Defence Finance Monitor Digest #38

Defence Finance Monitor is a specialised source of analysis for professionals who seek to anticipate how strategic priorities shape investment patterns in the defence sector. In a landscape shaped by high-stakes political choices and rapid technological shifts, understanding the link between military doctrine, operational requirements, and industrial policy is not a competitive edge—it is a prerequisite.

We analyse how strategic imperatives set by NATO, the European Union, allied Indo-Pacific democracies, and national Ministries of Defence translate into procurement programmes, innovation roadmaps, and long-term industrial priorities. Rather than listing individual companies, we track how clearly defined strategic challenges—such as deterrence gaps, technological dependencies, or capability shortfalls—are converted into funding schemes and institutional demand. Only companies that respond to these challenges become relevant to institutional buyers and, by extension, to investors. This framework has already enabled a growing community of analysts and financial professionals to make more consistent, risk-aware decisions and to avoid costly misalignments.

Building on this methodology, we are developing a structured database of companies analysed and classified according to the strategic-technological criteria set out in our framework. Subscribing to Defence Finance Monitor therefore provides not only access to in-depth reports, but also to a continuously expanding database of European and allied defence firms assessed against clear benchmarks. Each company is positioned according to its alignment with EU and NATO priority capability areas, its contribution to European strategic autonomy, its level of interoperability and deterrence value, and its role in reducing dependencies on non-allied suppliers. Classification also covers technology readiness levels, participation in EU and NATO programmes, intellectual property assets, and dual-use applications. This allows subscribers to compare, benchmark, and identify the most strategically relevant actors within a coherent, transparent, and decision-oriented taxonomy.

Subscribing to Defence Finance Monitor means gaining access to a strategic intelligence service that connects financial decisions with defence priorities. At the core of our work is a structured database of European and allied defence companies, classified according to strategic-technological criteria such as autonomy, interoperability, deterrence, and supply chain resilience. In today’s environment, profitable investment requires more than market data: it requires understanding how limited public resources are channelled toward specific capability gaps, sovereign technologies, and the reduction of non-allied dependencies. By combining in-depth reports with a continuously expanding company database, Defence Finance Monitor enables investors to anticipate demand, benchmark firms against institutional priorities, and avoid costly misalignments.

Structural Violence and Digital Dependencies

Dependencies on non-allied suppliers are no longer seen as commercial inconveniences; they are strategic vulnerabilities. In the digital age, reliance on Chinese rare earths, Taiwanese semiconductors, or non-European cloud services constitutes a form of structural violence that constrains autonomy and weakens deterrence. These vulnerabilities are not episodic but systemic, embedded in global supply chains that adversaries can exploit. The European Union and NATO have recognised this reality, making sovereignty and supply chain resilience central to capability planning. Public funding streams such as the European Defence Fund, Horizon Europe, and national sovereignty programmes now target critical dependencies directly. For investors, this creates a structural opportunity: firms capable of substituting non-allied suppliers in strategic technologies enjoy institutional demand and long-term protection. Sovereignty has become not only a political imperative but an investment thesis. Reducing dependencies is no longer optional — it is the price of credible autonomy.

The Privatisation of Strategy and Defence Innovation

The centre of gravity in defence innovation is shifting from public laboratories and prime contractors to a wider, privately led ecosystem embedded in digital capitalism. Computing, cloud, AI and data-extractive platforms have become the backbone of contemporary doctrines and operations, and these capabilities are overwhelmingly developed, owned and iterated by private firms. This does not merely alter procurement channels; it reconfigures how strategy is made. When deterrence and multi-domain integration depend on architectures of data collection, processing and distribution, the owners of those architectures shape the menu of what is operationally possible. The consequence is a progressive displacement of decision-making power from public institutions to the companies whose technologies mediate command, sensing and effects. This dynamic is most visible in cyber and data-centric warfare, where the private sector designs tools that states then adopt as doctrine enablers. For defence finance, it implies that capital formation in tech now intersects directly with strategic design, creating new dependencies and new levers of influence.

