Defence Finance Monitor Digest #42

Defence Finance Monitor is a specialised source of analysis for professionals who seek to anticipate how strategic priorities shape investment patterns in the defence sector. In a landscape shaped by high-stakes political choices and rapid technological shifts, understanding the link between military doctrine, operational requirements, and industrial policy is not a competitive edge—it is a prerequisite.

We analyse how strategic imperatives set by NATO, the European Union, allied Indo-Pacific democracies, and national Ministries of Defence translate into procurement programmes, innovation roadmaps, and long-term industrial priorities. Rather than listing individual companies, we track how clearly defined strategic challenges—such as deterrence gaps, technological dependencies, or capability shortfalls—are converted into funding schemes and institutional demand. Only companies that respond to these challenges become relevant to institutional buyers and, by extension, to investors. This framework has already enabled a growing community of analysts and financial professionals to make more consistent, risk-aware decisions and to avoid costly misalignments.

Building on this methodology, we are developing a structured database of companies analysed and classified according to the strategic-technological criteria set out in our framework. Subscribing to Defence Finance Monitor therefore provides not only access to in-depth reports, but also to a continuously expanding database of European and allied defence firms assessed against clear benchmarks. Each company is positioned according to its alignment with EU and NATO priority capability areas, its contribution to European strategic autonomy, its level of interoperability and deterrence value, and its role in reducing dependencies on non-allied suppliers. Classification also covers technology readiness levels, participation in EU and NATO programmes, intellectual property assets, and dual-use applications. This allows subscribers to compare, benchmark, and identify the most strategically relevant actors within a coherent, transparent, and decision-oriented taxonomy.

Subscribing to Defence Finance Monitor means gaining access to a strategic intelligence service that connects financial decisions with defence priorities. At the core of our work is a structured database of European and allied defence companies, classified according to strategic-technological criteria such as autonomy, interoperability, deterrence, and supply chain resilience. In today’s environment, profitable investment requires more than market data: it requires understanding how limited public resources are channelled toward specific capability gaps, sovereign technologies, and the reduction of non-allied dependencies. By combining in-depth reports with a continuously expanding company database, Defence Finance Monitor enables investors to anticipate demand, benchmark firms against institutional priorities, and avoid costly misalignments.

The Privatization of Strategy: Accountability and Political Risks

One of the most striking transformations in contemporary warfare is the extent to which private corporations have become embedded in the core functions of military power. In earlier eras, private industry served primarily as a supplier of hardware—producing weapons, vehicles, and equipment under state direction. Today, however, technology firms not only manufacture but operate essential infrastructures, from satellite networks and cloud architectures to AI-powered data platforms. This shift means that the ability of states to conduct military operations increasingly depends on assets outside their direct control. When companies decide how and where their technologies are deployed, they exert real influence over national security outcomes. The privatization of strategic functions thus raises profound questions of sovereignty, accountability, and legitimacy, as decisions that once rested exclusively in the hands of governments are now shaped by corporate actors with their own interests, incentives, and vulnerabilities.

Nuclear Strategy and the Logics of International Stability

The advent of nuclear weapons radically transformed the conception of security and warfare. Before 1945, war was seen as an extreme but limited means, where victory could be achieved through the destruction of military forces or the occupation of territory. The emergence of nuclear and later thermonuclear weapons shattered this premise: the destructive capacity was such that the very notion of victory became inconceivable. Strategy could no longer be based on the conduct of war but on the prevention of its outbreak. Out of this rupture emerged deterrence, understood as the ability to influence adversary behavior through the threat of use rather than actual employment. Nuclear weapons became political instruments as much as military ones, their function tied to the management of fear, the credibility of threats, and the preservation of an unstable but enduring equilibrium. Understanding nuclear strategy thus requires analyzing how world politics attempted to stabilize instability itself.

Strategic Factors and Consequences of Military Modernization in Southeast Asia after the Cold War

The end of the Cold War created a transformed strategic environment in Southeast Asia, where states suddenly faced the dual challenge of adapting to new global dynamics and responding to persistent regional rivalries. With the binary logic of bipolar confrontation gone, national security priorities diversified, reflecting a mix of domestic imperatives, territorial disputes, and aspirations for international recognition. The modernization of armed forces became an essential tool through which governments sought to safeguard sovereignty, project deterrent capability, and position themselves within wider global security frameworks. The focus was not only on replacing obsolete equipment but also on building institutional resilience, operational flexibility, and technological sophistication. These ambitions coincided with rapid economic growth in parts of the region, providing both fiscal means and political legitimacy to pursue ambitious procurement programs. Modernization thus developed as a multidimensional process shaped by economics, politics, and geopolitics alike, reflecting the complex demands of the post–Cold War order.

