Defence Finance Monitor Digest #46

Defence Finance Monitor is a specialised source of analysis for professionals who seek to anticipate how strategic priorities shape investment patterns in the defence sector. In a landscape shaped by high-stakes political choices and rapid technological shifts, understanding the link between military doctrine, operational requirements, and industrial policy is not a competitive edge—it is a prerequisite.

We analyse how strategic imperatives set by NATO, the European Union, allied Indo-Pacific democracies, and national Ministries of Defence translate into procurement programmes, innovation roadmaps, and long-term industrial priorities. Rather than listing individual companies, we track how clearly defined strategic challenges—such as deterrence gaps, technological dependencies, or capability shortfalls—are converted into funding schemes and institutional demand. Only companies that respond to these challenges become relevant to institutional buyers and, by extension, to investors. This framework has already enabled a growing community of analysts and financial professionals to make more consistent, risk-aware decisions and to avoid costly misalignments.

Building on this methodology, we are developing a structured database of companies analysed and classified according to the strategic-technological criteria set out in our framework. Subscribing to Defence Finance Monitor therefore provides not only access to in-depth reports, but also to a continuously expanding database of European and allied defence firms assessed against clear benchmarks. Each company is positioned according to its alignment with EU and NATO priority capability areas, its contribution to European strategic autonomy, its level of interoperability and deterrence value, and its role in reducing dependencies on non-allied suppliers. Classification also covers technology readiness levels, participation in EU and NATO programmes, intellectual property assets, and dual-use applications. This allows subscribers to compare, benchmark, and identify the most strategically relevant actors within a coherent, transparent, and decision-oriented taxonomy.

Subscribing to Defence Finance Monitor means gaining access to a strategic intelligence service that connects financial decisions with defence priorities. At the core of our work is a structured database of European and allied defence companies, classified according to strategic-technological criteria such as autonomy, interoperability, deterrence, and supply chain resilience. In today’s environment, profitable investment requires more than market data: it requires understanding how limited public resources are channelled toward specific capability gaps, sovereign technologies, and the reduction of non-allied dependencies. By combining in-depth reports with a continuously expanding company database, Defence Finance Monitor enables investors to anticipate demand, benchmark firms against institutional priorities, and avoid costly misalignments.

Security Guarantees, the Logic of Deterrence, and Putin’s Psychological Warfare

The war in Ukraine has made it clear that European stability cannot rest solely on declarations of principle or episodic financial support. What is needed are credible, durable security guarantees that are clearly perceived as binding by all parties involved. The central question is whether the West—and Europe in particular—is willing and able to provide Ukraine with mechanisms of deterrence that go beyond indirect assistance, up to and including the possibility of a military presence on the ground. It is precisely in this context that Russia’s recent threat against potential British and French deployments must be read: a warning that touches the core of the issue, namely the credibility of guarantees. Since deterrence rests on the perception of automaticity in responses, any ambiguity in Western commitments does not strengthen security—it weakens it, increasing the risk that Moscow will be tempted to test allied resolve.

The Credibility of Deterrence Lies in Automatic Mechanism

Deterrence is not a mathematical function of the number of forces deployed or the size of arsenals. It is, above all, a psychological and political construct that resides in the mind of the adversary. Its effectiveness depends on a firm and unquestionable conviction that any act of aggression will generate a response that is certain, immediate, and inexorable. Possessing the means to retaliate is not enough: the potential aggressor must be persuaded that those means will be used without hesitation, as if triggered by an automatic mechanism. It is precisely this perception that renders the costs of aggression prohibitive and discourages its initiation.

How Rearmament and Disarmament Cycles Shaped Defence Industry Valuations (1945–2025)

Policies of rearmament and disarmament since World War II have driven pronounced cycles in military spending that heavily influenced the financial fortunes of major defence companies. This report traces the period 1945–2025 in the United States and Europe, examining how political decisions on military expenditure translated into market outcomes for key defence firms (e.g. Lockheed Martin, Northrop Grumman, Raytheon, Boeing Defense, BAE Systems, Airbus Defence, Leonardo, Thales, Rheinmetall, Saab). We construct a chronological timeline of arms build-ups and drawdowns, analyze their impact on defence contractors’ valuations and performance, identify recurring patterns (including lags between political shifts and company outcomes), and assess how factors like public opinion, debt and fiscal constraints have moderated these cycles. The goal is to provide a historical framework for investors and decision-makers to understand and anticipate the defence sector’s reaction to political-military cycles.

