Defence Finance Monitor Digest #40

Defence Finance Monitor is a specialised source of analysis for professionals who seek to anticipate how strategic priorities shape investment patterns in the defence sector. In a landscape shaped by high-stakes political choices and rapid technological shifts, understanding the link between military doctrine, operational requirements, and industrial policy is not a competitive edge—it is a prerequisite.

We analyse how strategic imperatives set by NATO, the European Union, allied Indo-Pacific democracies, and national Ministries of Defence translate into procurement programmes, innovation roadmaps, and long-term industrial priorities. Rather than listing individual companies, we track how clearly defined strategic challenges—such as deterrence gaps, technological dependencies, or capability shortfalls—are converted into funding schemes and institutional demand. Only companies that respond to these challenges become relevant to institutional buyers and, by extension, to investors. This framework has already enabled a growing community of analysts and financial professionals to make more consistent, risk-aware decisions and to avoid costly misalignments.

Building on this methodology, we are developing a structured database of companies analysed and classified according to the strategic-technological criteria set out in our framework. Subscribing to Defence Finance Monitor therefore provides not only access to in-depth reports, but also to a continuously expanding database of European and allied defence firms assessed against clear benchmarks. Each company is positioned according to its alignment with EU and NATO priority capability areas, its contribution to European strategic autonomy, its level of interoperability and deterrence value, and its role in reducing dependencies on non-allied suppliers. Classification also covers technology readiness levels, participation in EU and NATO programmes, intellectual property assets, and dual-use applications. This allows subscribers to compare, benchmark, and identify the most strategically relevant actors within a coherent, transparent, and decision-oriented taxonomy.

Subscribing to Defence Finance Monitor means gaining access to a strategic intelligence service that connects financial decisions with defence priorities. At the core of our work is a structured database of European and allied defence companies, classified according to strategic-technological criteria such as autonomy, interoperability, deterrence, and supply chain resilience. In today’s environment, profitable investment requires more than market data: it requires understanding how limited public resources are channelled toward specific capability gaps, sovereign technologies, and the reduction of non-allied dependencies. By combining in-depth reports with a continuously expanding company database, Defence Finance Monitor enables investors to anticipate demand, benchmark firms against institutional priorities, and avoid costly misalignments.

Strategic Context & International Security

Technology and Conflict: From the Industrial Revolution to Digital War

Military history clearly shows that every major technological innovation has profoundly transformed the nature of war. The introduction of gunpowder, the industrial revolution, mechanization, and ultimately nuclear weapons all redefined strategic balances and the logic of deterrence. Today we are witnessing a new phase in this long sequence: the digital revolution and the development of artificial intelligence have made war pervasive and continuous, extending it into domains without spatial boundaries or temporal limits. This transformation forces us to view technology not only as a factor of military superiority but as an element that reshapes the very boundaries between peace and conflict. Digital war is not an episodic phenomenon but a structural condition shaping both the present and the future of international relations.

Permanent War and Europe’s Strategic Awakening

In recent years, the European strategic debate has revived a theme thought to have been buried with the end of the Cold War: the persistence of war as a structural element of international politics. The wars in the Balkans, the long era of counterterrorism, Russia’s return as a revisionist power, and China’s rise have gradually undermined the idea of a global order built on stability and the linear expansion of liberal peace. It is in this context that Jean-Baptiste Jeangène Vilmer, jurist and director of the Institut de recherche stratégique de l’École militaire (IRSEM), published Le réveil stratégique. Essai sur la guerre permanente (2023), advancing a radical thesis: war is not an exception but a permanent condition. He analyzes the changes that have made the boundary between peace and war increasingly porous, offering a framework that forces Western democracies to confront a genuine “strategic awakening.”

Emerging Defence Technologies

Human-Machine Teaming and the Future of Command Responsibility

The integration of artificial intelligence into military systems has not led to the replacement of human decision-making, but rather to the emergence of hybrid arrangements in which humans and machines operate together in tightly coupled teams. This dynamic, often described as “human-machine teaming,” represents one of the most significant organizational changes in modern warfare. At its core, it involves the delegation of certain tasks—such as data filtering, target recognition, and predictive analytics—to machines, while retaining human oversight and judgment over decisions of strategic and ethical importance. The logic is pragmatic: machines excel at processing vast amounts of information quickly, but they lack contextual reasoning, moral judgment, and the ability to interpret intent. Humans, conversely, are limited in speed and capacity but bring indispensable judgment to bear on complex and ambiguous situations. Human-machine teaming seeks to leverage the comparative advantages of each, with the hope of producing more effective, adaptive, and accountable military organizations. The question that emerges, however, is whether such arrangements genuinely enhance responsibility, or whether they risk diffusing and diluting it across increasingly complex sociotechnical systems.

