Defence Finance Monitor Digest #37

Defence Finance Monitor is a specialised source of analysis for professionals who seek to anticipate how strategic priorities shape investment patterns in the defence sector. In a landscape shaped by high-stakes political choices and rapid technological shifts, understanding the link between military doctrine, operational requirements, and industrial policy is not a competitive edge—it is a prerequisite.

We analyse how strategic imperatives set by NATO, the European Union, allied Indo-Pacific democracies, and national Ministries of Defence translate into procurement programmes, innovation roadmaps, and long-term industrial priorities. Rather than listing individual companies, we track how clearly defined strategic challenges—such as deterrence gaps, technological dependencies, or capability shortfalls—are converted into funding schemes and institutional demand. Only companies that respond to these challenges become relevant to institutional buyers and, by extension, to investors. This framework has already enabled a growing community of analysts and financial professionals to make more consistent, risk-aware decisions and to avoid costly misalignments.

Building on this methodology, we are developing a structured database of companies analysed and classified according to the strategic-technological criteria set out in our framework. Subscribing to Defence Finance Monitor therefore provides not only access to in-depth reports, but also to a continuously expanding database of European and allied defence firms assessed against clear benchmarks. Each company is positioned according to its alignment with EU and NATO priority capability areas, its contribution to European strategic autonomy, its level of interoperability and deterrence value, and its role in reducing dependencies on non-allied suppliers. Classification also covers technology readiness levels, participation in EU and NATO programmes, intellectual property assets, and dual-use applications. This allows subscribers to compare, benchmark, and identify the most strategically relevant actors within a coherent, transparent, and decision-oriented taxonomy.

Subscribing to Defence Finance Monitor means gaining access to a strategic intelligence service that connects financial decisions with defence priorities. At the core of our work is a structured database of European and allied defence companies, classified according to strategic-technological criteria such as autonomy, interoperability, deterrence, and supply chain resilience. In today’s environment, profitable investment requires more than market data: it requires understanding how limited public resources are channelled toward specific capability gaps, sovereign technologies, and the reduction of non-allied dependencies. By combining in-depth reports with a continuously expanding company database, Defence Finance Monitor enables investors to anticipate demand, benchmark firms against institutional priorities, and avoid costly misalignments.

Future of War & Emerging Defence Technologies

Lethal Autonomous Weapons and the Political Economy of Automated Warfare

Autonomous weapons are no longer confined to science fiction — they are entering procurement pipelines and reshaping the defence industry. These systems, often described as “killer robots,” are designed to identify and strike targets without direct human control, raising unprecedented ethical, legal, and strategic dilemmas. Beyond the moral debate, however, lies a new political economy of warfare, where artificial intelligence, robotics, and data-driven targeting create markets with enormous growth potential. Governments see these technologies as tools to reduce casualties and increase battlefield efficiency, while contractors regard them as profitable commodities in a fast-expanding sector. For institutional investors, this creates a dual reality: high-value opportunities intertwined with reputational and regulatory risks. The arrival of lethal autonomous weapons signals not only a technological revolution but also a financial one, where automation becomes the driver of both strategic power and capital accumulation. Automated warfare is not the future — it is the emerging reality of twenty-first-century defence finance.

Data as the Central Strategic Asset in Modern Warfare

In contemporary warfare, the decisive resource is increasingly not the weapon system itself, but the information that enables its use. The effectiveness of any military operation depends on the ability to collect, process, and distribute data at a scale and speed that outpaces the adversary. This transformation means that raw firepower or numerical strength can no longer guarantee victory unless accompanied by informational superiority. The digitalization of command-and-control systems, the proliferation of sensors across domains, and the emergence of real-time communications networks have made data the foundation of military effectiveness. It determines how quickly threats are detected, how accurately targets are identified, and how efficiently forces are coordinated. Data is not only an enabler but has become a decisive weapon in its own right, shaping the tempo, precision, and resilience of armed forces in both conventional and hybrid conflicts.

Company Profiles & Industrial Intelligence

Oddity.ai: AI Surveillance for Real-Time Violence Detection

In an era where European security is increasingly augmented by artificial intelligence, Oddity.ai has emerged as a noteworthy innovator. Founded in the Netherlands in 2018, this deep-tech startup has pioneered an AI-driven software that can automatically recognize violent acts and threats in real time on surveillance video[1][2]. The company’s technology continuously scans live CCTV feeds and alerts security personnel within half a second of detecting fights, attacks, or perimeter intrusions[3]. By focusing on behavioral analysis instead of biometric identification, Oddity.ai offers a privacy-conscious solution that operates entirely on-premises, ensuring that sensitive video data never leaves European control[4]. This approach has already gained the trust of Dutch law enforcement agencies and even prison authorities, who have used Oddity’s AI to catch incidents that human operators might miss[2]. As Europe strives for strategic autonomy in critical technologies, Oddity.ai presents a compelling case: a home-grown AI system enhancing public safety and reducing reliance on foreign surveillance solutions. The following analysis delves into how this Utrecht-based spin-off from academia is contributing to European defense-tech sovereignty and what gaps remain on its path to broader EU and NATO integration.

