Defence Finance Monitor Digest #16

Defence Finance Monitor analyses how strategic imperatives defined at the national and supranational level—by EU institutions, NATO, and national Ministries of Defence—shape defence policy, technology priorities, and industrial development. Rather than identifying individual companies, we examine how recognised strategic problems—such as deterrence shortfalls, technological dependencies, or capability gaps—are translated into public funding programmes, procurement frameworks, and defence innovation roadmaps. Our premise is simple: a company becomes relevant to investors only if it is relevant to institutional buyers. And it becomes relevant to those buyers only if it contributes—directly or indirectly—to solving a clearly defined strategic challenge. We trace this logic from political doctrine to operational requirements and industrial structures, highlighting the strategic, technological, and organisational dimensions that may signal long-term alignment with institutional demand. This enables more coherent and risk-aware capital allocation in a sector where investment decisions are inseparable from public strategy.

Strategic Coherence and Full-Spectrum Capability

A foundational premise of strategic theory holds that while the instruments of war evolve, the underlying logic of conflict persists. The capacity to project force, to control territory, and to impose one’s will through coercion remains central to the functioning of political power—even in a context increasingly shaped by digital infrastructures, autonomous systems, and space-based platforms. Within this evolving technological landscape, the mere addition of new domains—such as cyber or space—cannot compensate for the erosion or neglect of conventional capabilities. Strategic relevance requires an integrated, full-spectrum posture.

Analysis of the 2024 European Defence Industrial Strategy

The 2024 European Defence Industrial Strategy (EDIS) marks a turning point in the EU’s response to high-intensity warfare and strategic dependence. It sets ambitious targets for onshoring defence production, scaling joint procurement, and integrating Ukraine into the European defence industrial base. Through the launch of the European Defence Industry Programme (EDIP), Brussels is creating new instruments—loans, equity schemes, and strategic co-investment platforms—to accelerate supply chain resilience and dual-use innovation. Critical technologies including semiconductors, AI, secure connectivity, space, and advanced drones are now explicitly prioritised. With €1.5 billion of EU budget funding already allocated, a €500 million Defence Equity Facility launched, and future Euro-defence bonds under discussion, EDIS opens concrete opportunities for investors aligned with European sovereignty goals. Firms positioned within EU collaborative projects or compliant with NATO standards are best placed to benefit. This in-depth analysis offers strategic insight for capital allocators looking to navigate ESG constraints, export controls, and regulatory shifts. Full report available to subscribers.

Competition between U.S. Patriot and European SAMP/T NG in light of the EU Defence Industrial Strategy

As Europe redefines its air and missile defence priorities, the competition between the U.S.-made Patriot and the European SAMP/T NG systems reveals a fundamental shift in strategic and industrial policy. The EU’s 2024 Defence Industrial Strategy marks a turning point, promoting domestic procurement, reducing reliance on U.S. systems, and advancing long-term autonomy in key capabilities. This shift is reinforced by multibillion-euro national commitments in France and Italy, and emerging industrial alliances across Europe. For investors, this signals actionable opportunities: the European Defence Fund and Defence Equity Facility are now major instruments to catalyze private capital toward missile defence, advanced sensors, and dual-use technologies. The SAMP/T NG program, with new export traction and supply chain reconfiguration, offers visibility into a scalable, sovereign alternative to Patriot. As ESG constraints evolve and procurement policies favour EU-origin systems, investors equipped with regulatory insight and sectoral alignment stand to benefit from this restructuring of Europe’s defence ecosystem. Full analysis available to subscribers.

Systemic and Industrial Deficiencies in the European Armoured Vehicle Sector

This analysis examines the structural deficiencies undermining Europe's ability to scale and modernise its armoured vehicle sector, at a time when geopolitical pressures and battlefield lessons from Ukraine demand urgent rearmament. Despite the growing demand for tanks and armoured fighting vehicles (AFVs), Europe faces significant barriers: a fragmented industrial landscape with redundant platforms and non-standardised systems; critical dependence on non-EU suppliers for engines, sensors, and protection systems; and limited surge manufacturing capacity due to underinvestment and regulatory constraints. The current EU funding mechanisms (EDF, EDIRPA, ASAP) remain insufficiently coordinated and too slow to deliver the necessary industrial transformation.

