Defence Finance Monitor Digest #59

Defence Finance Monitor is a specialised source of analysis for professionals who seek to anticipate how strategic priorities shape investment patterns in the defence sector. In a landscape shaped by high-stakes political choices and rapid technological shifts, understanding the link between military doctrine, operational requirements, and industrial policy is not a competitive edge—it is a prerequisite.

We analyse how strategic imperatives set by NATO, the European Union, allied Indo-Pacific democracies, and national Ministries of Defence translate into procurement programmes, innovation roadmaps, and long-term industrial priorities. Rather than listing individual companies, we track how clearly defined strategic challenges—such as deterrence gaps, technological dependencies, or capability shortfalls—are converted into funding schemes and institutional demand. Only companies that respond to these challenges become relevant to institutional buyers and, by extension, to investors. This framework has already enabled a growing community of analysts and financial professionals to make more consistent, risk-aware decisions and to avoid costly misalignments.

Building on this methodology, we are developing a structured database of companies analysed and classified according to the strategic-technological criteria set out in our framework. Subscribing to Defence Finance Monitor therefore provides not only access to in-depth reports, but also to a continuously expanding database of European and allied defence firms assessed against clear benchmarks. Each company is positioned according to its alignment with EU and NATO priority capability areas, its contribution to European strategic autonomy, its level of interoperability and deterrence value, and its role in reducing dependencies on non-allied suppliers. Classification also covers technology readiness levels, participation in EU and NATO programmes, intellectual property assets, and dual-use applications. This allows subscribers to compare, benchmark, and identify the most strategically relevant actors within a coherent, transparent, and decision-oriented taxonomy.

Subscribing to Defence Finance Monitor means gaining access to a strategic intelligence service that connects financial decisions with defence priorities. At the core of our work is a structured database of European and allied defence companies, classified according to strategic-technological criteria such as autonomy, interoperability, deterrence, and supply chain resilience. In today’s environment, profitable investment requires more than market data: it requires understanding how limited public resources are channelled toward specific capability gaps, sovereign technologies, and the reduction of non-allied dependencies. By combining in-depth reports with a continuously expanding company database, Defence Finance Monitor enables investors to anticipate demand, benchmark firms against institutional priorities, and avoid costly misalignments.

The Franco-German Defence Partnership in Europe

The security shock of Russia’s 2022 invasion of Ukraine has intensified debates on Europe’s defence capabilities, thrusting the Franco–German partnership into the spotlight. France and Germany together account for the EU’s largest military forces and defence industries. Their bilateral cooperation – often described as the “Franco-German engine” of European integration – has historically been seen as a catalyst for deeper EU defence integration, dating back to the 1963 Élysée Treaty and subsequent initiatives like the Weimar Triangle. At the same time, each power has cultivated a distinct strategic culture. France has traditionally championed the notion of European strategic autonomy – the ability to act militarily independent of the United States – while Germany, constrained by its postwar pacifist tradition and reliance on NATO, has long emphasized multilateral security frameworks. The two countries’ decisions profoundly shape Europe’s overall posture: their choices on defence spending, procurement and industrial policy determine whether the EU can field credible forces or must depend increasingly on U.S. capabilities.

Europe’s First Private Credit Fund for Defence SMEs

The establishment of a dedicated financial instrument targeting the European defence sector marks a significant institutional development in the intersection between security policy and capital markets. For decades, European defence has been financed primarily through government budgets, complemented by limited private equity and occasional industrial partnerships. The creation of Sienna Hephaistos Private Investments, with the European Investment Fund acting as cornerstone investor, demonstrates a structural shift toward the mobilisation of private debt to reinforce the industrial base. The logic underpinning this initiative is rooted in the recognition that Europe’s security cannot depend solely on public expenditure or reliance on non-European suppliers. Instead, there is an urgent need to broaden the spectrum of financing channels available to small and mid-sized firms that constitute the backbone of the defence value chain. This development takes place against the background of heightened geopolitical instability, the pressure to accelerate rearmament, and the emergence of strategic autonomy as a guiding European principle.