Tietoevry Oyj: Strengthening Europe’s Digital Sovereignty in Defense and Security

Tietoevry Oyj is a Nordic technology company stepping onto the European defense stage with a unique profile. Founded in Finland over half a century ago, it has evolved from a banking IT unit into a publicly traded digital services powerhouse. Today, Tietoevry’s 24,000 experts span nearly 90 countries, delivering cloud, data and software solutions with a strong Nordic emphasis[1]. The company is not a traditional arms manufacturer or prime defense contractor; instead, it brings deep expertise in secure digital infrastructure, software engineering, and critical IT systems. This background positions Tietoevry as an intriguing player in Europe’s push for technological sovereignty and defense modernization. As European nations seek to reduce dependence on non-allied suppliers and strengthen their cyber resilience, Tietoevry’s heritage in secure networks and public-sector IT could prove strategically valuable. The company’s recent entry as a NATO-approved supplier underscores its ambitions to support collective security with homegrown tech expertise. Investors and policymakers alike are watching how this Finnish-born firm leverages its civil digital strengths to meet Europe’s defense and security needs – a crossover that could redefine what a “defense company” looks like in the era of cyber warfare and AI-driven operations.

Peak Technology: Austria’s Composite Tank Specialist Strengthening Europe’s Space and Defense Autonomy

Peak Technology GmbH is a quietly transformative force in Europe’s aerospace sector. From an unassuming tech park in rural Austria, this company has grown into a pivotal supplier for high-profile European space missions[1][2]. Founded in 2007 by engineer Dieter Grebner, Peak Technology began as a specialist in ultra-light composite parts for Formula One racing and soon parlayed that expertise into the space industry[3]. Today it designs and manufactures cutting-edge components like carbon fiber fuel tanks and thermal protection structures that are integral to European launch vehicles and satellites[4][5]. Its propellant tanks and pressure vessels, built with proprietary composite techniques, have been selected by major primes such as Airbus and Avio for programs ranging from Galileo navigation satellites to the Vega rocket[6][7]. In an era when Europe strives for strategic autonomy in space and defense, Peak Technology exemplifies the nimble, high-tech supplier filling critical gaps once dominated by larger foreign firms. Unheralded but highly respected among insiders, the company combines innovation and reliability – qualities that have made it a “hidden champion” powering European missions behind the scenes[1]. The following analysis will delve into how this small Austrian firm is bolstering Europe’s strategic capabilities, from reducing dependence on non-allied suppliers to enabling next-generation defense and space platforms.

VISIONAIRtronics: European Power Management Systems for Reliable Tactical UAVs

In an era when Europe is striving for technological self-reliance in defense, VISIONAIRtronics has quietly positioned itself as a pivotal player in unmanned aerial vehicle (UAV) reliability. This Austrian startup specializes in the unglamorous but mission-critical niche of power management systems for drones – the “circulatory system” that keeps UAVs flying safe and steady. Founded in 2014, the company has evolved from solving basic power safety issues for small drones into a provider of advanced, fail-safe power control units now sought by defense and aerospace developers. Its products – rugged power distributors, smart battery controllers, and generator units – tackle a problem high on European strategic agendas: ensuring that drones and robotic systems never lose power at a critical moment. By engineering redundant and high-reliability power supplies, VISIONAIRtronics addresses a key vulnerability that has grounded too many UAVs and undermined trust in autonomous technology. European defense planners and NATO allies are taking notice. The company’s solutions promise to reduce reliance on foreign electronics, strengthen the backbone of Europe’s unmanned fleets, and enhance the resilience of allied operations. The following analysis will explore how a small firm’s deep-tech ingenuity in power management aligns with Europe’s grander goals of strategic autonomy and interoperable, next-generation defense capabilities.