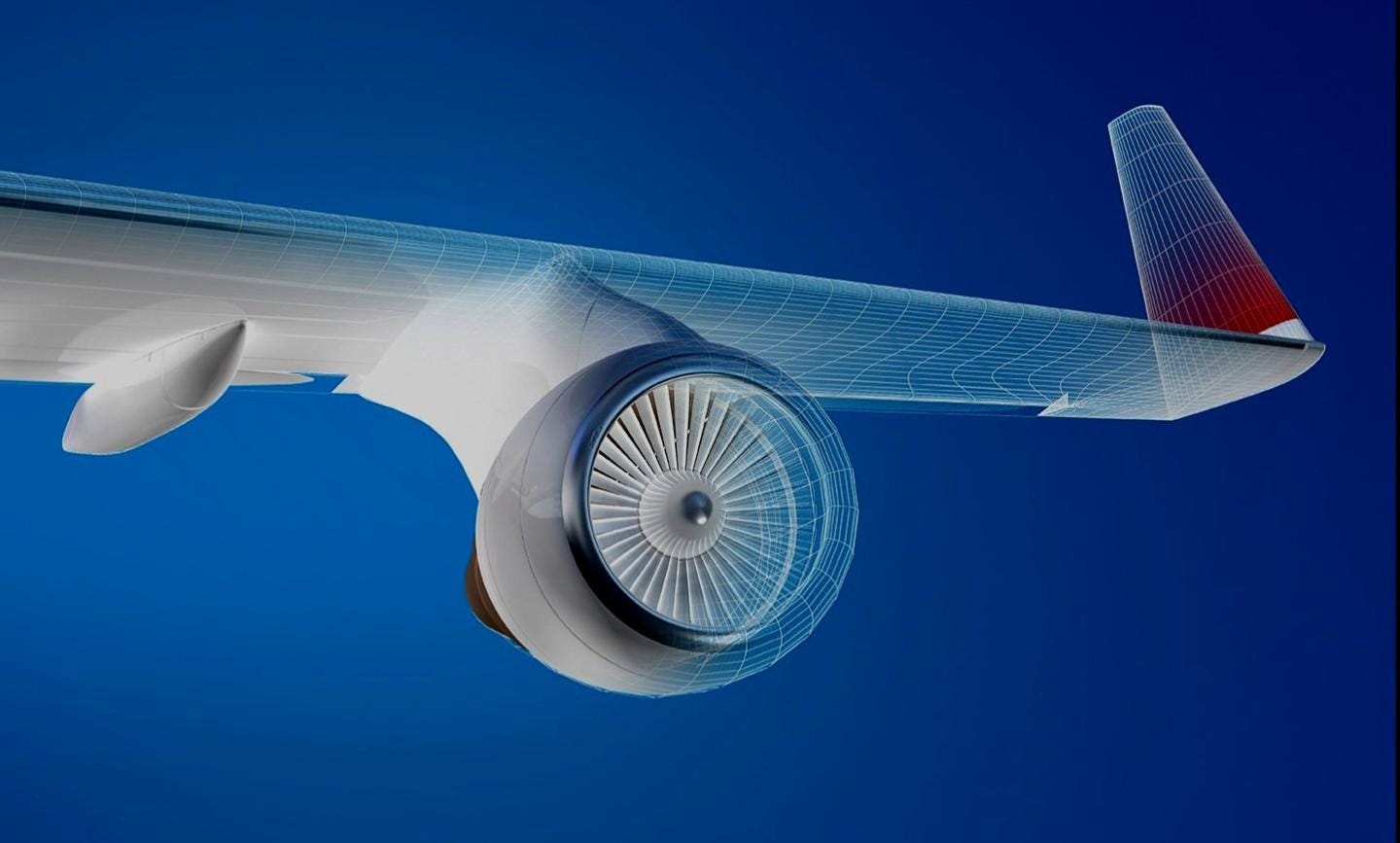

Electric and Hybrid Propulsion for Military Aircraft: European Context and Trends

This report offers an in-depth strategic analysis of electric and hybrid propulsion technologies for aerial and light military platforms, a sector that is rapidly becoming central to Europe’s defense and dual-use innovation agenda. As European institutions link climate resilience, technological sovereignty and military readiness, electrified aviation stands out for its ability to deliver operational advantages—such as reduced acoustic and thermal signatures, enhanced stealth, and simplified maintenance—while also advancing sustainability mandates. The report presents a clear and detailed view of the technological landscape, covering the most promising propulsion architectures, energy systems, and demonstrator platforms currently under development across Europe. It outlines how public R&D programs, from the EDF to national innovation funds, are de-risking early-stage ventures and accelerating the transition from civilian advanced air mobility to deployable military assets.