Defence Finance Monitor Digest #54

Defence Finance Monitor is a specialised source of analysis for professionals who seek to anticipate how strategic priorities shape investment patterns in the defence sector. In a landscape shaped by high-stakes political choices and rapid technological shifts, understanding the link between military doctrine, operational requirements, and industrial policy is not a competitive edge—it is a prerequisite.

We analyse how strategic imperatives set by NATO, the European Union, allied Indo-Pacific democracies, and national Ministries of Defence translate into procurement programmes, innovation roadmaps, and long-term industrial priorities. Rather than listing individual companies, we track how clearly defined strategic challenges—such as deterrence gaps, technological dependencies, or capability shortfalls—are converted into funding schemes and institutional demand. Only companies that respond to these challenges become relevant to institutional buyers and, by extension, to investors. This framework has already enabled a growing community of analysts and financial professionals to make more consistent, risk-aware decisions and to avoid costly misalignments.

Building on this methodology, we are developing a structured database of companies analysed and classified according to the strategic-technological criteria set out in our framework. Subscribing to Defence Finance Monitor therefore provides not only access to in-depth reports, but also to a continuously expanding database of European and allied defence firms assessed against clear benchmarks. Each company is positioned according to its alignment with EU and NATO priority capability areas, its contribution to European strategic autonomy, its level of interoperability and deterrence value, and its role in reducing dependencies on non-allied suppliers. Classification also covers technology readiness levels, participation in EU and NATO programmes, intellectual property assets, and dual-use applications. This allows subscribers to compare, benchmark, and identify the most strategically relevant actors within a coherent, transparent, and decision-oriented taxonomy.

Subscribing to Defence Finance Monitor means gaining access to a strategic intelligence service that connects financial decisions with defence priorities. At the core of our work is a structured database of European and allied defence companies, classified according to strategic-technological criteria such as autonomy, interoperability, deterrence, and supply chain resilience. In today’s environment, profitable investment requires more than market data: it requires understanding how limited public resources are channelled toward specific capability gaps, sovereign technologies, and the reduction of non-allied dependencies. By combining in-depth reports with a continuously expanding company database, Defence Finance Monitor enables investors to anticipate demand, benchmark firms against institutional priorities, and avoid costly misalignments.

Operation Chrome Dome: Permanent Deterrence and the Risks of Continuous Airborne Alert

Operation Chrome Dome was one of the most ambitious and controversial strategies implemented by the United States Strategic Air Command (SAC) during the Cold War. Introduced in the early 1960s, it required a significant portion of the B-52 strategic bomber fleet, armed with thermonuclear weapons, to remain permanently in flight along predetermined routes. The primary objective was to guarantee the survivability of a retaliatory nuclear strike even in the event of a surprise attack by the Soviet Union. At that time, the Soviet demonstration of launching Sputnik into orbit had made clear that Moscow already possessed missile vectors capable of striking directly at U.S. territory. By contrast, the United States still relied heavily on strategic bombers, which were vulnerable if caught on the ground. Chrome Dome was designed to address this vulnerability, embodying the logic of permanent deterrence. The message was unambiguous: even in the event of a devastating Soviet first strike, part of America’s nuclear force would already be airborne and ready to respond immediately.

2025 Update of the EU Dual-Use Control List: Strategic Implications for European Technology and Security

On 8 September 2025, the European Commission adopted a Delegated Regulation updating the EU dual-use export control list under Annex I of Regulation (EU) 2021/821. This update follows decisions made in 2024 by the multilateral export control regimes—the Wassenaar Arrangement, the Missile Technology Control Regime, the Australia Group, and the Nuclear Suppliers Group. The new list incorporates both multilateral commitments and additional items agreed by EU Member States for uniform control. The changes reflect a broader EU strategy, set out in the 2024 White Paper on Export Controls, to strengthen oversight of sensitive technologies at the Union level. With quantum computing, advanced semiconductor equipment, additive manufacturing and peptide synthesis now included, the EU is consolidating its role as a proactive regulator in the governance of emerging dual-use technologies. These changes are not simply technical adjustments but part of a broader framework connecting trade, security, and strategic autonomy.