uCrowds (Netherlands) – Strategic Technological Analysis

In an era when European security planning extends beyond military hardware to include the movements of people, one Dutch start-up is bridging the gap between virtual simulations and real-world safety. uCrowds – a spin-off from Utrecht University – has emerged as a leader in real-time crowd simulation software, capable of populating digital models of cities with hundreds of thousands of virtual individuals. Originally developed to help manage civilian crowds at airports and public events, this technology is now finding dual-use relevance in defense. Picture NATO troops training for urban missions with realistic civilian bystanders, or EU civil protection authorities rehearsing mass evacuations in a “digital twin” of a city. uCrowds provides exactly these capabilities, offering Europe a home-grown solution to simulate complex human dynamics during crises. This innovative company sits at the intersection of academia, industry and security – an embodiment of how deep-tech research can enhance both European strategic autonomy and public safety without fanfare or hype. As we delve into uCrowds’ profile, it becomes clear how a niche technology for crowd behavior is contributing to broader goals like strengthened deterrence, multi-domain preparedness, and reduced dependence on non-European suppliers.

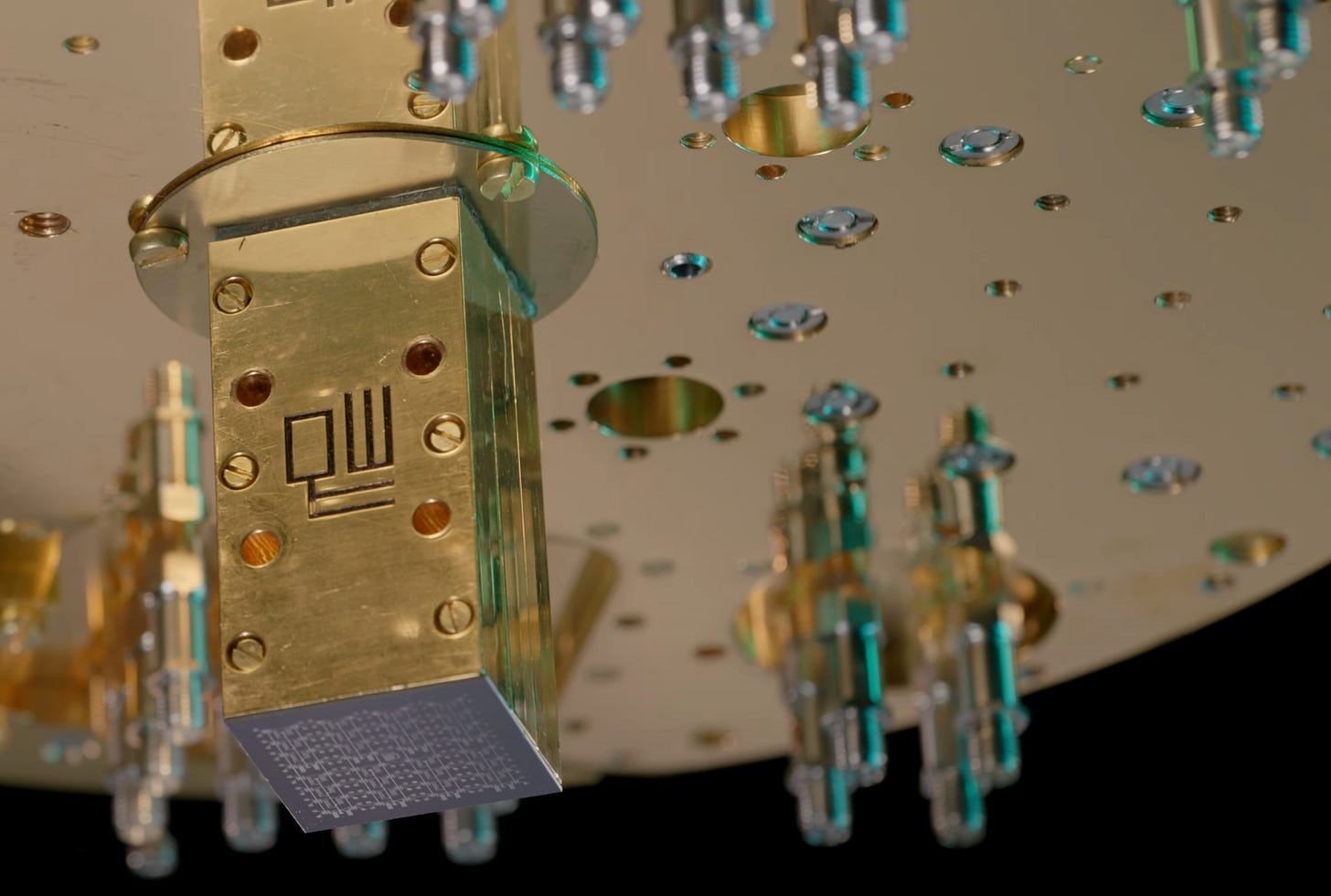

QuantWare: Europe’s Quantum Hardware Vanguard in Strategic Autonomy

QuantWare is a Dutch quantum technology venture pushing the frontiers of computing hardware and European technological sovereignty. Spun out of Delft University of Technology’s QuTech institute, this deep-tech company designs and fabricates superconducting quantum processors that could define the next era of computing[1]. QuantWare’s innovative 3D quantum chip architecture promises to scale quantum computers from the tens of qubits available today to the millions required for disruptive performance[2]. In doing so, the company aims to become the “Intel of quantum computing,” supplying processors at a fraction of competitors’ costs[3]. Such ambitions place QuantWare at the heart of Europe’s drive for strategic autonomy in critical technologies. By providing home-grown quantum hardware, QuantWare is helping Europe and its allies reduce reliance on external suppliers in a field often dominated by U.S. and Chinese players. The company’s processors already power quantum computers across 20 countries[4], including the first quantum systems in Spain and Israel[5]. This early traction, coupled with strong ties to Europe’s academic and innovation ecosystem, makes QuantWare an intriguing case of a startup at the nexus of cutting-edge technology and continental strategic interests.

Q*Bird – Strategic-Technological Analysis