Company Profiles & Industrial Intelligence

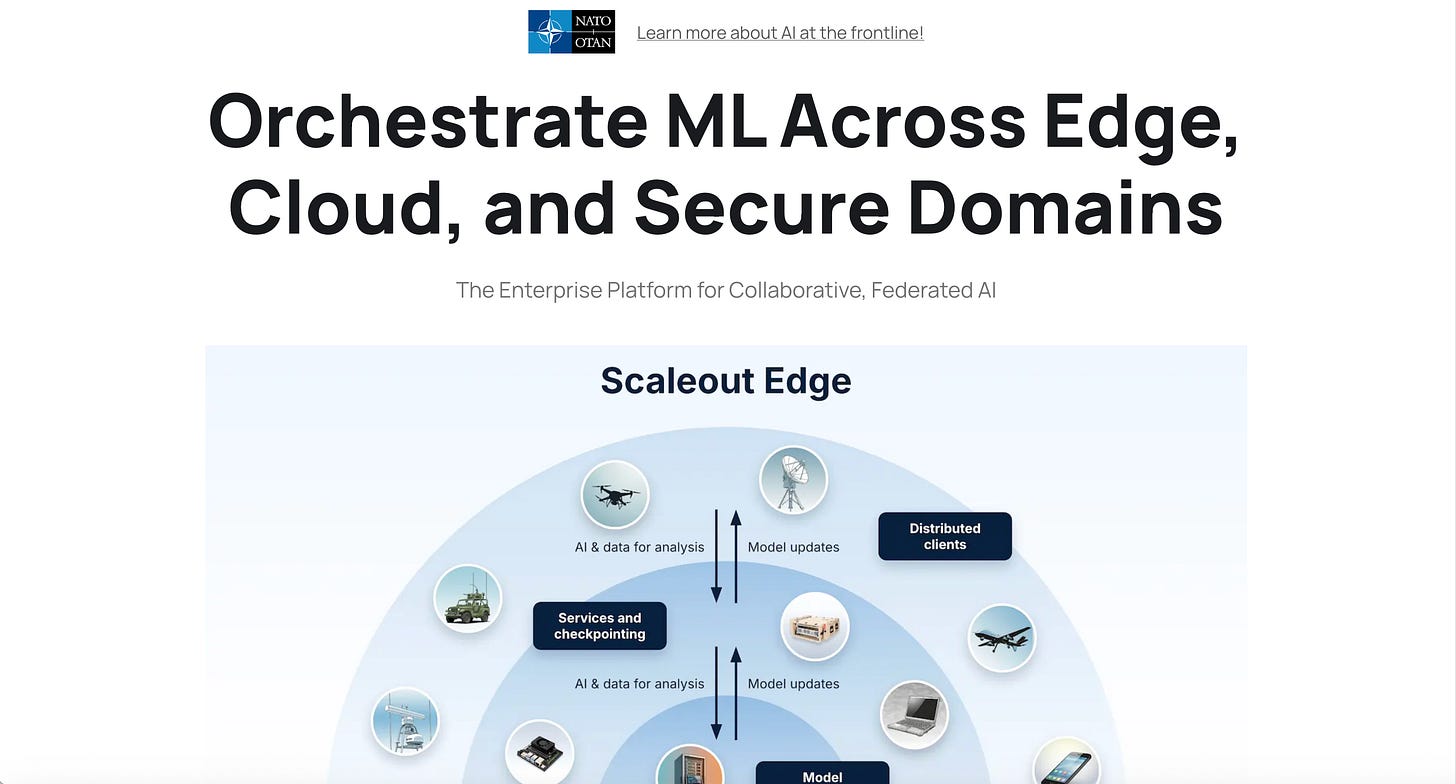

Scaleout (Sweden) – Distributed AI Platform for Big Data and Defense

In a world where data privacy and strategic autonomy are paramount, a Swedish spinoff is quietly reshaping how artificial intelligence is deployed in defense. Scaleout Systems – born in Uppsala’s academic halls – has developed a distributed AI platform that allows machine learning models to learn from sensitive data without moving that data. This novel approach, known as federated learning, means soldiers, sensors, and even vehicles can benefit from AI insights on-site, rather than relying on distant cloud centers. Scaleout’s technology gained early recognition in civilian sectors for enabling GDPR-compliant AI solutions, and it now draws interest from Europe’s defense community. The company’s inclusion in NATO’s cutting-edge innovation programs and visits from Sweden’s Defense Minister hint at its growing strategic value[1][2]. Could a small Scandinavian startup really help Europe reduce reliance on foreign AI providers and secure a spot at the forefront of defense tech? The journey of Scaleout from university lab to defense partner offers a compelling glimpse into how Europe might achieve technological sovereignty in the AI era.

Quantum-Safe Encryption for Europe’s Strategic Autonomy – The Case of ResQuant (Poland)

ResQuant is a Polish deep-tech company pioneering solutions against the looming threat of quantum-powered cyber attacks. Founded in Łódź in 2020, ResQuant develops advanced quantum-safe encryption hardware to safeguard sensitive data in the coming era of quantum computing[1][2]. The company’s core innovation – a post-quantum cryptographic (PQC) accelerator – positions it as a rare European player addressing a critical vulnerability: today’s encryption will be easily broken by tomorrow’s quantum computers[3][4]. By building proprietary cryptographic chips entirely designed and manufactured in the EU, ResQuant aligns closely with Europe’s drive for technological sovereignty[5]. Its hardware-based security modules implement the new NIST-standard algorithms (like Dilithium and Kyber) at high performance, offering future-proof protection for military communications, IoT devices, satellites, and critical infrastructure[6][7]. In an environment where NATO and EU institutions urgently call for quantum-resilient defenses, this Polish startup has quickly become an influential contributor. ResQuant’s emergence exemplifies how Europe’s own innovators can reduce strategic dependencies on foreign cryptography – particularly from untrusted suppliers – while staying interoperable with allied standards[8][9]. The following analysis explores ResQuant’s strategic-technological profile in depth, examining how its quantum-safe solutions support European strategic autonomy, strengthen NATO’s deterrence posture, and fortify supply chain resilience in the face of accelerating technological change.