Company Profiles & Industrial Intelligence

NCC Group: Cybersecurity Capabilities and Strategic Relevance for European Defense Autonomy

In an era where cyber threats are reshaping defense priorities, European and NATO planners scrutinize private-sector technology. NCC Group plc is a UK-based cyber security and software resilience firm, noted as a “global cyber and software resilience business”[1][2]. Its expertise now underpins critical infrastructure and defense operations, earning attention in government strategies. For example, NCC’s role is mentioned in the UK Strategic Defence Review and it has engaged with allied tech initiatives (e.g. NATO Summit security and UK–US tech agreements)[3][4]. As the EU seeks to reduce reliance on non-allied technology, understanding NCC Group’s offerings in network security, cryptography and threat intelligence becomes vital. This report examines NCC Group’s capabilities, program involvement and strategic partnerships, assessing how its technologies and services contribute to European strategic autonomy, NATO interoperability and resilient defense against state and non-state threats. The analysis will detail whether NCC’s solutions can substitute foreign suppliers and strengthen the European defense posture.

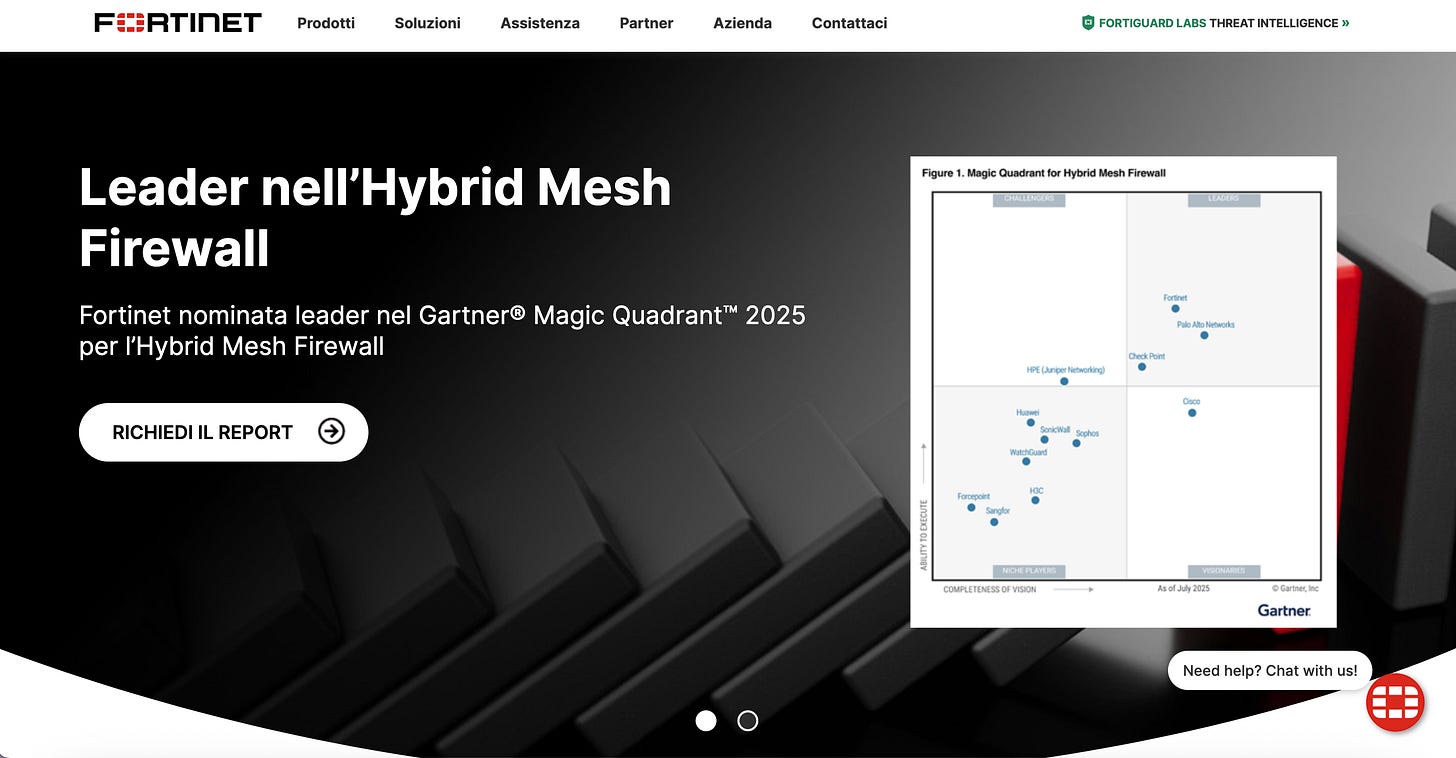

Fortinet (USA): Strategic-Technological Analysis

Fortinet, Inc. is a prominent American cybersecurity company founded in 2000 by Ken and Michael Xie[1]. Headquartered in Sunnyvale, California, it operates globally with offices in North America, Europe and Asia[2]. Best known for its FortiGate firewalls and integrated network security appliances, Fortinet markets a broad “Security Fabric” of interconnected products designed to protect enterprises and critical infrastructure[3]. With a portfolio of over fifty products and nearly 890,000 customers worldwide[4], Fortinet wields significant influence in cybersecurity. Its technologies are extensively used in commercial and government networks, including partnerships with NATO and national governments. Against the backdrop of Europe’s drive for digital sovereignty and defence autonomy[5], Fortinet’s role raises strategic questions: it offers a non-Chinese alternative for key cyber capabilities, yet is an American supplier. This report examines Fortinet’s corporate profile, technology offerings and partnerships, assessing how its capabilities align with European Union and NATO priorities – including interoperability, deterrence and dependence reduction. It highlights both the ways Fortinet’s solutions could bolster Europe’s cyber defenses and the gaps that arise from its U.S. origins and supply chains.