Globalstar Expands Government and Defense Market with $60M SATCOM and 5G Wins

The fusion of satellite communications and 5G technologies is emerging as a decisive enabler of modern defense operations. In an era where contested electromagnetic environments, dispersed force structures, and autonomous systems drive operational concepts, militaries require communications architectures that are flexible, resilient, and globally deployable. Low Earth Orbit (LEO) satellite constellations, when combined with licensed spectrum and advanced terrestrial networking, provide the foundation for seamless connectivity across multiple theaters. Globalstar’s recent contract wins highlight how commercial satellite operators are becoming critical players in national security ecosystems, bridging the gap between military-grade requirements and commercial innovation to deliver mission-critical connectivity.

Company Profiles & Industrial Intelligence

Pix4D: Strategic-Technological Analysis for European Defense and Dual-Use Autonomy

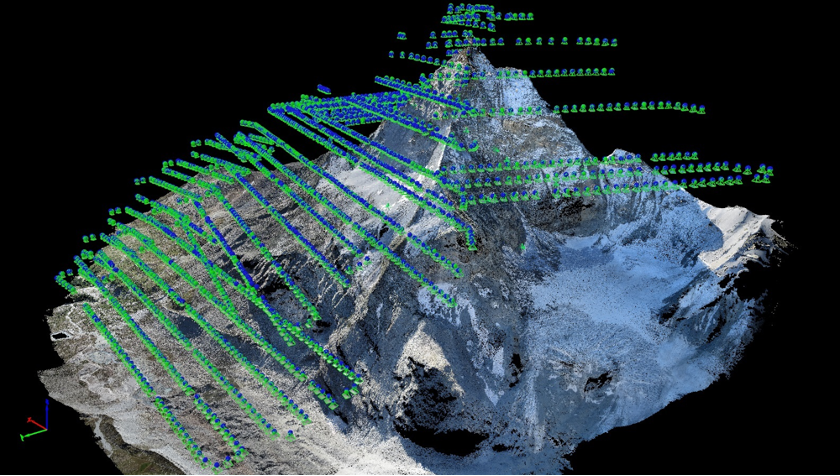

A Swiss startup founded in 2011, Pix4D has quietly become a leader in drone-based photogrammetry. Emerging from an EPFL computer-vision lab, Pix4D’s software turns thousands of aerial images into 3D maps with survey-grade accuracy[1][2]. In one test its team flew drones for under six hours to snap 2,188 pictures of the Matterhorn, then computed a 300-million-point 3D model of the terrain[2]. Such European-developed capabilities – hosted on EU-based cloud servers[3] – are of growing interest to defense planners who wish to replace foreign mapping tools. Pix4D’s photogrammetry suite supports civil and security use cases, from infrastructure inspection to emergency response, hinting at how it could bolster NATO’s mapping and reconnaissance needs. At the same time, its Swiss/Parrot ownership and EU-focused data practices suggest it can reduce strategic dependencies on non‑allied technology (for example by avoiding Chinese software backdoors[3]). The analysis below examines Pix4D’s legal status, tech portfolio and readiness, partnerships, and overall contribution to European strategic autonomy and deterrence.

Strategic-Technological Analysis of SenseFly (EPFL Spin-off, Switzerland)

SenseFly is a Swiss drone manufacturer that emerged from the Ecole Polytechnique Fédérale de Lausanne (EPFL) over a decade ago. This Lausanne-based spin-off, originally founded in 2009 by researchers including Professor Dario Floreano and his students, pioneered lightweight autonomous fixed-wing unmanned aerial vehicles (UAVs) for high-resolution mapping and data collection[1][2]. Over time the company’s eBee series became a world-leading commercial mapping drone, logging over one million flights and collecting imagery for agencies ranging from surveying firms to border security services[1]. In 2021 senseFly was acquired by U.S. firm AgEagle Aerial Systems, integrating its Swiss R&D into a transatlantic enterprise. Today senseFly’s technology underpins advanced autonomous drones (including ISR versions) now deployed by European and NATO forces[3][4]. This report investigates senseFly’s strategic role in European defence, focusing on its technological portfolio, autonomy impact, and alignment with EU/NATO strategic objectives.

