Defence Finance Monitor Digest #14

Defence Finance Monitor is a specialised analysis and intelligence platform focused on the nexus between European defence policy, strategic industries, and public investment. Each issue provides in-depth, carefully considered assessments designed to offer maximum strategic insight to subscribers.

Far from superficial or rapid commentary, DFM delivers structured and rigorous analysis based on primary sources, official documents, and sectoral data. The aim is to support professionals—investors, policymakers, industry leaders, and analysts—with the depth and clarity needed to understand how defence funding and procurement decisions are reshaping markets, capabilities, and geopolitical balances in Europe and beyond.

Israel, Iran, and the Limits of Liberal Deterrence

The ongoing confrontation between liberal democracies and authoritarian regimes has become the main axis along which the international order is being redefined. This is not an abstract ideological clash, but a concrete struggle between political systems, economic models, and opposing worldviews, where the stakes involve the ability of states to autonomously determine their political choices, ensure institutional security, and safeguard civil liberties.

Rising Lion and the Endgame in Tehran

The name Rising Lion chosen for Israel’s military operation is not a rhetorical flourish—it articulates a strategic vision that reaches far beyond the immediate goal of neutralizing Iran’s nuclear program. In Iranian political tradition, the rising lion symbolizes sovereignty, renewal, and secular nationhood. It is closely associated with the Pahlavi monarchy and with a vision of Iran integrated into the international order rather than opposed to it. By reviving this image, the operation signals an aspiration not only to degrade military assets but to challenge the very ideological and historical foundations of the Islamic Republic. The lion rising is not Israel asserting itself; it is Iran being imagined differently.

QinetiQ Group plc: Strategic Role in Defence Technology and Alliances

QinetiQ Group plc is a leading British defence and security technology company, originally formed in 2001 from the UK Ministry of Defence’s Defence Evaluation and Research Agency (DERA). As part of that reorganization, QinetiQ inherited the bulk of DERA’s non-nuclear research, test, and evaluation establishments – a foundation that established QinetiQ as a core industrial partner to the UK military. It became a public-private entity in 2002 and was floated on the London Stock Exchange in 2006. Today QinetiQ is an integrated global defence and security company with a workforce of over 8,500 scientists, engineers, and personnel worldwide. The company emphasizes “mission-led innovation,” focusing its expertise and unique facilities on solving defense and aerospace challenges for government and allied customers. QinetiQ’s CEO, Steve Wadey, describes the firm as operating “at the forefront of defence technology” and stresses its long-term partnerships with government, industry, and international allies to maintain a military advantage for the UK and its partners.

