Defence Finance Monitor Digest #39

Defence Finance Monitor is a specialised source of analysis for professionals who seek to anticipate how strategic priorities shape investment patterns in the defence sector. In a landscape shaped by high-stakes political choices and rapid technological shifts, understanding the link between military doctrine, operational requirements, and industrial policy is not a competitive edge—it is a prerequisite.

We analyse how strategic imperatives set by NATO, the European Union, allied Indo-Pacific democracies, and national Ministries of Defence translate into procurement programmes, innovation roadmaps, and long-term industrial priorities. Rather than listing individual companies, we track how clearly defined strategic challenges—such as deterrence gaps, technological dependencies, or capability shortfalls—are converted into funding schemes and institutional demand. Only companies that respond to these challenges become relevant to institutional buyers and, by extension, to investors. This framework has already enabled a growing community of analysts and financial professionals to make more consistent, risk-aware decisions and to avoid costly misalignments.

Building on this methodology, we are developing a structured database of companies analysed and classified according to the strategic-technological criteria set out in our framework. Subscribing to Defence Finance Monitor therefore provides not only access to in-depth reports, but also to a continuously expanding database of European and allied defence firms assessed against clear benchmarks. Each company is positioned according to its alignment with EU and NATO priority capability areas, its contribution to European strategic autonomy, its level of interoperability and deterrence value, and its role in reducing dependencies on non-allied suppliers. Classification also covers technology readiness levels, participation in EU and NATO programmes, intellectual property assets, and dual-use applications. This allows subscribers to compare, benchmark, and identify the most strategically relevant actors within a coherent, transparent, and decision-oriented taxonomy.

Subscribing to Defence Finance Monitor means gaining access to a strategic intelligence service that connects financial decisions with defence priorities. At the core of our work is a structured database of European and allied defence companies, classified according to strategic-technological criteria such as autonomy, interoperability, deterrence, and supply chain resilience. In today’s environment, profitable investment requires more than market data: it requires understanding how limited public resources are channelled toward specific capability gaps, sovereign technologies, and the reduction of non-allied dependencies. By combining in-depth reports with a continuously expanding company database, Defence Finance Monitor enables investors to anticipate demand, benchmark firms against institutional priorities, and avoid costly misalignments.

Strategic Context & International Security

The End of the Post–Cold War Era and the Return of Hard Power

After 1991 the post–Cold War international order was built on U.S. primacy, liberal institutions, and the expectation of a durable peace in Europe. U.S. strategy documents from 1992 onward (e.g. the leaked Defense Planning Guidance) explicitly foresaw an “unchallenged supremacy” for America and a liberal order topped by the United States. American policymakers sought to “cultivate an open, democratic order in which [the U.S.] remained firmly atop the international hierarchy”. In practice this meant NATO remained central: the alliance was expanded eastward to lock in Europe’s security under U.S. leadership. NATO enlargement proceeded in stages (1999, 2004, 2009, 2017/20) as former Warsaw Pact countries joined, reflecting the assumption that a “whole and free Europe” should be achieved under Western auspices.

The New Privatization of War: When Tech Companies Become Strategic Actors in National Security

The debate on the privatization of war has long been associated with private military companies and mercenaries. Yet the most significant transformation of recent years lies elsewhere: the rise of major private technology firms as indispensable actors for national defense and security. SpaceX, through its Starlink satellite network, ensured the continuity of communications in Ukraine when traditional infrastructures had been severely compromised. Palantir, with its data analytics and artificial intelligence platforms, provides operational tools that are central to military planning and intelligence. These firms are no longer mere contractors: they have become strategic pillars with the ability to shape the very conduct of warfare. This marks a historic shift, in which the instruments of war are no longer the exclusive monopoly of states, but increasingly depend on global private entities.