SAFE Instrument: EU Opens Negotiations with the UK and Canada

On 18 September 2025, the Council of the European Union authorised the European Commission to open negotiations with the United Kingdom and Canada regarding their participation in the Security Action for Europe (SAFE), a €150 billion defence loan instrument. SAFE, established as the first pillar of the Commission’s ReArm Europe Plan/Readiness 2030, aims to provide long-maturity loans to Member States to finance common defence procurements. This marks a significant development in the EU’s defence investment architecture, as it explicitly extends the potential for third-country participation in joint procurements funded under EU mechanisms. The decision reflects the Union’s recognition of the urgent need to accelerate defence capability acquisition in light of the deteriorating geopolitical environment. By allowing the UK and Canada into structured procurement frameworks, the EU is testing how to align its strategic autonomy agenda with pragmatic cooperation among NATO allies outside the Union.

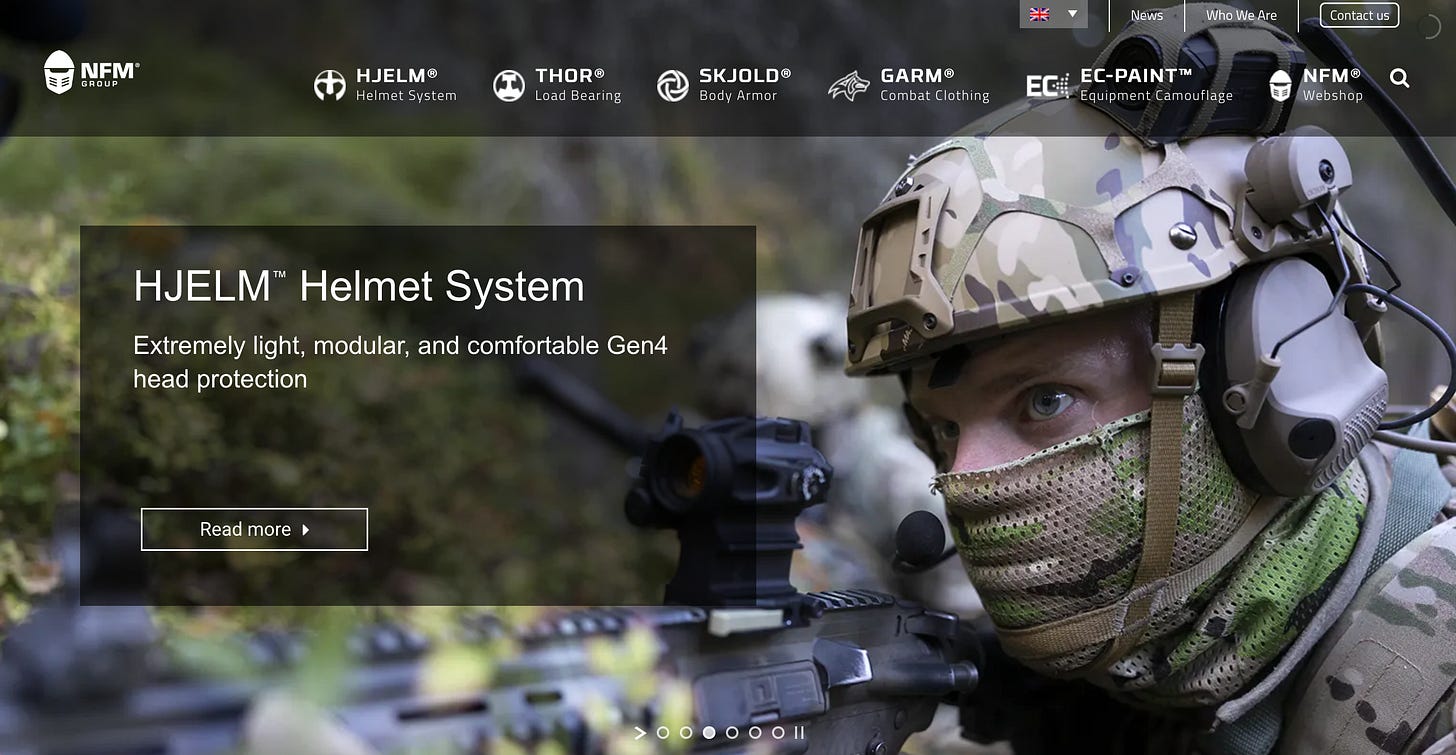

NFM Group (Norway) – Strategic-Technological Analysis

NFM Group AS is a Norwegian mid-cap defence technology company founded in 1996 by ex-Norwegian soldiers[1]. It designs and manufactures advanced personal protection systems for military and police forces. Headquartered in Ski (Oslo area), its 1,000+ workforce (30+ nationalities) spans Europe and North America[2][3]. Through vertically integrated R&D and production, NFM has