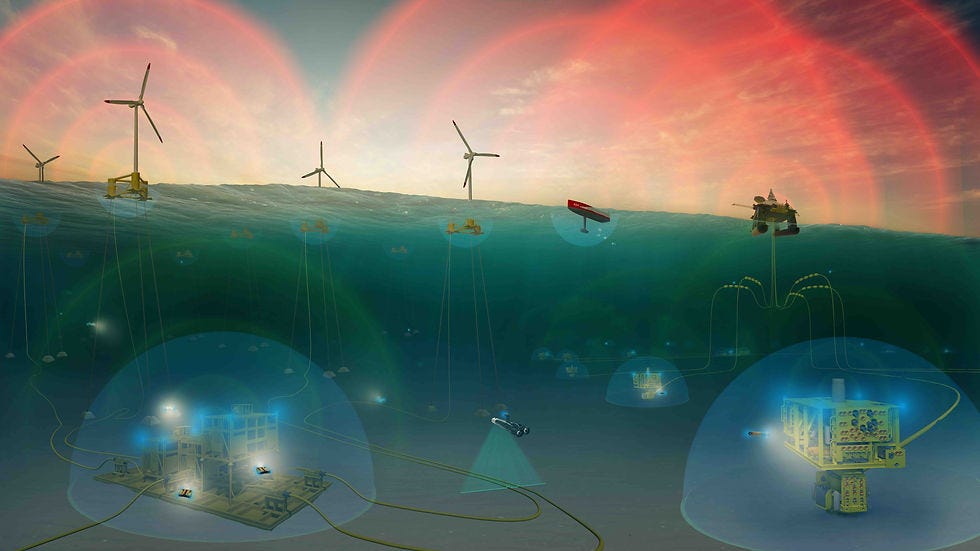

Hydromea: Cutting the Underwater Cord

Hydromea is a Swiss deep‑tech spin‑off from EPFL in Lausanne, founded in 2014 to “cut the cord” on underwater asset inspection and monitoring. Its team of engineers and roboticists has created a suite of compact, battery‑powered underwater drones and optical wireless modems that enable real‑time high‑definition video and data transmission beneath the waves. By combining proprietary LUMA optical communications modems with lightweight hubless thrusters and an untethered ROV platform (ExRay), Hydromea addresses longstanding limitations of subsea operations – such as the risk and expense of tethered inspections – in a novel way. Its products aim to make underwater infrastructure surveys and surveillance faster, safer and less reliant on large support vessels. This capability is increasingly relevant as Europe and its allies expand offshore wind farms, subsea cables and maritime patrols, where real-time data links and autonomous robots can fill critical gaps. Hydromea’s story – from two EPFL PhD projects in underwater swarms to a funded startup – hints at a strategic opportunity. It offers a home‑grown solution to subsea communications and robotics that could strengthen Europe’s industrial base and defense autonomy in the underwater domain, potentially justifying closer support from European innovation programs and allied partners to realize its full potential.

Verity AG – Autonomous Indoor Drone Systems from Switzerland

Verity AG, a Zurich-based spin-off of ETH Zurich founded in 2014[1][2], develops fully autonomous indoor drone systems for commercial use. Its drones perform inventory checks in warehouses and dazzling indoor light shows at events[2][3]. This blend of technology and entertainment reflects deep Swiss engineering and its roots in academic research. Verity’s self-flying drones carry cameras and AI software to scan barcodes and manage stock with high precision, aiming for the so-called “zero-error warehouse” operation[3]. Such innovations hint at dual-use potential: while currently focused on logistics and entertainment, the underlying autonomy, sensing, and safety technologies align with broader European goals in autonomous systems and supply-chain resilience.