AI in Warfare: Speed, Fragility, and the Risks of Overreliance

The progressive integration of artificial intelligence into military systems has often been described as a revolutionary development, capable of reshaping the very nature of warfare. Much of the public debate has focused on the prospect of autonomous weapons, the so-called “killer robots” able to operate without human intervention and to make engagement decisions independently. Yet this narrative risks obscuring the structural limits of currently available technologies and the vulnerabilities they introduce once deployed on the battlefield. Contemporary AI, despite its rapid progress, remains fundamentally rooted in statistical models that excel at pattern recognition but lack genuine contextual understanding, causal reasoning, and reliable adaptation to unforeseen circumstances. These weaknesses are not abstract issues but have direct consequences in environments defined by uncertainty, deception, and rapid change. Military organizations therefore face a paradox: while AI accelerates the collection and processing of information, its probabilistic nature may magnify errors, introduce new risks, and undermine the reliability of decision-making in war.

Emerging Defence Technologies

Investing in Quantum: Key Public Companies in the US and Europe

Quantum computing has transitioned from pure research to an emerging industry, with a handful of companies now publicly traded. Many leading quantum players (e.g. Google, IBM, Microsoft) are large tech firms where quantum is a small segment, but direct exposure for investors comes from specialized pure-play quantum companies. Below we analyze the main publicly-listed companies in the quantum computing and related quantum technologies space (focusing on US and Europe), excluding still-private startups. For each company, we provide basic facts, financial metrics, business model, technology approach, partnerships, history, risks, and an investment outlook, enabling a side-by-side comparison.

Company Profiles & Industrial Intelligence

NeuVasQ Biotechnologies -Technological Analysis

NeuVasQ Biotechnologies is a Belgian life-sciences spin-off tackling one of neuroscience’s most elusive challenges: repairing the blood-brain barrier (BBB)[1]. Founded in 2021 out of the Université Libre de Bruxelles (ULB), this young company is developing biotechnological therapies aimed at restoring the brain’s protective vascular seal in conditions ranging from stroke to Alzheimer’s disease[1][2]. NeuVasQ’s origins in cutting-edge academic research and its focus on the BBB set it apart in the biomedical landscape. While many innovators have tried to bypass the BBB to deliver drugs, NeuVasQ instead works to reinstate the barrier’s integrity, a novel approach that could transform treatment of acute neurological injuries and degenerative disorders. Backed by European investors and public funds, the company embodies a new breed of deep-tech startups in Europe’s biotech sector. Its breakthrough science has attracted interest not only for potential clinical impact, but also for its strategic implications: a home-grown European technology addressing critical health vulnerabilities. NeuVasQ Biotechnologies thus stands at the intersection of biomedical innovation and strategic health security – a position that has observers eager to see how this venture will evolve in the context of Europe’s broader push for technological sovereignty and resilience.

Santero Therapeutics – Strategic-Technological Analysis

Santero Therapeutics is a Belgian biotech venture emerging from academic research, dedicated to solving one of the world’s most pressing health security challenges: antibiotic resistance. Founded in 2021 as a spin-off from the Université Libre de Bruxelles, Santero is pioneering a new class of antibiotics to combat multidrug-resistant “superbugs” that evade existing treatments[1][2]. At a time when Europe is striving for greater strategic autonomy in critical technologies, Santero’s work targets a vulnerability with both public health and security implications. The company has attracted attention not only for its innovative science – blocking a bacterial “Achilles heel” in stress response mechanisms – but also for its strategic value in reducing Europe’s dependence on foreign pharmaceutical supplies. Santero’s story intertwines cutting-edge biotechnology with the broader goals of European resilience and sovereignty, offering a compelling glimpse into how a small startup could help fortify Europe’s defenses against an invisible yet formidable threat.

REHAL-IT – European Strategic-Technological Analysis

A Belgian deep-tech venture is quietly blurring the lines between neuroscience and virtual reality, aiming to transform how cognitive disorders are evaluated and treated. REHAL-IT, a spin-off of the Université Libre de Bruxelles (ULB), develops immersive software that places patients with cognitive impairments into realistic virtual scenarios for assessment and rehabilitation[1][2]. Born at the crossroads of academic research and interactive technology, this young company has attracted attention not only in health circles but also among strategists interested in Europe’s technological autonomy. Its flagship platform, known as R.O.G.E.R., was co-developed by university researchers, clinicians, and a Belgian game studio to create life-like cognitive training exercises[2]. REHAL-IT’s novel approach – harnessing VR “serious games” for cognitive therapy – hints at a dual-use potential that could support both civilian healthcare and military resilience. As Europe strives for strategic autonomy in critical technologies, even niche healthcare innovations like REHAL-IT’s may play an outsized role in reducing reliance on foreign providers and strengthening the human dimension of defense readiness. Such prospects make this unassuming start-up a compelling subject for a deeper strategic-technological analysis.