secured a leading share of Europe’s body armour and combat uniform market. Its gear – from modular ballistic vests and helmets to tactical clothing – embodies “Scandinavian quality” and innovation[4][5]. This analysis will explore how NFM’s technology portfolio and partnerships contribute to European defence autonomy, interoperability and resilience, by substituting non-EU suppliers (especially Chinese) and strengthening deterrence across the Alliance.

Photonic Inc.: Quantum Photonic Computing and Communication

Europe’s interest in quantum photonics has surged as the continent seeks secure, future-proof communications and computing infrastructure. Photonic Inc. (HQ Vancouver) is a North American quantum startup pioneering “photonically linked silicon spin qubits” for scalable quantum computers and networks[1][2]. Its “Entanglement First™” architecture is designed to integrate computing and telecom interconnects for fault-tolerant quantum processing, with high connectivity and hardware error correction[3][4]. Photonic has attracted major investment ($140M+ to date) and partnered with Microsoft, TELUS and defense agencies[5][6]. Though Canadian-led, its work addresses shared Allied priorities: ultra-secure quantum communications, advanced computing capabilities and cryptography-safe networking. Photonic’s innovations—demonstrated in lab and carrier fiber tests—embody the kind of emerging quantum technologies that European and NATO planners view as critical for future deterrence, interoperability and autonomy[7][8].

