Defence Finance Monitor Digest #10

Defence Finance Monitor is a specialised analysis and intelligence platform focused on the nexus between European defence policy, strategic industries, and public investment. Each issue provides in-depth, carefully considered assessments designed to offer maximum strategic insight to subscribers.

Far from superficial or rapid commentary, DFM delivers structured and rigorous analysis based on primary sources, official documents, and sectoral data. The aim is to support professionals—investors, policymakers, industry leaders, and analysts—with the depth and clarity needed to understand how defence funding and procurement decisions are reshaping markets, capabilities, and geopolitical balances in Europe and beyond.

Defence M&A and Geopolitical Risk: A Strategic Finance Perspective

Europe’s defence architecture is undergoing a strategic realignment. In response to geopolitical threats, both NATO and the EU have launched major initiatives to reinforce readiness, industrial capacity, and financial coordination. The EU’s White Paper on European Defence and the ReArm Europe plan mark a turning point, aiming to transform the continent’s fragmented defence market into an integrated, resilient system. Tools like EDIRPA, ASAP, and the proposed SAFE facility are designed to co-finance joint procurement, expand production, and attract private capital. Meanwhile, the defence industry is consolidating across borders, with major players scaling up and forming new partnerships. ESG investment criteria are also shifting, as policymakers and asset managers reconsider the role of defence in sustainable finance. In this analysis, we explore the implications of these developments for industry, finance, and European strategic autonomy.

Baltic Air Policing 3.0: Industry and Readiness Impacts of NATO’s New Eastern Posture

NATO’s evolving posture on its eastern flank signals a structural shift in European security. What began as a reactive reinforcement after 2022 is now consolidating into a permanent model of deterrence by denial. Forward-deployed brigades, integrated air and missile defences, and enhanced Baltic Air Policing are reshaping the Alliance’s readiness architecture. At the same time, European institutions are stepping up: the EU’s SAFE instrument and joint procurement initiatives reflect a new financial and industrial strategy aimed at sustaining high-readiness forces. Defence manufacturers are expanding production and integrating new technologies, while ESG investors begin to reconsider their stance on security-related assets. For analysts, policymakers, and financial actors, these developments raise critical questions. Will the current momentum hold? Are Europe’s regulatory and industrial frameworks prepared for long-term strategic competition? In this issue, we explore NATO’s new eastern posture, its industrial implications, and the evolving role of finance in defence preparedness.

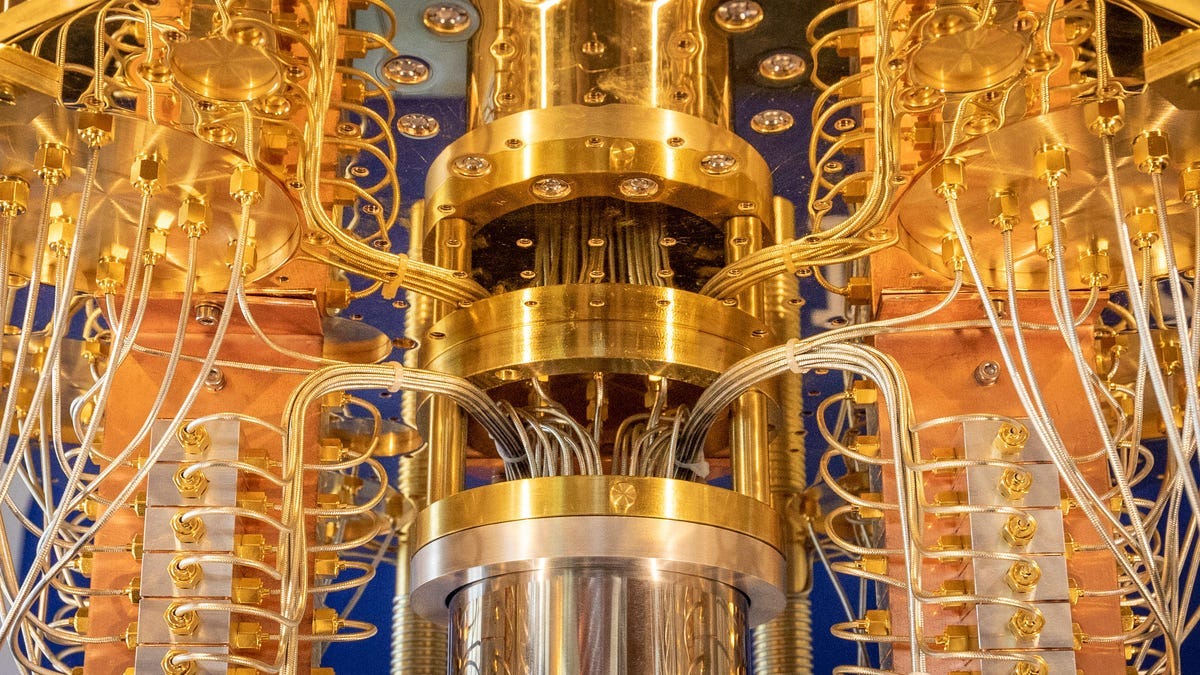

AI, Quantum, and EW: Mapping the New Technological Core of the Defence Economy

Across Europe and the transatlantic alliance, artificial intelligence (AI), quantum technologies, and electronic warfare (EW) have become central to defence strategies. NATO Allies have explicitly prioritized these technologies – alongside fields like autonomy, biotechnology, and space – for their transformative impact on security and warfare. NATO’s first Artificial Intelligence Strategy (initially adopted in 2021 and revised in 2024) seeks to accelerate the safe and responsible use of AI within the Alliance. It emphasizes combining AI with other disruptive technologies and improving interoperability of AI systems across NATO forces. Similarly, in January 2024 NATO released its first Quantum Technologies Strategy to ensure the Alliance becomes “quantum-ready”. This strategy outlines defence applications of quantum innovation – from quantum-enhanced sensing and imaging to ultra-precise navigation, submarine detection, and secure communications via quantum-resistant cryptography. Both NATO strategies stress close cooperation with industry and academia: NATO’s Defence Innovation Accelerator (DIANA) and the new NATO Innovation Fund are mechanisms to expand NATO’s innovation ecosystem by engaging startups and labs working on cutting-edge solutions. The NATO Innovation Fund, launched in 2023 as the world’s first multi-sovereign venture capital fund, will invest €1 billion in early-stage deep-tech startups across 23 participating Allied nations (soon 24 with Sweden) to harness commercial innovation for Alliance security needs. In short, NATO’s political guidance – including its 2022 Strategic Concept – places advanced technologies at the heart of collective defence modernization, backing these priorities with institutional support (DIANA) and funding initiatives (the Innovation Fund).