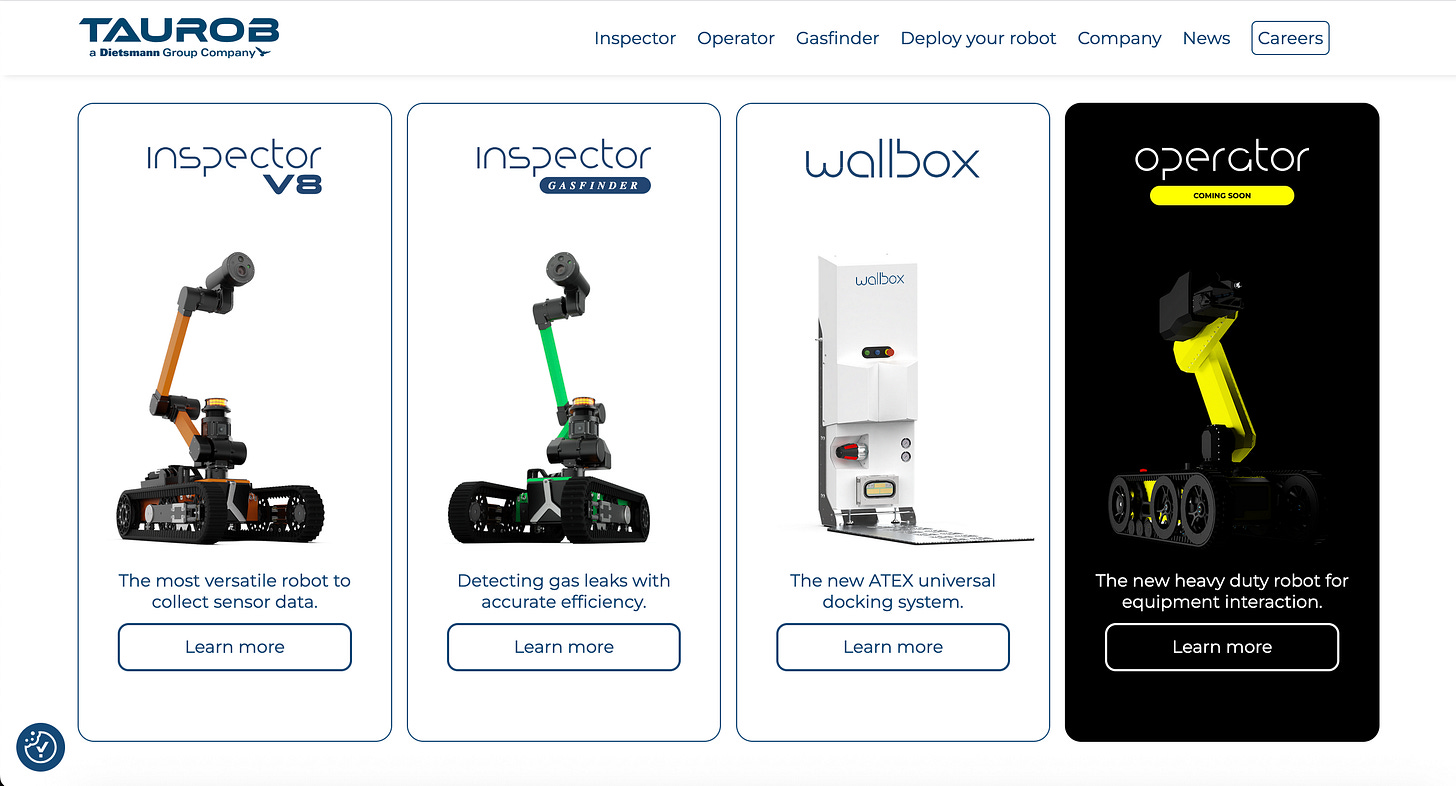

Taurob: ATEX-Certified Autonomous Ground Robots for Hazardous Environments

Taurob is a European robotics innovator developing autonomous ground vehicles that can operate in some of the most perilous industrial and security environments. Founded in 2010 in Vienna, Austria, the company has pioneered explosion-proof (ATEX-certified) robots capable of conducting inspections, maintenance, and emergency interventions without putting humans at risk[1][2]. Over the past decade, Taurob’s nimble engineering team has transformed a firefighting robotics concept into a versatile dual-use platform adopted in oil and gas installations and tested in defense scenarios. From winning TotalEnergies’ ARGOS competition for autonomous oil-rig robots to partnering with defense researchers on CBRN (chemical, biological, radiological, nuclear) response, Taurob has demonstrated the strategic value of home-grown European robotics. As the EU strives for greater technological sovereignty and NATO prioritizes cutting-edge capabilities, Taurob emerges as a case study in how a small European firm can deliver advanced autonomous systems that strengthen safety, resilience, and strategic autonomy. With backing from industry partners and a growing track record in harsh environments, the company is positioning its robots as key enablers for Europe’s autonomous operations – bridging civilian and military needs while reducing reliance on foreign suppliers.