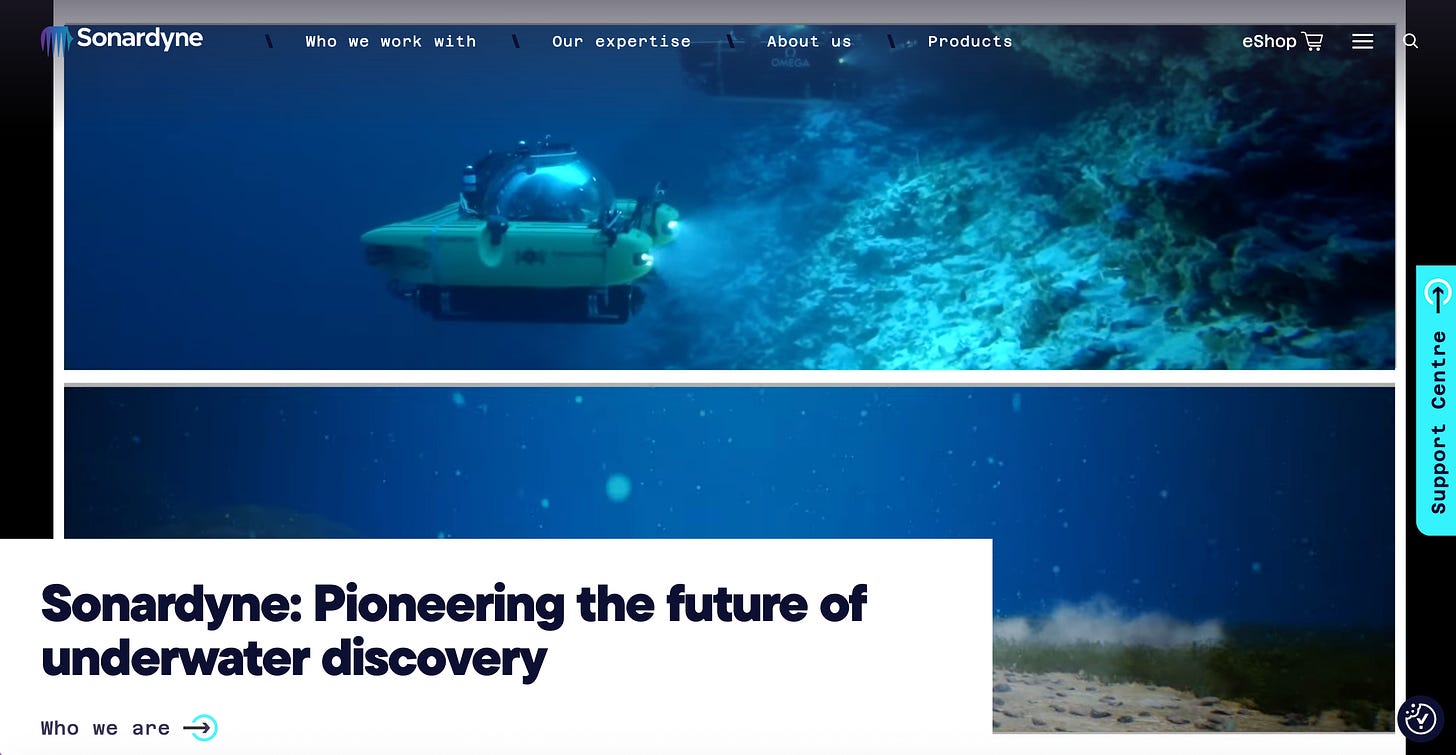

Sonardyne International Ltd – Strategic-Technological Analysis

Sonardyne International Ltd, a UK-headquartered marine technology company, has been a leader in underwater defense and dual-use sensors for over five decades. Founded in 1971 and still family-owned[1], it specializes in acoustic navigation, sonar imaging, inertial guidance and subsea communication systems. These tools allow naval and industrial clients to track, command and position unmanned fleets and monitor offshore assets from any platform[2][3]. This analysis explores Sonardyne’s role in strengthening Europe’s strategic autonomy: from substituting foreign suppliers in critical sensor domains, to enhancing NATO’s interoperable maritime defenses. The company’s technology lineup, R&D partnerships and program involvement are examined for their contributions to allied deterrence and supply-chain resilience. Despite being UK-based, Sonardyne’s innovations in autonomous undersea systems and secure data links have clear implications for European defense planning.

Arescosmo S.p.A.: Strategic-Technological Analysis

Arescosmo S.p.A. is an Italian defense and space technology firm founded in 1987[1]. Headquartered in Aprilia (Latina, Italy)[2], it operates primarily within Italy (with facilities also in Piedmont) and supplies high-tech life-support and protective systems to national and European projects. The company’s offerings – including parachute systems, personal armor, CBRN (Chemical/Biological/Radiological/Nuclear) protective suits, ground-support equipment for military aircraft, and space mission hardware – align it with European strategic autonomy and defense needs[1][3]. As a certified EN9100:2018/ISO9100 aerospace supplier, Arescosmo is recognized as a strategic partner by Italy’s Ministry of Defence, reflecting its role in substituting foreign dependence for critical equipment[4]. Its ISO-certified quality system and inclusion under Italy’s “golden power” regime indicate it can handle classified programs. These factors, combined with project collaborations, suggest it has the security clearances (likely NATO SECRET or national equivalent) to participate in classified EU and NATO missions.