Europe’s quest for unbreakable communications is spurring a new class of quantum technology innovators, and one of the most intriguing is QBird. Based in Delft in the Netherlands, QBird emerged from cutting-edge research at TU Delft’s QuTech institute and is pioneering Quantum Key Distribution (QKD) networks – essentially building an “untappable” internet[1]. The company’s hardware and software leverage the laws of quantum physics to secure data by distributing encryption keys as single photons. Any eavesdropping attempt is immediately apparent, a powerful assurance in an era when quantum computing threatens classical encryption. In 2023, QBird achieved a landmark by installing the world’s first multi-user QKD network in Europe’s largest port, Rotterdam[2]. This demonstration showed that multiple commercial entities could exchange quantum-secured data over standard fiber infrastructure, foreshadowing an ultra-secure European communications backbone. From critical infrastructure to government ministries, QBird’s technology promises European users the ability to communicate with immunity against even the most sophisticated future threats. As NATO and EU leaders emphasize technological edge and autonomy, Q*Bird stands at the intersection of innovation and strategy – a small academic spin-off with outsized implications for Europe’s defense and digital sovereignty.

QHarbor – A Quantum Data Platform Fueling European Strategic Autonomy

In an era when quantum laboratories produce more data in a week than they once did in a year, the way researchers handle that information can be as crucial as the experiments themselves. QHarbor, a young spin-off emerging from Delft’s QuTech institute, has positioned itself as Europe’s homegrown solution to this challenge. This deep-tech startup provides a secure digital harbor for experimental physics data, ensuring that the breakthroughs born in European quantum labs remain under European control. Founded in the mid-2020s by a team of physicists-turned-entrepreneurs, QHarbor set out to eliminate the chaos of ad-hoc data storage that plagues cutting-edge labs. Instead of scattering invaluable quantum test results across local disks and spreadsheets, scientists can now entrust them to a structured, encrypted repository tailored for high-throughput experiments. The promise is compelling: faster insights, easier collaboration, and uncompromised sovereignty over sensitive research. QHarbor’s story – from an internal tool crafted at TU Delft to a venture-backed platform poised to serve labs across NATO and EU nations – hints at its strategic significance. Quietly but decisively, it addresses a niche that sits at the intersection of Europe’s quantum ambitions and its quest for technological autonomy, making it a company to watch for those mapping Europe’s defense-tech ecosystem.