Strategic-Technological Analysis: myLanguage (Switzerland)

In an era when secure, real-time communication across language barriers is vital, myLanguage stands out as a pioneer in AI-driven translation. This Swiss-based company has quietly built a reputation for its offline-capable, secure translation platform that empowers users to converse fluently without needing internet connectivity. From humanitarian missions to military coalitions, language differences can hinder cooperation – and that’s exactly the challenge myLanguage tackles with innovative technology. Its flagship solutions turn ordinary mobile devices into personal translators, allowing speech and text to be translated instantly on the spot. More than just another translation app, myLanguage emphasizes privacy and security by design, ensuring sensitive conversations never leave the device. This unique approach has begun to attract attention beyond the consumer realm, drawing interest from defense and security stakeholders looking for European-developed alternatives. myLanguage’s journey – from early startup accolades to involvement in NATO’s innovation initiatives – offers a glimpse into how a focused deep-tech company can contribute to European strategic autonomy. The following analysis delves into myLanguage’s strategic-technological profile, exploring how its linguistic AI platforms align with Europe’s defense and security priorities while reducing reliance on non-allied technologies.

IS-Wireless (Poland) – Secure 5G Networks for Defence and Communications

A Polish deep-tech company is quietly redefining how Europe builds its wireless networks. IS-Wireless, based near Warsaw, has emerged as a key innovator in secure 5G technology, targeting both defence and demanding commercial applications. Founded by wireless engineers and researchers, the company is developing “sovereign” mobile networks – systems built in Europe, free from untrusted foreign components, and hardened for extreme conditions. IS-Wireless’s mission aligns with Europe’s urgent quest for strategic autonomy in critical communications: reducing reliance on non-allied suppliers and ensuring that connectivity never falters under pressure[1][2]. Over the past few years, this little-known firm has been proving its worth through live 5G deployments, patents for novel network architectures, and selection for prestigious NATO and EU innovation programs. It is a prime example of how a European startup can contribute to collective security by marrying cutting-edge tech with strategic purpose, intriguing defence planners and telecom leaders alike.