security tech ecosystem. Its flagship “Colossus” robot famously helped save Notre-Dame Cathedral by tirelessly blasting water amid 800°C flames. Such high-profile deployments hint at a broader story: Shark Robotics is quietly bolstering European strategic autonomy in critical technologies. As NATO allies and EU institutions seek resilient, home-grown solutions for multi-domain operations, Shark Robotics offers a case study in European ingenuity – a company marrying battlefield grit with cutting-edge engineering to reduce reliance on foreign suppliers. The following analysis will delve into how this dynamic French firm aligns with Europe’s strategic priorities, from interoperable defense capabilities to supply chain sovereignty, and why its rise matters for the continent’s security future.

Donaustahl GmbH: A Tactical-Scale Contributor to European Defence Sovereignty and Strategic Autonomy

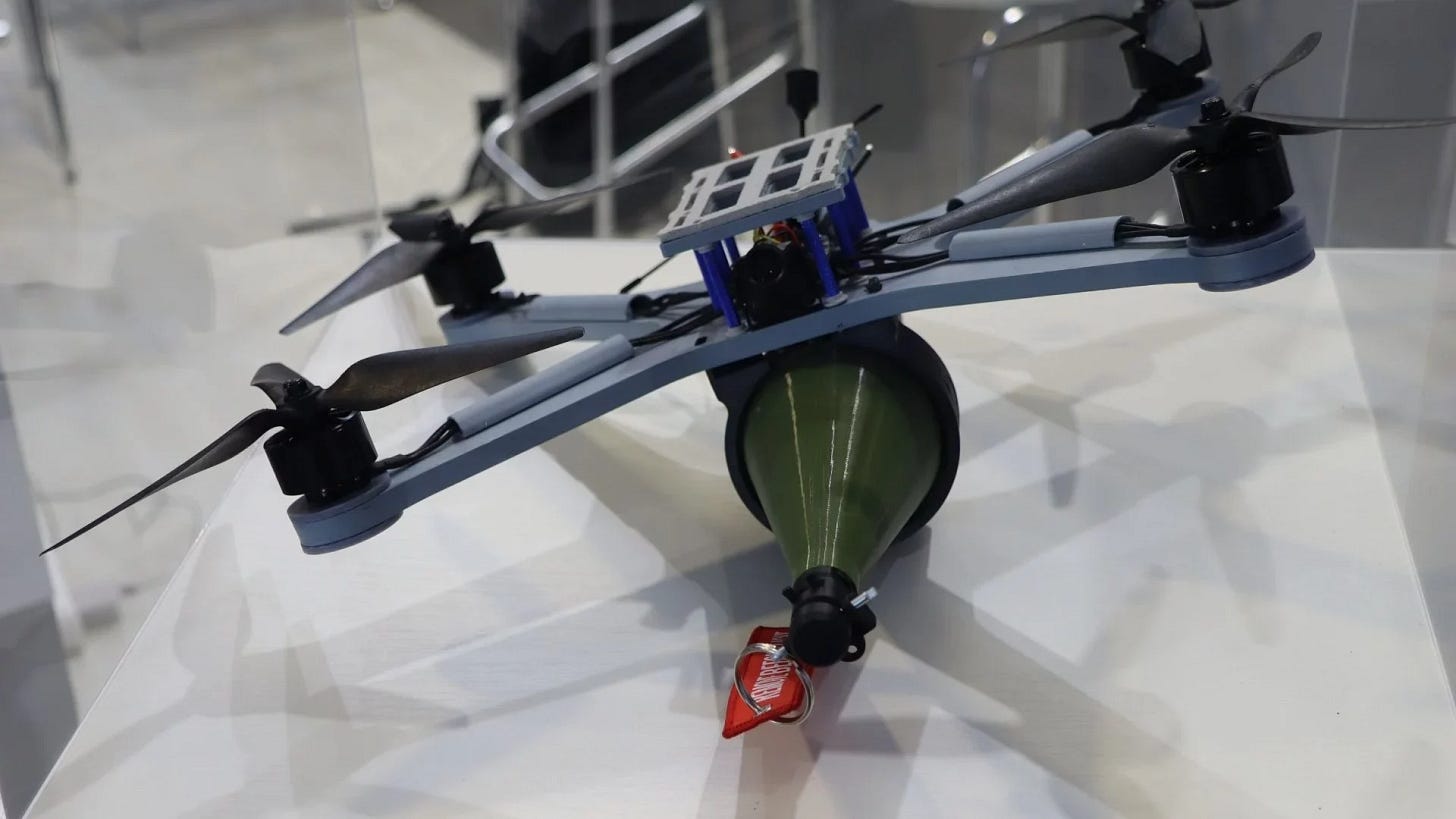

The rise of Donaustahl GmbH – a little-known Bavarian startup turned defense innovator – has captured the attention of Europe’s security community. From a humble origin making sports shooting accessories, Donaustahl rapidly reinvented itself as a producer of loitering munitions and combat drone systems, aligning its trajectory with Europe’s urgent quest for strategic autonomy. In an era when the EU seeks to reduce dependence on foreign (often Chinese) technologies, Donaustahl offers a compelling success story: it has delivered the first NATO-made “kamikaze” drones to Ukraine, replacing what were once exclusively off-the-shelf Chinese hobby UAVs on the battlefield. The company’s flagship “MAUS” drone – a modular quadcopter built from unconventional materials – exemplifies European ingenuity under pressure. Equally intriguing is how quickly this private venture has plugged into the defense ecosystem: by mid-2024, Donaustahl had secured German government export clearance for its drones to support Ukraine’s defense, and by late 2024 it was regarded as Germany’s leading loitering munition developer. This report explores Donaustahl’s strategic-technological profile in depth, examining how a nimble EU startup contributes to Europe’s deterrence and resilience – from advanced materials and robotics to transatlantic cooperation – while pointing to the evolving role of small industry players in European defense sovereignty.

Microamp Solutions: Enabling Secure 5G and mmWave Technologies for European Defence and Strategic Autonomy

Microamp Solutions is a Polish deep-tech company spearheading Europe’s push into ultra-secure, high-frequency wireless communications. Based in Warsaw, this young venture develops cutting-edge millimeter-wave (mmWave) radio systems that deliver multi-gigabit, near-zero latency connectivity for next-generation 5G networks. In an era when 5G infrastructure has become a linchpin of economic and security policy, Microamp stands out as a homegrown