Defence Finance Monitor Digest #32

Defence Finance Monitor is a specialised source of analysis for professionals who seek to anticipate how strategic priorities shape investment patterns in the defence sector. In a landscape shaped by high-stakes political choices and rapid technological shifts, understanding the link between military doctrine, operational requirements, and industrial policy is not a competitive edge—it is a prerequisite.

We analyse how strategic imperatives set by NATO, the European Union, allied Indo-Pacific democracies, and national Ministries of Defence translate into procurement programmes, innovation roadmaps, and long-term industrial priorities. Rather than listing individual companies, we track how clearly defined strategic challenges—such as deterrence gaps, technological dependencies, or capability shortfalls—are converted into funding schemes and institutional demand. Only companies that respond to these challenges become relevant to institutional buyers and, by extension, to investors. This framework has already enabled a growing community of analysts and financial professionals to make more consistent, risk-aware decisions and to avoid costly misalignments.

Subscribing to Defence Finance Monitor means gaining access to a strategic intelligence service designed to support financial decisions in the defence sector. Our work is based on a clear method and principle: In today’s environment, there is no profitable investment without strategic understanding. Resources are limited. Knowing where public money is going—and why—makes the difference between reacting to the market and making informed decisions ahead of time.

Germany’s Typhon Acquisition: Strategic Depth and Transatlantic Dependence

The Bundeswehr's decision to pursue the acquisition of the American Typhon missile system marks a shift in Berlin’s strategic calculus. It signals a reorientation of German defence posture toward a deeper strike capability independent of manned platforms. Unlike short-term procurement programs aimed at plugging equipment gaps, this initiative reflects a broader understanding of deterrence under 21st-century conditions. It also reveals Germany’s current limitations in developing indigenous solutions for long-range precision strike. As geopolitical tensions intensify on NATO’s eastern flank, the German Ministry of Defence appears to be embracing systems that can deny adversaries sanctuary within their own territory, without exposing aircrews to growing threats from integrated air defences. This evolving approach to defence procurement is not merely about filling operational gaps, but about rethinking conventional deterrence in a contested environment.

Germany’s Procurement Reform: Fast-Tracking the Bundeswehr’s Readiness

In the shifting security landscape of Europe, the challenge of time has become paramount for defence policy. For Germany, the perceived mismatch between strategic threats and procurement capabilities has emerged as a central issue. In response, the federal cabinet has initiated a legislative reform to accelerate the acquisition of military equipment for the Bundeswehr. The initiative is framed not as an isolated bureaucratic adjustment but as a structural overhaul of procurement norms, aiming to align administrative speed with operational urgency. The key objective is to overcome institutional inertia and enhance the reactivity of the German military. This change is motivated by two factors: the expanding threat from Russia and the Bundeswehr’s stated goal of being “kriegstüchtig” (war-ready) by 2029. In this context, the traditional slow pace of German defence acquisition is now seen as a national vulnerability.

Avio (Italy) – Propelling European Strategic Autonomy in Space and Defense

Avio S.p.A. is a century-old Italian aerospace company that has quietly become a linchpin of Europe’s quest for technological sovereignty. Headquartered in Colleferro near Rome, Avio builds the propulsion systems that launch European satellites and power advanced missiles. From the Vega rocket—an ESA-backed launcher giving the EU independent access to orbit—to the two-stage Aster 30 interceptor defending European skies, Avio’s innovations underpin critical defense and space capabilities. In an era of renewed great-power competition and fragile supply chains, Avio has positioned itself at the forefront of Europe’s drive for strategic autonomy. The company’s solid-fuel rockets, composite materials expertise, and multinational partnerships address EU and NATO priorities: enhancing deterrence, ensuring interoperability, and reducing reliance on non-allied suppliers. The following analysis explores how Avio’s technology portfolio and strategic engagements strengthen Europe’s defense posture and industrial sovereignty, illustrating why this Italian firm has become a strategic asset for both the European Union and the transatlantic alliance.