Oxford Instruments: Strategic-Technological Role in Europe’s Dual-Use and Defense Innovation

Oxford Instruments plc is a UK-based high-technology engineering firm founded in 1959 as the first commercial spin-out of the University of Oxford[1][2]. It designs and manufactures scientific instruments (e.g. superconducting magnets, cryogenic refrigeration, microscopes, spectroscopy and deposition tools) that serve research and industrial markets worldwide[2][3]. Originally a pioneer in MRI magnets and cryogenic systems, the company today addresses emerging fields such as semiconductor fabrication, advanced materials research, battery development and quantum computing. In the context of European strategic autonomy and deterrence, Oxford Instruments occupies an intriguing niche: it is neither a traditional defense prime nor a pure academic spin-off, but its deep-tech instrumentation underpins critical R&D. This analysis examines Oxford Instruments’ technology portfolio and strategic positioning – especially in relation to European Union and NATO priorities – to assess how its capabilities might substitute non-EU suppliers, strengthen collective defense research, and diversify sensitive technology supply chains. By studying its products, collaborations and intellectual assets, we aim to clarify Oxford Instruments’ potential role in Europe’s defense-industrial base and where gaps remain in meeting EU/NATO technology requirements[4][3].

QuantumBasel – Strategic-Technological Analysis

QuantumBasel AG is a recently founded Swiss company positioned as the country’s first commercial quantum computing and AI hub. Located on the Arlesheim innovation campus near Basel, it provides enterprises, research institutes, and startups with direct access to advanced quantum computing hardware and services. The hub is closely linked with the uptownBasel innovation campus and has brought in leading quantum systems (such as IonQ’s latest trapped-ion processors) for European users[1][2]. As part of the Basel-area innovation ecosystem, QuantumBasel sits at the intersection of academic research and industry, with partnerships that range from the University of Basel to international technology firms. Its mission is to accelerate innovation by leveraging quantum computing and machine learning, but as a Swiss-based entity it operates outside the EU institutional framework. This analysis examines QuantumBasel’s strategic and technological profile in the context of European defense and dual-use objectives, assessing its contributions to EU strategic autonomy, NATO interoperability, deterrence capabilities, transatlantic cooperation, and supply chain resilience.