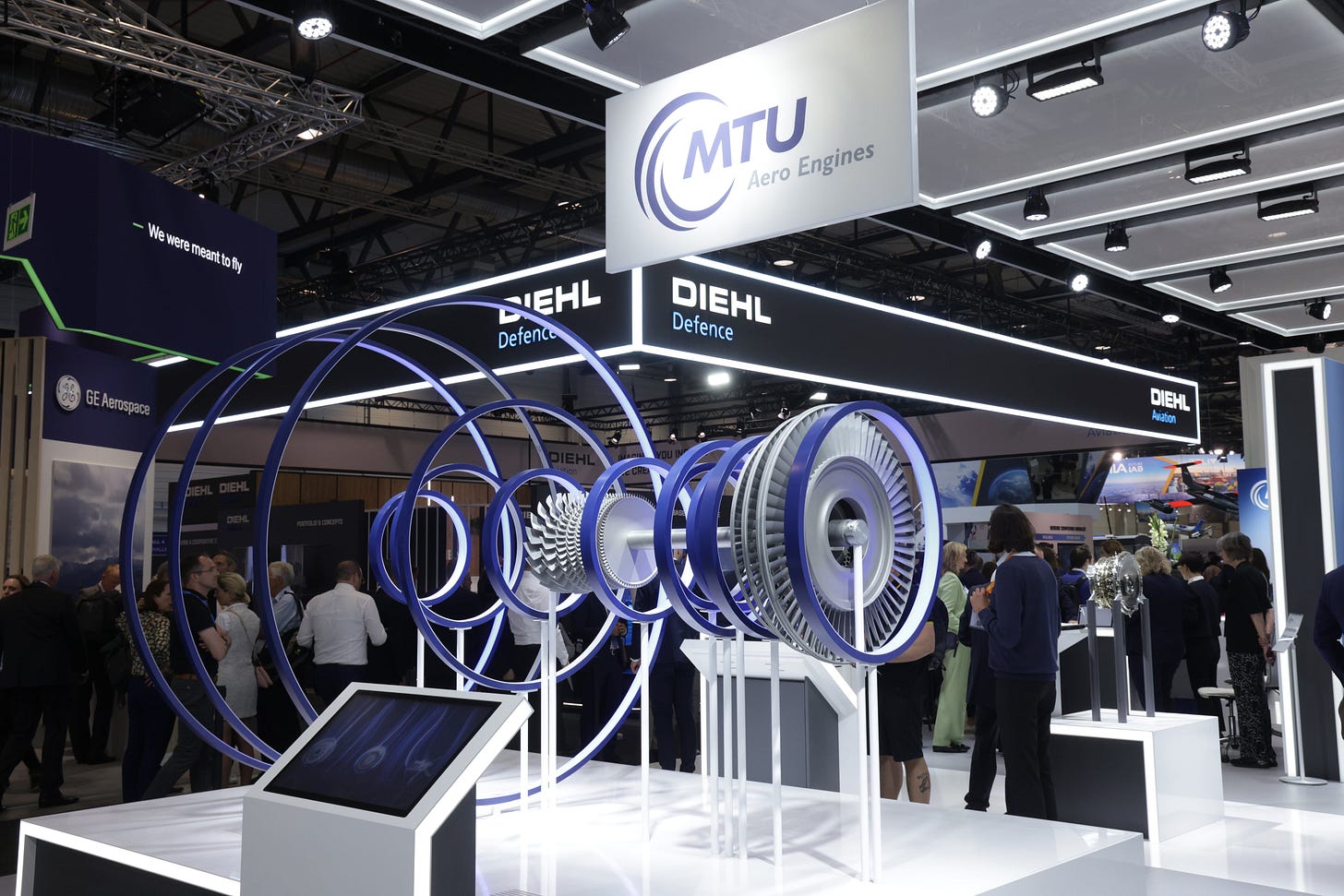

MTU Aero Engines: Industrial Profile and Strategic Role in Aerospace Propulsion

MTU Aero Engines AG is Germany’s leading aircraft engine manufacturer and one of the few independent engine specialists in the world. The company employs over 13,000 people and operates at 19 locations worldwide, with facilities spanning Europe, North America, South America, Asia, and Australia. In Germany, MTU’s primary engineering and production center is in Munich (also the corporate headquarters), complemented by major maintenance sites in Hannover (Langenhagen) and Berlin-Brandenburg (Ludwigsfelde). MTU’s international footprint includes manufacturing and service subsidiaries or joint ventures in Poland (MTU Aero Engines Polska in Rzeszów), China (MTU Maintenance Zhuhai), the United States (MTU Aero Engines North America in Connecticut, and a Dallas, TX, maintenance facility), Canada (Vancouver area), and elsewhere. This global network enables MTU to develop, produce, and support aircraft engines across all thrust classes, as well as industrial gas turbines, in all key markets.

Thales and the Cyber-Defence Nexus: Strategic Investments in Dual-Sector Capabilities

European and transatlantic policy now prioritizes cyber defence and dual-use technologies as core elements of security strategy. The EU’s 2022 Strategic Compass commits to an “EU Cyber Defence Policy” and to integrating cyber resilience across all domains. Likewise, the 2022 NATO Strategic Concept and recent Summit declarations emphasize cyberspace as a new operational domain. Leading actors include EU institutions (e.g. the Commission’s DG DEFIS, European Defence Agency, European Defence Fund and InvestEU) and NATO bodies (Allied Command Transformation, the NATO Communications and Information Agency (NCIA), and the NATO Cooperative Cyber Defence Centre of Excellence). National governments (notably France, Germany, the UK, etc.) have updated their defence white papers to stress cyber readiness and civil–military cooperation in cyber. For example, France’s cyber strategy and Germany’s “Bundeswehr Cloud” plans underscore investment in secure networks.

EU–Japan Defence Dialogue and Prospects

The EU and Japan have significantly elevated their strategic partnership in defence. In November 2024 the two sides formalized a Security and Defence Partnership for joint action across all defence domains. This framework – agreed at a summit and subsequent strategic dialogue – establishes an annual foreign-minister-level security dialogue and multiple thematic working groups (cyber, space, maritime security, WPS, disinformation, etc.). It explicitly ties into broader policy guidelines: the EU’s 2022 Strategic Compass calls for “tailored bilateral partnerships” with like-minded countries including Japan, and Japan’s National Security Strategy likewise emphasizes international cooperation. The partnership reaffirmed shared goals (e.g. upholding a rules-based order, strong maritime security, interoperability). Institutional actors on the EU side include the Commission, EEAS, EDA and defence procurement bodies; on the Japanese side, the Ministries of Defence and Foreign Affairs (along with industry delegations). NATO also remains relevant, as Japan is a close NATO partner and many cooperative activities are complementary to NATO–Japan initiatives. This enhanced EU–Japan defence dialogue thus has implications for European defence governance: it encourages the EU to integrate Indo-Pacific considerations into its policies (for example by aligning EDF projects or CSDP missions with joint EU–Japan objectives) and to coordinate with NATO processes for global stability.