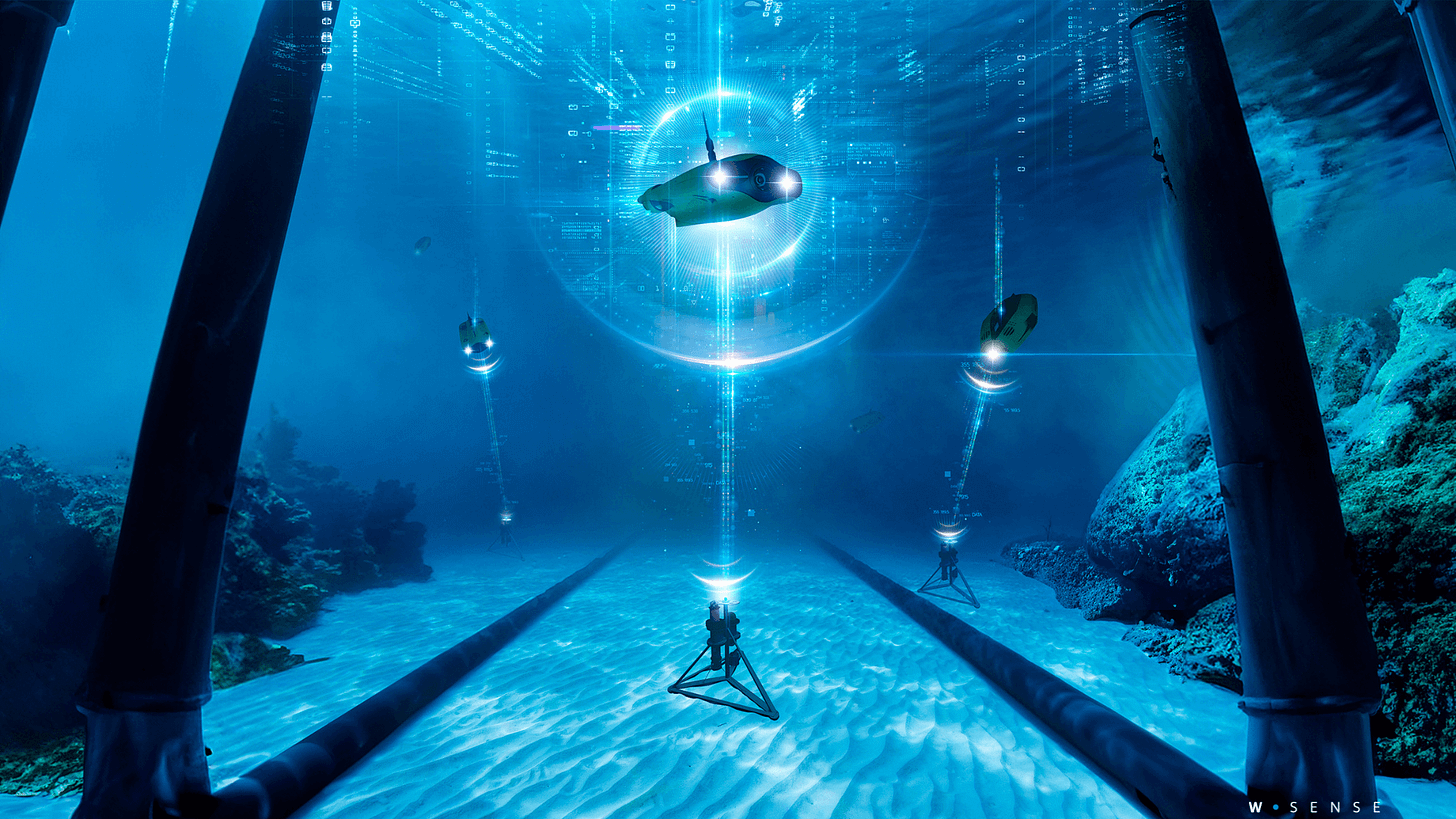

Strategic-Technological Analysis: WSense Srl (Rome, Italy)

WSense Srl is an Italian deep-tech scale-up spun off from Sapienza University of Rome, pioneering underwater wireless networks often dubbed the “Internet of Underwater Things.” Its mission is to enable reliable, secure submarine communications and real-time environmental monitoring. Headquartered in Rome with subsidiaries in London (UK) and Bergen (Norway)[1][2], the privately held company develops complete turnkey systems – hardware nodes, modems, sensors and AI-driven software – for subsea connectivity[1][3]. Under CEO Prof. Chiara Petrioli (founder) and Chairman Salvatore Sardo[4], WSense has grown to about 50 engineers (as of 2023) with a further expansion planned. Its innovative platform uses acoustic and optical links combined with adaptive routing algorithms to achieve stable data exchange up to 3,000 m deep[3]. The technology targets maritime infrastructure (pipelines, aquaculture farms, offshore wind farms), scientific monitoring, and even diver communications – all domains of strategic interest for Europe’s Blue Economy and security. Although much of its deployment so far has been environmental or industrial (e.g. fisheries, archaeology), WSense’s capabilities are directly relevant to coastal defense and resilience (e.g. protection of undersea cables and ports). The company has attracted significant EU support (winning a 2022 European Commission BlueInvest award[5]) and venture capital (Series A €9M in 2023[6], pre-Series B €7.2M in 2025 led by Fincantieri[7]), signaling its strategic potential in European autonomy for undersea domains.