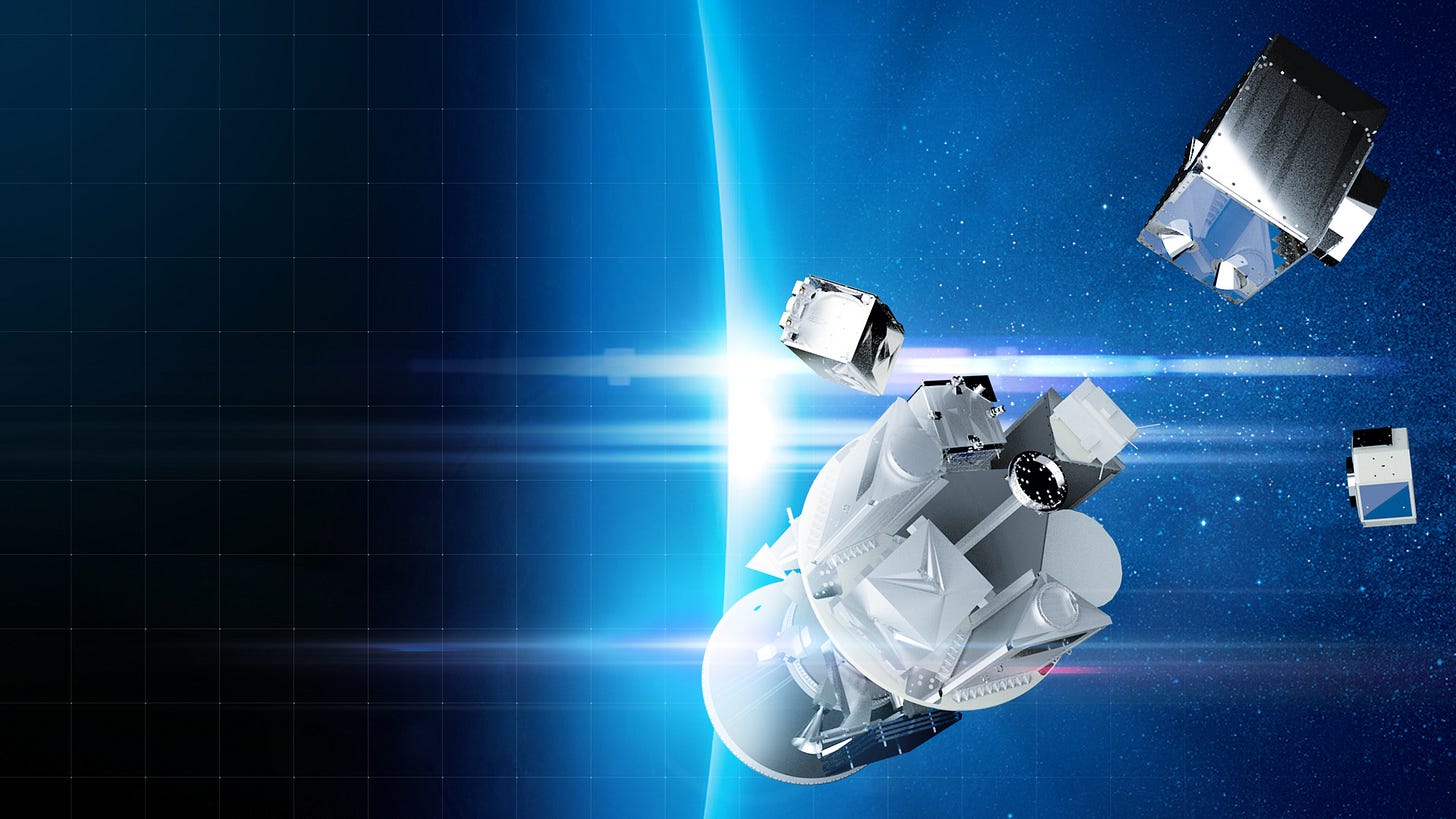

Telespazio: Strategic-Technological Analysis

Telespazio has quietly become a linchpin of Europe’s space and defense ecosystem. Founded in 1961 at the dawn of satellite communications, this Italian-French joint venture grew from pioneering satellite experiments into a global leader bridging civilian and military space domains. From its headquarters in Rome, Telespazio now operates across 15 countries, delivering everything from orbital launch support to secure communications and earth observation services. The company’s heritage of innovation spans decades – from early live satellite TV broadcasts in Europe to today’s cutting-edge projects like lunar navigation networks and AI-automated mission control. As Europe pursues strategic autonomy in critical technologies, Telespazio stands at the forefront, leveraging European know-how to reduce reliance on foreign providers. Its role in flagship programs such as Galileo, Copernicus, and secure military satcom positions it as a key enabler of Europe’s independent space capabilities. The following analysis explores how Telespazio’s technology portfolio and strategic initiatives bolster European deterrence, NATO interoperability, and supply chain sovereignty in an era of renewed great-power competition.

Hexagon AB: Strategic-Technological Analysis

Hexagon AB is a Swedish industrial technology champion quietly underpinning Europe’s defense and dual-use capabilities. Headquartered in Stockholm, this publicly traded innovator has evolved from precision measurement origins into a global provider of sensors, software, and autonomous solutions. Within European security circles, Hexagon’s name is not as loud as a fighter jet manufacturer’s, yet its technology resonates across battlefields and industries alike. From digital geospatial intelligence that maps conflict zones in real time to advanced manufacturing systems shaping next-generation aircraft, Hexagon delivers the behind-the-scenes tools that strengthen Europe’s strategic autonomy. Its technologies – often born in civilian markets – are now indispensable for military situational awareness, resilient navigation, and industrial self-reliance. This introduction explores how Hexagon AB’s unique blend of innovation and European rootedness intrigues defense planners and technology enthusiasts. It invites readers to discover a firm at the nexus of Europe’s digital transformation and defense modernization, and to learn why Hexagon’s story is vital to understanding Europe’s future in security and technology.