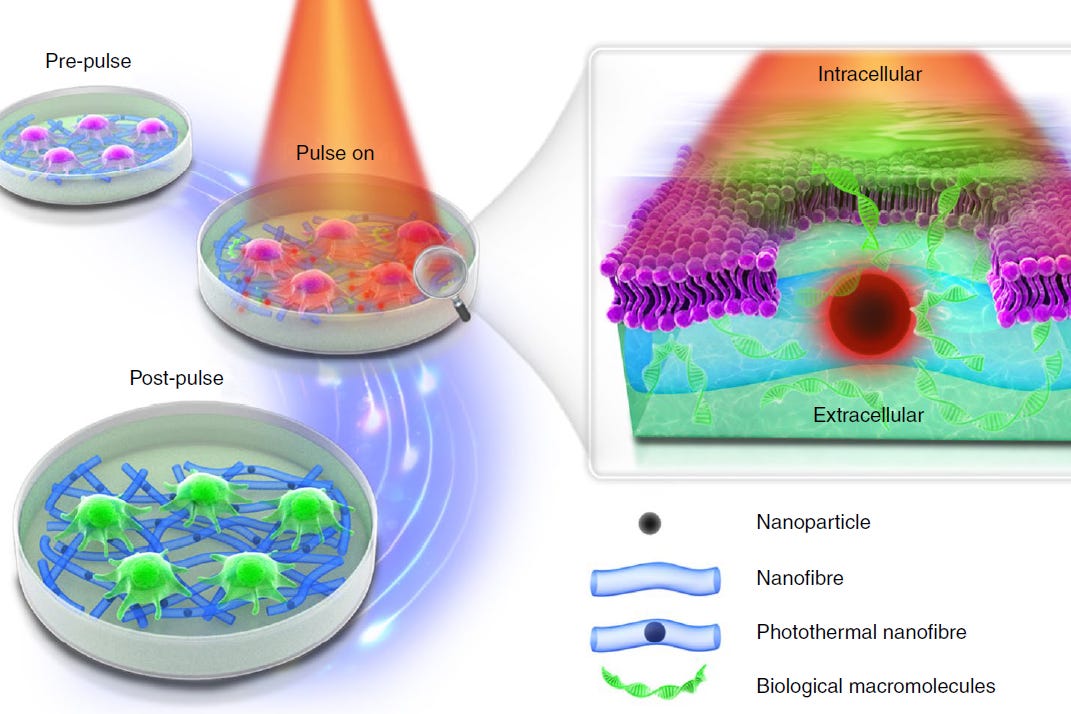

Trince: Laser Photoporation for Europe’s Biotech Sovereignty

Trince is a Belgian deep-tech spin-off that has emerged from Ghent University’s biophotonics research community. The company is pioneering a laser-based method for inserting genetic material into living cells, offering a gentler alternative to traditional gene delivery techniques. Its proprietary LumiPore technology uses ultrashort laser pulses and custom-designed nanoparticles to temporarily open pores in cell membranes, allowing DNA, RNA, or other therapeutic molecules to enter without harming the cells. This innovation addresses a crucial bottleneck in cell therapy manufacturing: how to genetically modify patient cells efficiently while preserving their viability and function. Founded in late 2021 in Ghent, Trince has quickly gained recognition in the biotech industry for its novel approach. In 2024 it won Nature’s Spinoff Prize, underscoring the broad potential of its platform. The company’s vision aligns with Europe’s drive for technological sovereignty in critical health and defense-related domains, positioning Trince as a promising contributor to European strategic autonomy in biotechnology.