European innovator challenging the global incumbents. Its proprietary mmWave amplifiers and RF front-ends were born from advanced research and are now fielded in real-world deployments, from smart factories to military test ranges. The company’s rapid rise has attracted attention beyond Poland: NATO tech incubators and the European Space Agency are already enlisting Microamp’s expertise to fortify European networks. This report will delve into how Microamp’s technology and strategy contribute to Europe’s defense autonomy and allied interoperability – offering a glimpse into why a Warsaw startup has become a strategic asset in the EU’s quest for tech sovereignty.

Akheros (France) – Strategic Technological Analysis

In an era when Europe is determined to secure its digital and industrial backbone against cyber intrusions, the French startup Akheros has emerged with a novel approach to cybersecurity. Founded by a veteran of France’s cyber-defense research community, Akheros specializes in “behavioral intelligence” – teaching machines to recognize when something isn’t right in their machine-to-machine communications. Rather than relying on known malware signatures or constant connectivity, Akheros’s software learns the normal patterns of each machine and autonomously flags anomalous behaviors in real time. This unique approach has drawn the attention of European defense institutions and NATO programs seeking to harden critical systems against sophisticated cyber threats. Akheros promises a sovereign European solution in a domain often dominated by foreign cybersecurity vendors, making it a company of growing interest to those invested in Europe’s strategic autonomy and resilience.

ESET – Strategic Company Profile

Amid Europe’s push for greater digital sovereignty, one Slovakia-born company has become an indispensable guardian of the continent’s cyber domain. ESET – headquartered in Bratislava – has spent over three decades developing advanced antivirus and cybersecurity solutions entirely on European soil. Little known to the public, its technology quietly protects millions of users and critical infrastructures worldwide, including government networks and essential services across EU member states. ESET’s founders, who still helm the privately-owned firm, built a reputation for technical excellence early on by pioneering heuristic malware detection and uncovering high-profile cyber threats like the Industroyer malware that caused a Ukrainian power outage. In an industry long dominated by U.S. and Russian vendors, ESET stands out as a European alternative – one of the first companies awarded the EU’s “Cybersecurity Made in Europe” label for its home-grown security capabilities. This strategic-technological profile explores how ESET’s European identity and innovations contribute to the EU’s defense autonomy, NATO cyber interoperability, and the reduction of reliance on non-allied suppliers.