Garvis: A Bionic Forecasting Pioneer Driving European Supply Chain Sovereignty

Europe’s recent crises – from pandemic disruptions to the Suez Canal blockage – have exposed the vulnerability of global supply chains[1]. In response, a new wave of innovation is reimagining how we plan and protect the flow of critical goods. Enter Garvis: an Antwerp-based spin-off that has built a “bionic” forecasting platform merging transparent AI with human insight[2]. Born in the heart of Europe’s tech ecosystem, Garvis harnesses artificial intelligence to help organizations anticipate demand shocks and logistic bottlenecks in real time. The company’s SaaS solution empowers planners to incorporate their domain expertise alongside AI predictions, yielding faster, smarter decisions while keeping humans in control[3]. Garvis’s cutting-edge approach – even integrating generative AI for natural language queries[4][5] – promises to turn supply chain forecasting from a backward-looking chore into a forward-looking strategic asset. For European industry and defense planners alike, this breakthrough offers a glimpse of supply chain autonomy: a homegrown technology that could strengthen Europe’s resilience against external shocks and reduce reliance on foreign forecasting tools. The following analysis explores how Garvis, a young European innovator, is aligning with EU strategic autonomy goals and transforming supply chain planning into a source of strategic advantage.

Neurastech: European AI Decision-Support for Strategic Autonomy

Neurastech is a young Italian defense technology venture quietly positioning itself at the forefront of artificial intelligence innovation. A recent academic spin-off from the University of Trento, the company has no flashy website or public fanfare – yet it tackles one of the most pressing challenges in modern security: making sound decisions amid uncertainty. Neurastech builds AI systems designed to support human decision-makers in chaotic, high-risk environments where information is incomplete and situations evolve rapidly. This low-profile approach belies the strategic significance of its work. European defense circles have begun to take note of how homegrown AI solutions like Neurastech’s could strengthen Europe’s technological sovereignty. By developing advanced decision-support AI entirely within Europe, Neurastech exemplifies the kind of innovation that could reduce reliance on foreign (often US or Chinese) systems and enhance NATO’s operational readiness. The following analysis explores how this small spin-off might become an outsized asset for European strategic autonomy and defense capabilities.

DeepForm: Strategic-Technological Analysis

DeepForm is a University of Cambridge spin-off that promises to reinvent how metal components are manufactured, with implications stretching from the automotive sector to the defense industry. At its core is a new approach to sheet metal forming that dramatically cuts waste and energy use. In an era when Europe is striving for both strategic autonomy and a greener industrial base, DeepForm offers a technology that aligns with both aims. Its patented process can reduce the trimming scrap in car body panels by up to 80%, slashing both material costs and carbon emissions[1]. Born from a decade of research in Cambridge’s engineering labs, DeepForm is now transitioning from academic concept to industrial reality. European automakers have already taken notice of its potential to save thousands of tonnes of metal per year[2]. The real question is whether this resource-efficient innovation can also bolster Europe’s strategic independence in critical manufacturing, making DeepForm not just a cleantech curiosity but a strategic asset for the continent.

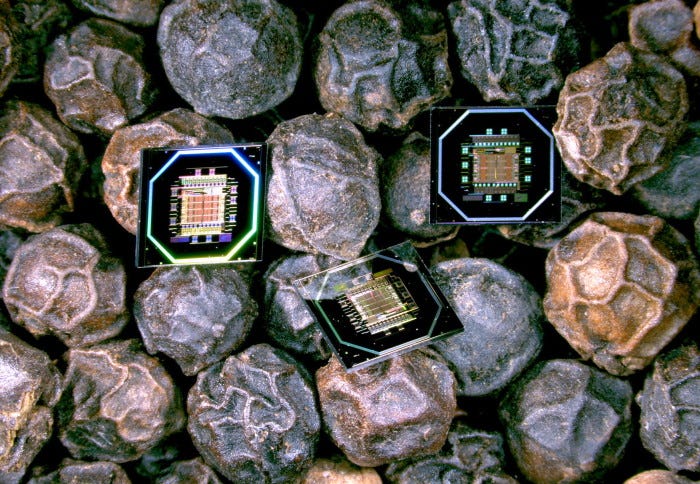

MintNeuro: European Neural Microchips for Strategic Autonomy

Neural implants are on the verge of a revolution—and a small European deep-tech company is quietly at the forefront. MintNeuro, a spin-off from Imperial College London, is designing bespoke semiconductor chips “smaller than a grain of rice” to radically miniaturize brain implants[1]. Today’s neural devices can treat conditions like Parkinson’s or epilepsy, but they remain bulky, power-hungry and expensive, often requiring invasive surgery[2]. MintNeuro’s founders saw an opportunity to upend this status quo by rethinking the electronics inside these implants. By combining Europe’s strengths in microelectronics and neuroengineering, the company has created ultra‐low-power ASIC chips purpose-built for the brain, aiming to make advanced neurotechnology more accessible[3][4]. This bold intersection of semiconductors and biotech has implications beyond medicine. In an era when Europe seeks strategic autonomy in critical technologies, MintNeuro’s innovation hints at dual-use potential—from enhancing soldier resilience to reducing dependency on foreign microchips. The following analysis delves into how this young company’s “brain-on-a-chip” platform could strengthen Europe’s technological sovereignty and defense capabilities, all while transforming patient care.